Value leakage is not a side effect of DeFi. It is a design consequence.

Value leakage is not a side effect of DeFi. It is a design consequence.

Transparent DeFi promised fairness through openness. In practice, it delivered something else: a permanent extraction layer where those who see first earn most, and those who act last subsidize everyone else.

This leakage is not accidental.

It is the inevitable outcome of making intent visible before execution.

That is why Dusk Network approaches DeFi from a different premise: value leaks because information leaks.

Transparent DeFi turns information into a tradable commodity

On public chains, every transaction broadcasts:

what will happen,

how large it is,

which contracts are involved,

when execution will occur.

This transforms block production into a competitive intelligence game. Validators, builders, and searchers don’t need to break rules to extract value they simply optimize around what they can already see.

Front-running and MEV are not exploits.

They are rational arbitrage on leaked intent.

Why users always lose first in transparent systems

Value leakage hits users before protocols notice:

swaps execute at worse prices,

liquidations happen earlier than expected,

arbitrage drains upside silently,

execution outcomes vary based on visibility, not logic.

Users experience this as “slippage” or “market conditions.” In reality, it is a structural tax embedded in transparency.

The more valuable the transaction, the more visible and extractable it becomes.

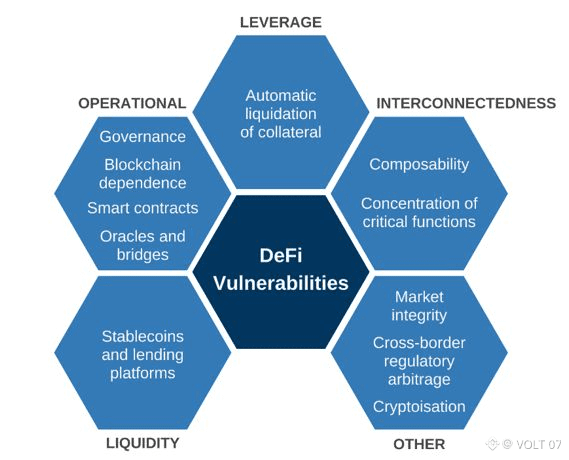

Protocols leak value even when they work as designed

Transparent DeFi doesn’t fail.

It functions perfectly and still leaks value.

Why?

ordering rules are predictable,

state transitions are observable,

execution paths can be simulated in advance.

Even honest validators are incentivized to reorder, delay, or insert transactions if the system allows it. Governance can discourage this, but it cannot eliminate it without changing the information model.

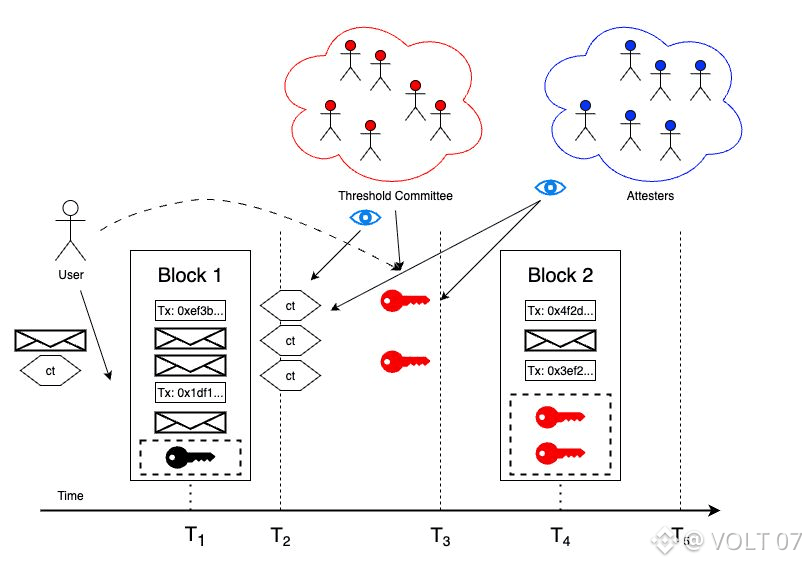

Dusk changes the information model.

How Dusk fixes value leakage at the root

Instead of policing extraction, Dusk removes its raw material.

In Dusk’s architecture:

transaction intent is private,

smart contract execution is confidential,

intermediate state is never exposed,

finality reveals correctness, not strategy.

Validators cannot see what to exploit.

Searchers cannot simulate outcomes.

MEV collapses because there is nothing to extract against.

This is prevention, not mitigation.

Why confidential execution matters more than private balances

Some systems hide balances but expose execution. That still leaks value.

Dusk treats execution itself as sensitive:

logic runs inside a privacy boundary,

proofs verify outcomes without revealing steps,

ordering reveals no economic signal.

This closes the leak where it actually forms during execution, not settlement.

Value preservation restores economic fairness

When extraction disappears:

execution becomes outcome-driven,

pricing becomes predictable,

large orders stop signaling weakness,

users stop subsidizing insiders.

DeFi begins to resemble a real financial system one where returns come from risk and strategy, not from seeing someone else’s move first.

That shift is what attracts serious capital.

Why transparency scales experimentation, not capital

Public DeFi is excellent for:

composability experiments,

rapid iteration,

open research.

It is terrible for:

institutional liquidity,

large position management,

predictable execution under stress.

Institutions don’t avoid DeFi because they dislike decentralization. They avoid it because transparent execution guarantees value leakage.

Dusk resolves that contradiction.

Most chains try to manage leaks. Dusk seals the pipe.

MEV auctions, fair ordering, committees — these are all attempts to redistribute leaked value more politely.

Dusk takes a simpler stance:

If value leaks because intent is visible, remove visibility.

That single decision collapses entire extraction economies.

I stopped asking how DeFi shares value. I started asking where it leaks.

Once you follow the leak upstream, you discover it always starts with information exposure.

Dusk earns relevance by fixing that root cause, not by layering policy on top of it.

Transparent DeFi leaks value because it must.

Confidential DeFi preserves value because it can.