For most of modern history, finance has relied on trust layered on top of paperwork. Certificates printed on paper, ownership recorded in closed ledgers, settlement stretched across days, sometimes weeks. Even as markets digitized, the underlying structure remained largely unchanged. Custodians stood between buyers and sellers. Clearinghouses absorbed risk at a cost. Compliance was bolted on after the fact, often slowing innovation instead of guiding it. When I look at today’s financial system, I don’t see a lack of technology. I see inefficiency preserved by habit.

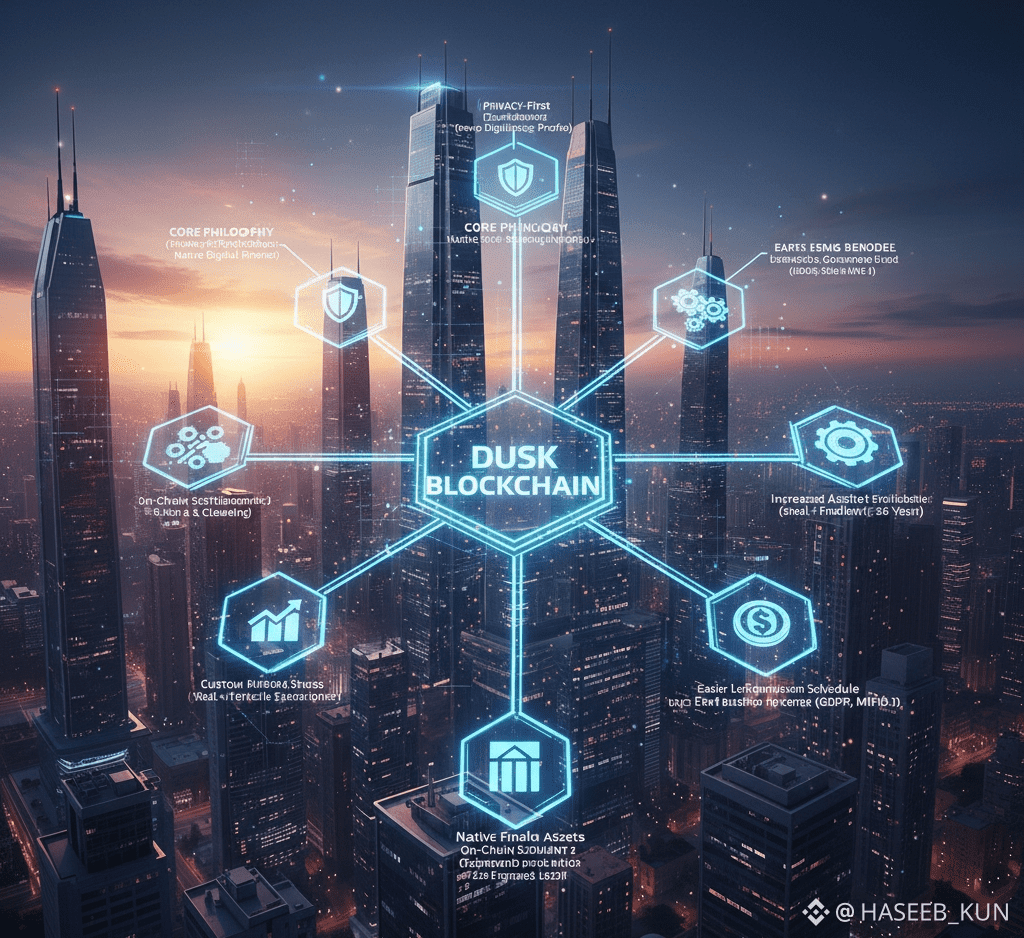

Blockchain promised an alternative. Yet many early implementations focused narrowly on speculation, token transfers, or abstract decentralization. They recreated markets without rebuilding financial infrastructure itself. Dusk takes a different path. It does not aim to merely tokenize assets or run decentralized applications. It positions itself as a full-stack, institutional-grade financial system, designed from the ground up for native digital finance where issuance, settlement, privacy, and compliance coexist naturally.

What stands out to me about Dusk is its refusal to treat privacy or regulation as constraints. Instead, both are treated as design inputs. The result is a blockchain that does not fight the realities of financial markets but absorbs them into its architecture. In this sense, Dusk is less about disruption and more about replacement through evolution.

At the core of Dusk’s vision is the idea of native issuance. In traditional markets, assets begin life off-chain. Shares are registered in centralized databases. Bonds are issued through intermediaries. Ownership is fragmented across custodians and brokers. Tokenization often comes later as a representation, not the source of truth. Dusk reverses this logic. Assets are born on-chain, governed by protocol rules, cryptography, and smart contracts. Ownership, compliance, and settlement are native properties, not external dependencies.

This shift matters because it removes layers of friction. When assets exist natively on-chain, settlement becomes immediate. There is no need for reconciliation across institutions or delayed clearing cycles. Transactions finalize with cryptographic certainty. For markets accustomed to T+2 or longer settlement windows, this change is profound. Risk is reduced, capital efficiency improves, and operational complexity collapses into code.

Privacy is often misunderstood in financial contexts. It is not secrecy for secrecy’s sake. It is about protecting sensitive information while preserving accountability. Dusk’s architecture reflects this nuance. Through its Phoenix transaction model, transactions can remain confidential without sacrificing verifiability. Amounts, counterparties, and balances are shielded, yet the system remains auditable at a protocol level. This balance is critical for institutional adoption, where confidentiality is expected but transparency is legally required.

