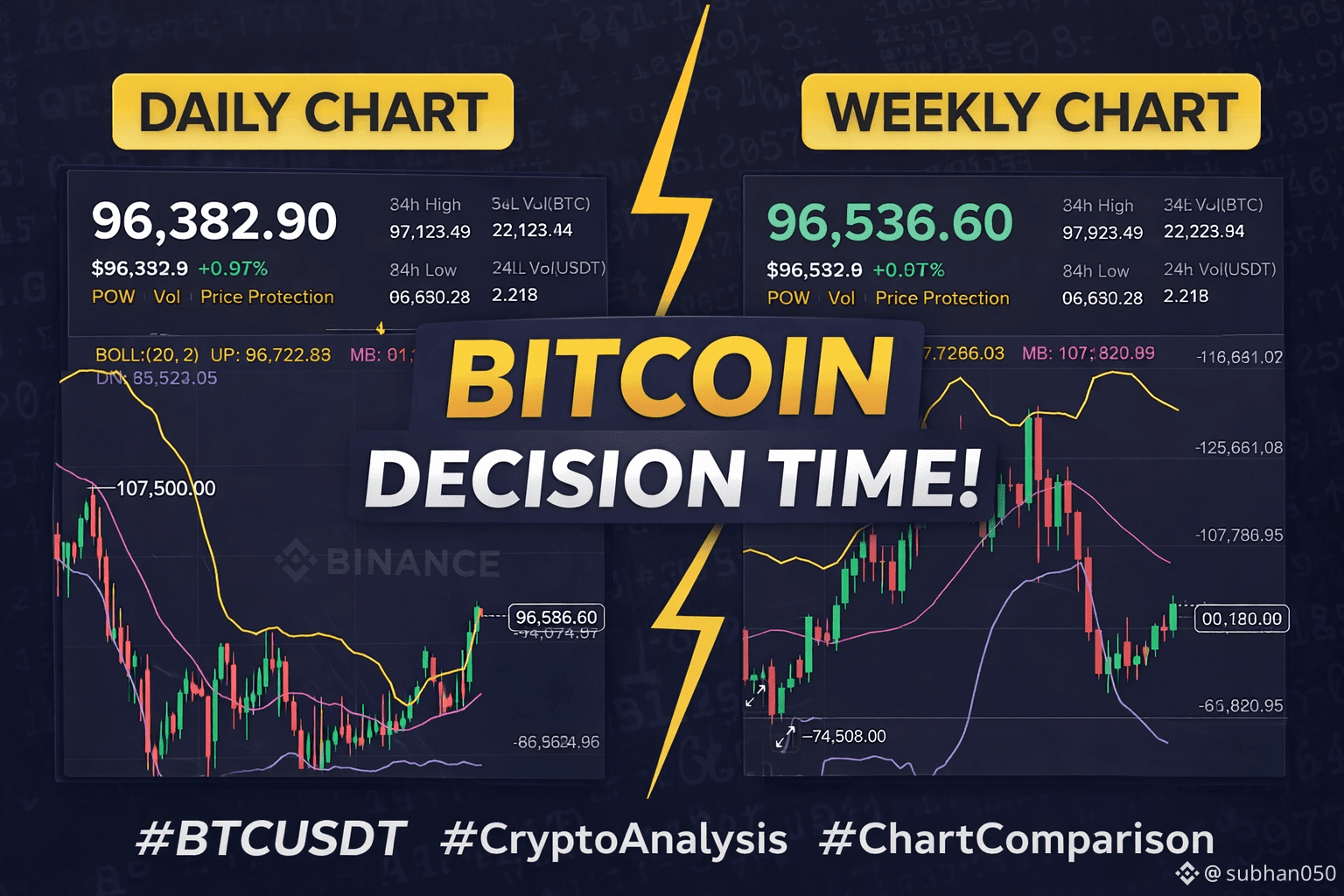

Bitcoin (BTC/USDT) is currently trading near the 96,000 USDT level, and the market is sending mixed but important signals. To avoid confusion and emotional trading, it is necessary to analyze both the weekly and daily charts, because each timeframe shows a different side of the market.

On the weekly timeframe, Bitcoin is still in a recovery phase after a strong correction. Price bounced from the lower Bollinger Band, which shows that sellers are losing strength. However, Bitcoin is still below the weekly middle Bollinger Band, which acts as the main trend decision level. Until a strong weekly candle closes above this level, the market cannot be considered fully bullish. Weekly structure always comes first for trend confirmation.

On the daily timeframe, the picture looks stronger. Bitcoin has moved above the daily middle Bollinger Band and is forming higher lows. This indicates short-term bullish momentum. However, price is now approaching the daily upper Bollinger Band, where temporary resistance and consolidation are common. Daily strength is positive, but it must align with the weekly structure to become sustainable.

Can Bitcoin Reach 100k?

A move toward 100,000 USDT is possible only with confirmation, not hope.

If Bitcoin holds above 94k–95k on daily closes and then gives a strong weekly close above the weekly middle band (around the 101k zone), the probability of price stabilizing near 100k increases.

If weekly rejection happens again, the market may return to consolidation or test lower support zones.

Professional Take

Bitcoin is currently in a decision zone.

Daily momentum is improving, but the weekly chart still controls the bigger picture.

Professional traders wait for confirmation — not excitement.

Wicks show attempts.

Candle closes show decisions.

Summary

Daily chart: Short-term strength

Weekly chart: Confirmation pending

100k: Conditional, not guaranteed

Safe Strategy

Follow weekly closes, not headlines

Avoid FOMO near resistance

Risk only 1–2% per trade

Warning ⚠️

Market conditions can change quickly.

This analysis is not financial advice and not a guarantee.

$BTC Bitcoin #BTCUSDT #CryptoAnalysis #WeeklyChart #DailyChart #TradingDiscipline #RiskManagement #NoFOMO #MarketStructure #CryptoEducation