How to spot market trends and make smart entry/exit decisions in crypto world

1. Spotting trends

Bullish Trend: Price is rising (higher highs & higher lows).

Bearish Trend: Price is falling (lower highs & lower lows).

Sideways/Range: Price moves within a specific range.

Use tools like Moving Averages (MA), RSI, and MACD to spot trends.

2. Entry Strategies

Trend Following: Buy when the trend is up (e.g., price breaks above resistance).

Pullback: Buy dips in an uptrend.

Breakout: Enter when price breaks key levels (support/resistance).

3. Exit Strategies

Target Profit: Set a price target and sell.

Stop-Loss: Set a stop-loss to limit losses.

Trailing Stop: Adjust stop-loss as price moves in your favor.

Example

Entry: Buy BTC if it breaks above $40k with strong volume.

Exit: Sell at $45k (target) or if it drops below $38k (stop-loss).

Important

Do your own research (DYOR).

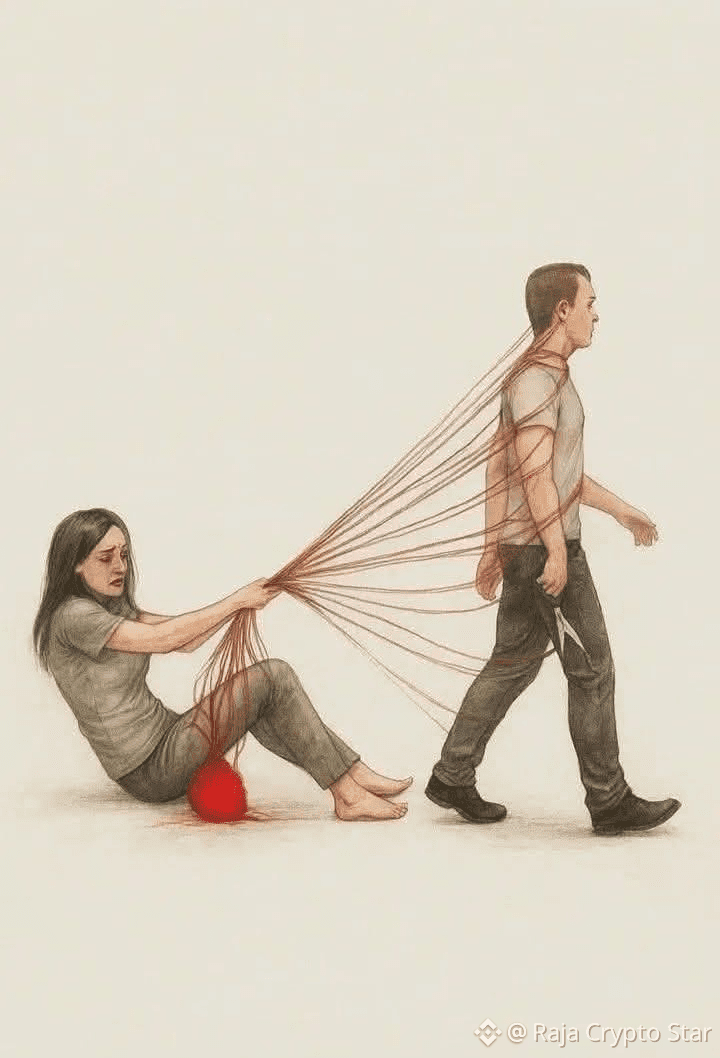

Manage risk; don't invest more than you can afford to lose.