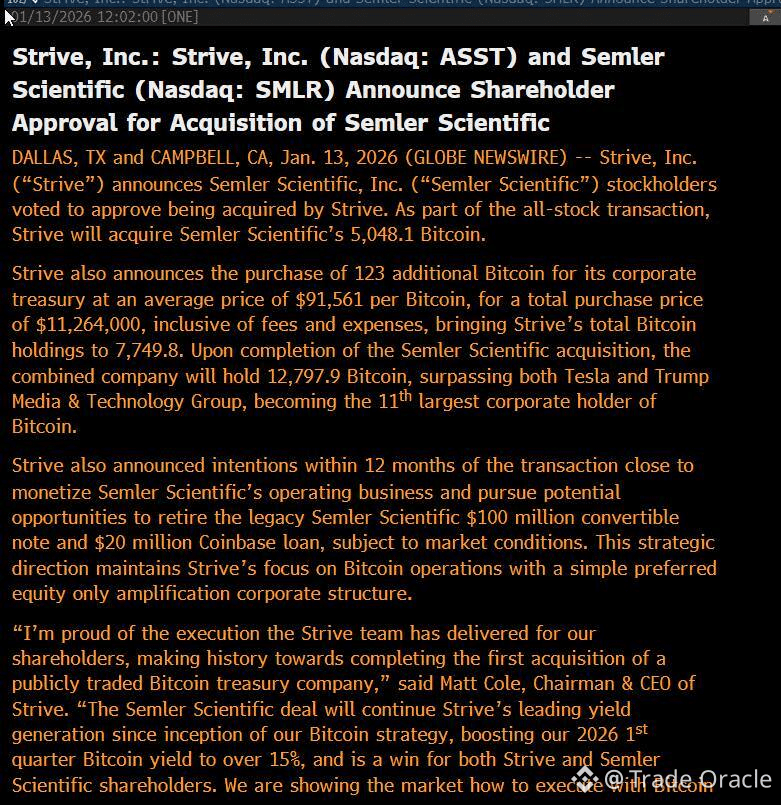

💥 Strive has officially approved its acquisition of Semler Scientific — and this is more than just a business deal. It’s a major power move in the Bitcoin arena. 🧠📈

🔥 With this acquisition, the combined Bitcoin treasury now stands at a massive 12,797 $BTC , instantly positioning the newly merged entity as the 11th largest corporate Bitcoin holder in the world 🌍💰

Let that sink in for a moment. ⏳

This isn’t speculation. This isn’t hype. This is strategic conviction. 💎🙌

🏦 At a time when many institutions are still “studying” Bitcoin, Strive and Semler are doubling down — signaling strong belief in BTC as a long-term store of value and a cornerstone of modern treasury strategy ⚡🟠

📊 What does this mean?

✅ Increased institutional confidence in Bitcoin

✅ Stronger balance sheets anchored in hard money

✅ Reduced exposure to fiat debasement

✅ A loud message to markets: Bitcoin is here to stay

🚀 Becoming the 11th largest corporate BTC holder isn’t just a ranking — it’s a statement. It shows leadership, foresight, and the courage to act while others hesitate.

🔑 This move could inspire more public companies to rethink treasury management, diversify reserves, and embrace digital scarcity. The domino effect may already be starting… 👀

🌐 As adoption accelerates, moments like this remind us that Bitcoin is no longer on the fringe — it’s moving straight into the corporate mainstream.

📢 Whether you’re an investor, builder, or believer, one thing is clear:

Institutional Bitcoin adoption just leveled up.

🟠 The future of finance is being written in real time — and Strive & Semler just etched their names into Bitcoin history.

💬 What are your thoughts on this massive acquisition? Bullish or SUPER bullish? 🚀🔥