Liquidity follows predictability not transparency.

Institutional capital does not avoid blockchains because they are decentralized. It avoids them because execution is observable. On public chains, intent leaks before settlement, strategies can be inferred mid-flight, and outcomes depend on who sees what first.

That is not a technology gap.

It is an execution-risk problem.

This is precisely where Dusk Network positions itself: confidential execution as a prerequisite for institutional liquidity.

Why public execution repels serious capital

Institutions price risk long before they price yield. In transparent execution environments, they face risks that do not exist in traditional markets:

pre-trade information leakage,

front-running and MEV exposure,

strategy reconstruction over time,

adversarial inference during stress events.

Even if assets are safe, intent is not. For risk committees, that alone disqualifies most public chains.

Confidential execution changes the economics of participation

Confidential execution ensures that:

transaction parameters are hidden until finality,

smart contract logic executes without revealing intermediate state,

outcomes are provable without exposing decision paths,

validators cannot exploit execution visibility.

This does not just protect users. It reshapes incentives. When intent is unknowable, extraction strategies collapse, and execution becomes outcome-driven rather than information-driven.

Liquidity prefers that environment.

Why institutions care more about execution than settlement

Settlement finality is necessary but insufficient. Institutions ask a harder question:

What can others learn about us before settlement?

On public chains, the answer is: a lot.

On confidentiality-first systems, the answer is: only what is strictly necessary.

Dusk’s design treats execution as the sensitive surface not an afterthought aligning on-chain behavior with off-chain financial norms.

MEV is a tax institutions will not pay

MEV is often framed as a validator or protocol issue. Institutions see it as a structural execution tax:

unpredictable slippage,

adversarial ordering,

opaque costs embedded in execution,

disadvantage for non-insiders.

Confidential execution removes the raw material MEV depends on: visibility. Without interpretable intent, front-running becomes guesswork, not strategy. Liquidity flows where execution is fair by construction.

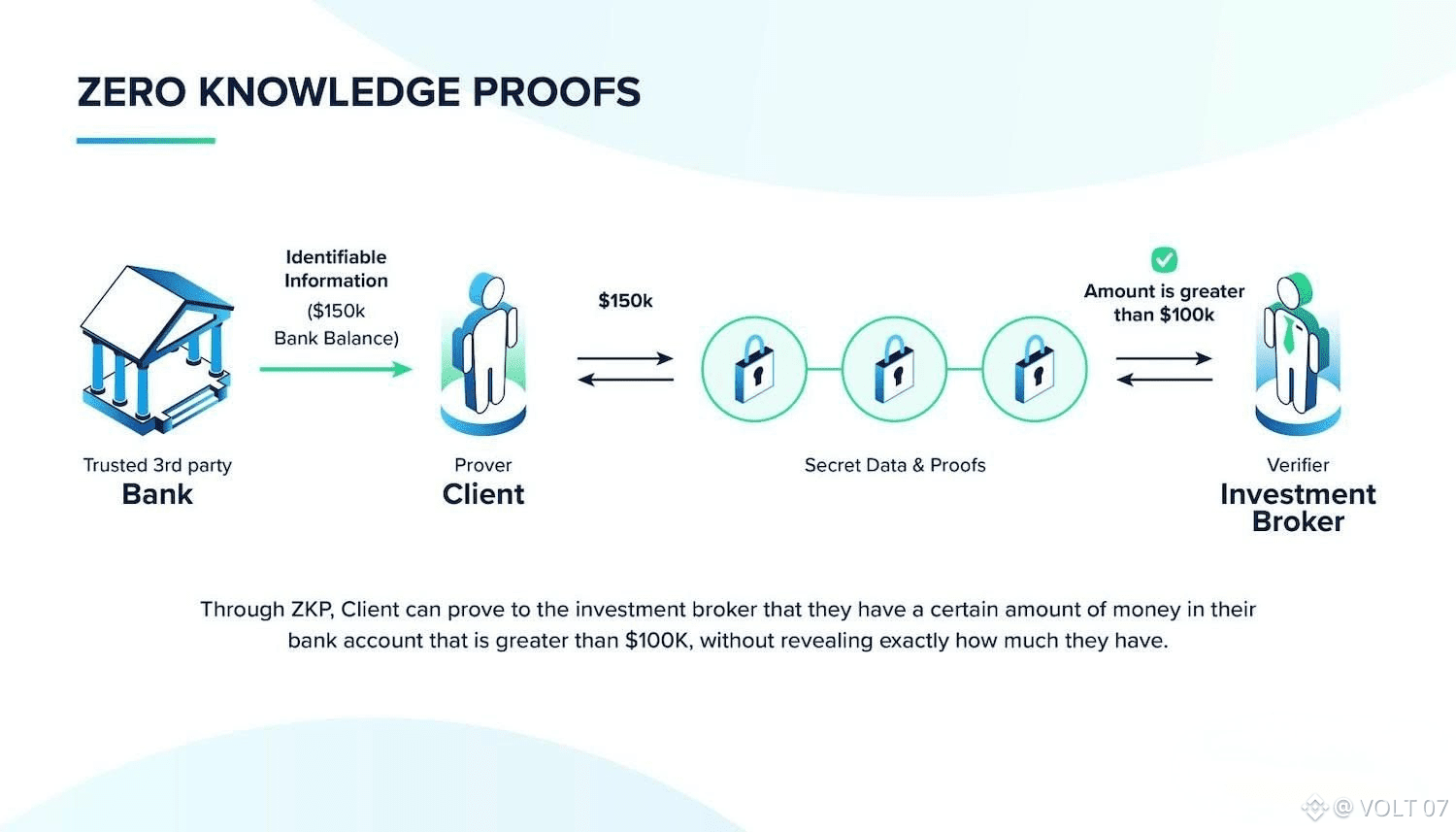

Confidential execution enables selective transparency

Institutions do not want secrecy; they want control over disclosure:

regulators can verify correctness,

auditors can validate compliance,

counterparties cannot infer strategy,

competitors cannot map behavior.

Dusk enables this separation. Proofs attest to correctness without revealing sensitive details, restoring the disclosure boundaries institutions already expect.

Why this unlocks real, durable liquidity

Liquidity that chases yield leaves quickly.

Liquidity that trusts execution stays.

Confidential execution supports:

large order sizes without signaling,

consistent execution under stress,

predictable outcomes independent of observer behavior,

integration with compliance workflows without public exposure.

These properties are not cosmetic. They determine whether capital can scale beyond pilots.

Public transparency scales experimentation. Confidential execution scales balance sheets.

Retail ecosystems thrive on openness. Institutional ecosystems require insulation. Trying to retrofit privacy onto transparent execution is rarely sufficient; inference leaks through the seams.

Dusk’s approach is native: execution is confidential by default, and verification is proof-based. That alignment is what institutions wait for before committing meaningful liquidity.

Why “eventual adoption” won’t happen on public execution

Transparency is not a maturity issue it is a design choice. Institutions know that once strategies are exposed, they cannot be unexposed. They will not “try and see” with public execution and hope MEV doesn’t matter.

They wait for systems where execution risk is structurally constrained.

I stopped asking how much liquidity a chain has. I started asking why it stays.

Sustainable liquidity remains where:

execution is predictable,

information leakage is minimized,

incentives reward correctness over extraction,

trust survives stress events.

Confidential execution is not a feature to attract institutions.

It is the precondition.

Dusk earns relevance by building for that reality not by asking institutions to accept public exposure as the cost of decentralization.