Alongside Phoenix sits Moonlight, Dusk’s transparent transaction layer. This dual model allows participants to choose visibility based on context. Public operations can remain open and auditable, while sensitive financial activity stays private. What I find compelling is that this choice is not imposed externally. It is embedded in the protocol itself, allowing financial institutions to design workflows that align with regulatory obligations without exposing proprietary or client data.

Settlement on Dusk is not just fast; it is final. The network’s consensus mechanism ensures that once a transaction is confirmed, it cannot be reversed or disputed through off-chain processes. This eliminates entire classes of counterparty risk that plague traditional markets. In environments where large sums move daily, certainty is not a luxury. It is foundational.

Compliance, often seen as the enemy of innovation, is treated differently on Dusk. Rather than enforcing rules after transactions occur, compliance is encoded into asset logic and smart contracts. This allows regulatory constraints to operate automatically. Transfers can respect jurisdictional rules. Participation can be restricted where necessary. Reporting requirements can be satisfied without manual intervention. From my perspective, this is where Dusk quietly redefines financial infrastructure. It shifts compliance from an operational burden into a programmable feature.

Smart contracts play a central role in this transformation. Dusk supports both WASM-based execution and EVM compatibility, allowing developers to build complex financial logic with predictability and performance. Deterministic execution matters in finance. It ensures that contracts behave consistently under all conditions, reducing legal ambiguity and operational risk. When automated systems control asset issuance, settlement, and yield distribution, predictability becomes a form of trust.

Tokenomics within the Dusk ecosystem reinforce this structure rather than distract from it. The DUSK token is not positioned merely as a speculative asset. It functions as a coordination tool, aligning incentives between validators, developers, and participants. Staking secures the network while encouraging long-term engagement. Governance mechanisms allow protocol evolution to reflect the needs of its users without centralized control. The economy supports the infrastructure, rather than overshadowing it.

One of the most significant implications of Dusk’s design is the reduction of intermediaries. In traditional finance, intermediaries exist to enforce trust, manage risk, and ensure compliance. Dusk replaces many of these roles with cryptography, protocol rules, and automated execution. Custodians become optional. Clearinghouses lose relevance. Trust shifts from institutions to mathematics and code. This does not eliminate regulation or oversight; it changes how they are implemented.

This transition opens the door to new market structures. Fractional ownership becomes native. Global participation no longer requires complex custody arrangements. Liquidity can move freely across borders while respecting legal frameworks. From an investor’s standpoint, this reduces friction and increases access. From an institutional perspective, it lowers operational costs and simplifies compliance.

The concept of native digital finance becomes clearer when viewed holistically. Dusk is not a platform where traditional assets are awkwardly mirrored. It is an environment where financial instruments are designed specifically for digital existence. Bonds can distribute yield automatically. Equity can embed voting rights directly into ownership logic. Funds can rebalance without manual oversight. These are not theoretical possibilities. They are structural outcomes of a blockchain designed for finance, not adapted to it.

Security underpins everything. Dusk’s cryptographic choices emphasize both performance and resilience. Zero-knowledge proofs, efficient hashing algorithms, and optimized data propagation ensure that privacy does not come at the cost of scalability. In financial markets, downtime and congestion are not inconveniences; they are systemic risks. Dusk’s architecture reflects an understanding of this reality.

What also stands out is the user experience layer. Tools like Rusk Wallet abstract complexity without hiding control. Users can manage assets, stake tokens, and interact with applications in a way that feels deliberate rather than overwhelming. Profiles that link public and shielded accounts allow flexibility without fragmentation. This matters because adoption is not driven by ideology alone. It is driven by usability.

From a broader market perspective, Dusk positions itself at a critical intersection. Regulatory clarity is increasing globally. Institutions are exploring blockchain seriously, not experimentally. At the same time, retail users demand privacy and autonomy. Dusk speaks to both audiences without diluting its focus. It offers a framework where efficiency, privacy, and compliance reinforce each other instead of competing.

What I find most compelling is that Dusk does not frame itself as a rebellion against traditional finance. It frames itself as an upgrade. It acknowledges the value of regulation, the necessity of privacy, and the inefficiencies of legacy systems. By rebuilding financial infrastructure natively on-chain, it creates space for innovation that feels inevitable rather than disruptive.

The educational aspect of Dusk’s approach lies in how it reframes blockchain’s role. Instead of asking institutions to compromise, it offers a system designed around their realities. Instead of forcing users to choose between transparency and confidentiality, it provides both. Instead of layering compliance on top of decentralized systems, it weaves it into the foundation.

In a future shaped by digital assets, the question is not whether blockchain will integrate with finance, but how. Dusk offers one of the clearest answers. By treating finance as a first-class use case rather than an afterthought, it builds infrastructure that feels aligned with where markets are heading. Faster settlement, native issuance, programmable compliance, and privacy by design are not optional features. They are requirements.

In closing, Dusk represents a shift in how we think about financial systems. It moves beyond tokenization toward native digital finance, where assets, rules, and settlement live in the same environment. Intermediaries become optional. Trust becomes programmable. Efficiency is no longer constrained by legacy processes. For anyone looking at the future of institutional finance, @Dusk does not promise revolution. It offers something more sustainable: a carefully designed path forward, where the next generation of financial markets can emerge with clarity, confidence, and purpose.