$USUAL USUAL Coin Short Analysis: The Yield-Generating Giant

As of January 13, 2026, Usual (USUAL) has established itself as a major bridge between traditional bank safety and crypto returns. If you’re seeing it all over your feed, here is the "human-friendly" breakdown of what’s actually happening.

1. What is USUAL? (The Simple Version)

Most stablecoins (like USDT) are just digital dollars—they don't "grow" while they sit in your wallet. Usual changes this:

* Real-World Backing: USUAL is the governance token for a protocol that issues USD0, a stablecoin backed by U.S. Treasury Bills (one of the world's safest assets).

* The "Yield" Secret: While traditional stablecoins keep the interest for themselves, Usual distributes the revenue from those Treasury Bills back to the community via the USUAL token.

* Ownership: Holding USUAL means you own a piece of the protocol and decide how the "vault" is managed.

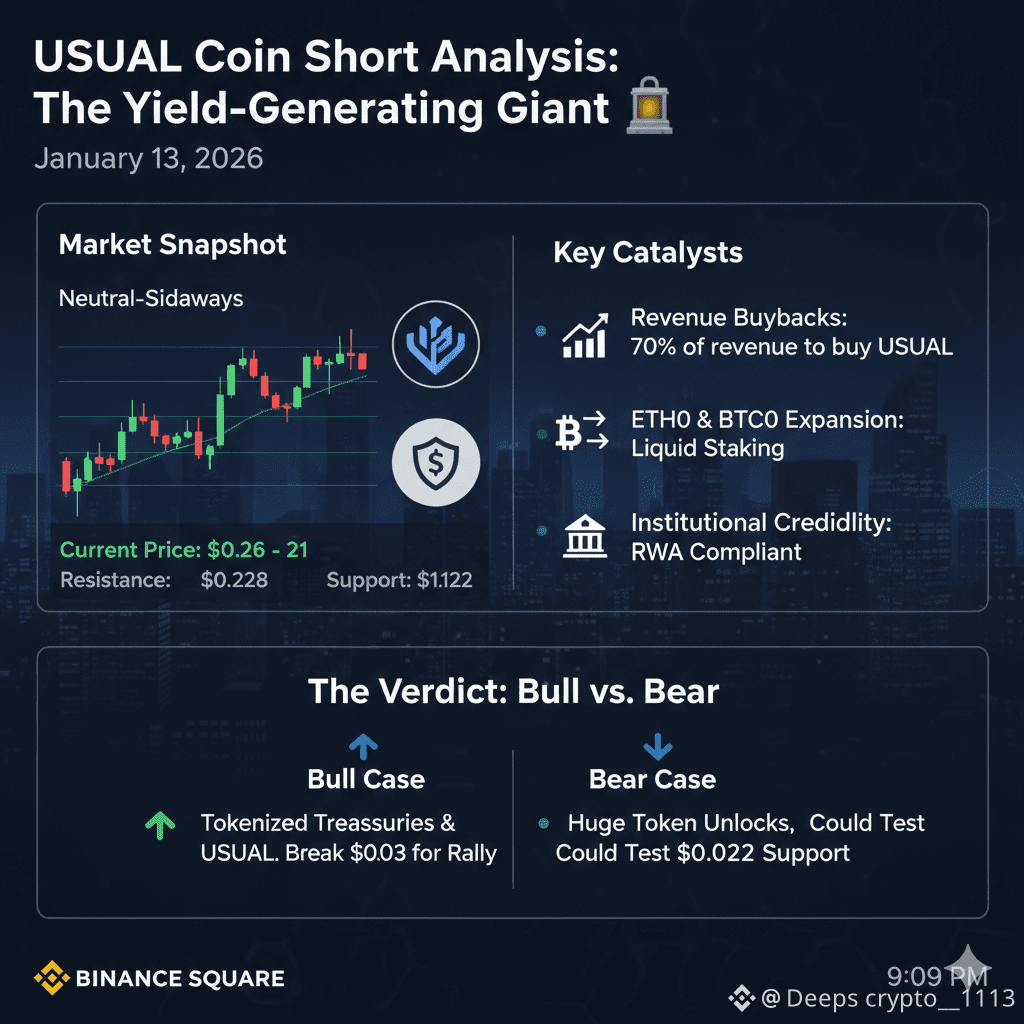

2. Current Market Snapshot (Jan 2026)

* Price Action: USUAL is currently trading in a neutral-sideways zone around $0.026 - $0.027.

* The Trend: After a volatile 2025, the price has found a "floor." Traders are watching the $0.028 resistance level closely.

* Staking Power: A massive 70% of the circulating supply is currently staked or locked, which means there isn't a lot of "easy" supply for sellers to dump on the market.

3. Why People Are Talking About It Now

* Revenue Buybacks: The protocol recently confirmed it uses 70% of its revenue to buy back USUAL tokens from the open market. This creates a constant "buy pressure" that helps support the price.

* ETH0 & BTC0 Expansion: Usual is moving beyond just dollars. They are launching "Liquid Staking" for Ethereum and Bitcoin, aiming to become the go-to place for safe, institutional-grade yields.

* Institutional Credibility: Because it's compliant with RWA (Real-World Asset) regulations, bigger "whale" investors are starting to use Usual as a safe haven during market uncertainty.

4. The Verdict: Bull vs. Bear

* The Bull Case (Price Up): If the protocol continues to successfully tokenize more Treasury Bills and expands into ETH/BTC yields, the USUAL token becomes a high-demand "dividend" asset. Breaking $0.03 could trigger a major rally.

* The Bear Case (Price Down): Huge token unlocks (where early investors get their coins) are still a risk. If a large group of early holders decides to exit at once, the price could test the $0.022 support level.

Bottom Line: USUAL is for the "smart money" investor who prefers real revenue and government-bond backing over hype and memes. It’s a stability play with a "growth" kicker.