In a world where blockchains are battling scalability nightmares, energy hogs, and privacy leaks, $DUSK Network is dropping a stealth bomb: Segregated Byzantine Agreement (SBA). This isn't your grandpa's Proof-of-Work or basic Proof-of-Stake - it's a privacy-first, lightning-fast consensus engine powering Dusk's Layer-1 revolution. Launched back in the day but hitting peak stride in 2026, SBA is why Dusk is the backbone for regulated DeFi, RWAs, and confidential smart contracts. Let's break it down without the jargon overload.

First Off: Why Does Consensus Even Matter?

Blockchains need a way to agree on what's real - like, "Did that trade happen? Is this block legit?" Without it, chaos ensues (forks, double-spends, you name it). Old-school PoW (Bitcoin-style) burns energy like a bonfire. PoS (Ethereum vibes) is better but can still get centralized or slow. SBA? It's Dusk's secret sauce: a permissionless PoS variant that's secure, efficient, and built for privacy from the ground up.

Inspired by classic Byzantine Fault Tolerance (think: generals coordinating attacks despite traitors), SBA "segregates" duties to make the network bulletproof. No more wasting power - just smart staking and crypto magic.

How SBA Actually Works (No PhD Required)

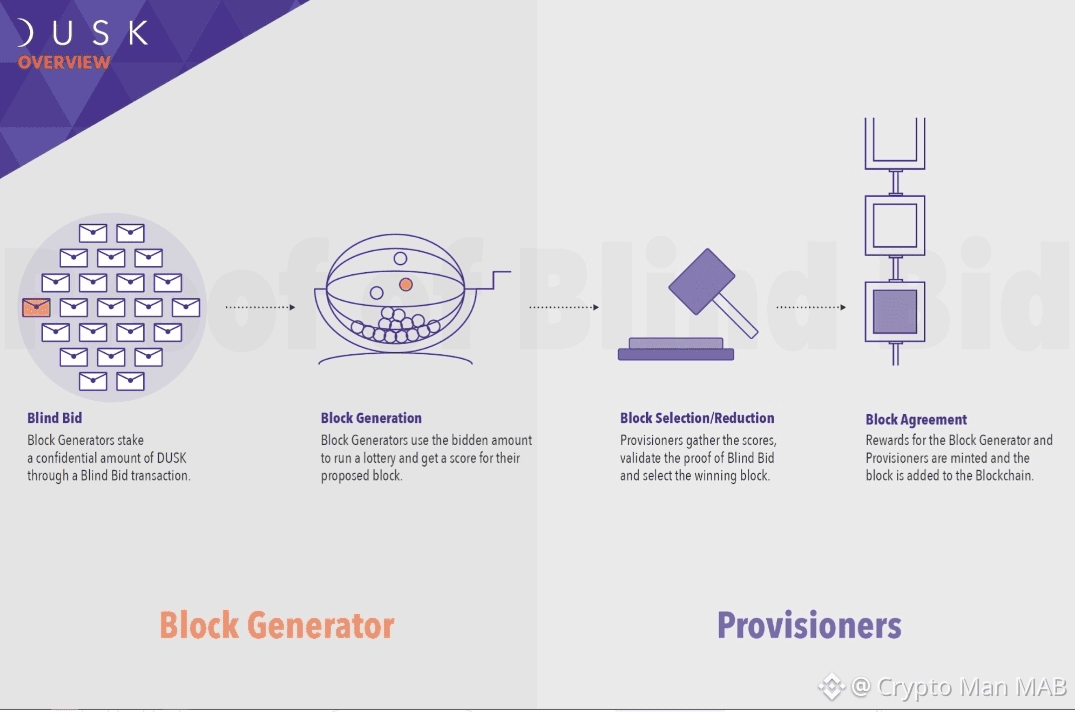

Picture this: Instead of everyone yelling at once, SBA splits the crowd into two VIP roles:

Generators (The Block Bosses): These folks propose new blocks. But here's the twist - they're selected via Proof-of-Blind Bid, a zero-knowledge lottery where you stake anonymously. No one knows how much you're betting, so no Sybil attacks or rich-kid dominance. It's like a secret auction where fairness wins.

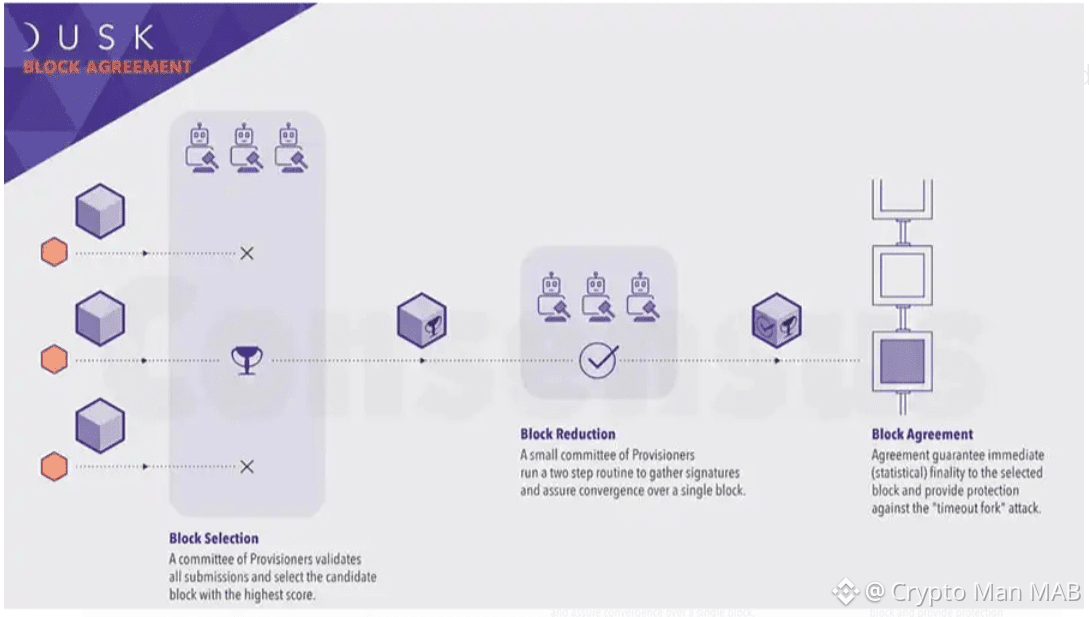

Provisioners (The Validators): A committee of stakers checks and signs off on the block. Picked via deterministic sortition (fancy random selection based on stake), they ensure everything's kosher without peeking at private data.

The magic? Zero-Knowledge Proofs (ZKPs) verify it all without revealing secrets. SBA assumes an "honest majority of money" - as long as good guys control more than 2/3 of the stake, the network stays secure. Result: Near-instant finality (blocks lock in seconds, no forks drama) and statistical security even if some nodes go rogue.

Bonus: Built-in anti-centralization. Pooling stakes? SBA slaps economic penalties, rewarding solo stakers and keeping things decentralized.

The 2026 Glow-Up: Why SBA is Crushing It

Fast-forward to now - SBA isn't just theory. Dusk's mainnet is live, handling confidential trades for banks and institutions. Perks include:

Speed Demon: Seconds to settle, not minutes. Perfect for high-frequency RWAs and DeFi.

Eco-Warrior: No mining rigs - energy-efficient AF, aligning with 2026's green crypto regs.

Privacy Powerhouse: Ties into Dusk's XSC standard for confidential tokens. Trade stocks on-chain without broadcasting your portfolio.

Bulletproof Security: Handles up to 1/3 bad actors without breaking a sweat. Plus, selective disclosure for audits (hello, MiCA compliance!).

Scalability Sneak: Low latency, high throughput - Dusk's gossip network routes data stealthily, dodging IP leaks.

While Ethereum scales with L2s and Solana races for TPS, SBA gives Dusk that enterprise edge: privacy + finality without compromises.

Bottom Line: SBA = Dusk's Superpower

Segregated Byzantine Agreement is Dusk flipping the script on consensus - making it private, fair, and future-proof. If you're stacking $DUSK for staking rewards, governance, or just betting on regulated crypto's boom, SBA is the tech making it all hum.

In 2026's tokenized world, Dusk isn't playing catch-up; it's leading the privacy parade. Ready to stake your claim? Hit up dusk.network and level up your portfolio.