The first time Dusk made sense, it wasn’t because of privacy. It was because of restraint. The realization came from noticing what the network does not encourage, not what it loudly enables.

Dusk supports confidential financial transactions, but its most interesting effect doesn’t appear at the moment a transaction is hidden. It appears months later, when participants begin to act differently precisely because confidentiality is reliable. The second-order effect is behavioral, not cryptographic.

At the surface, confidentiality promises discretion. Below that, it quietly alters how financial actors plan, disclose, and coordinate over time.

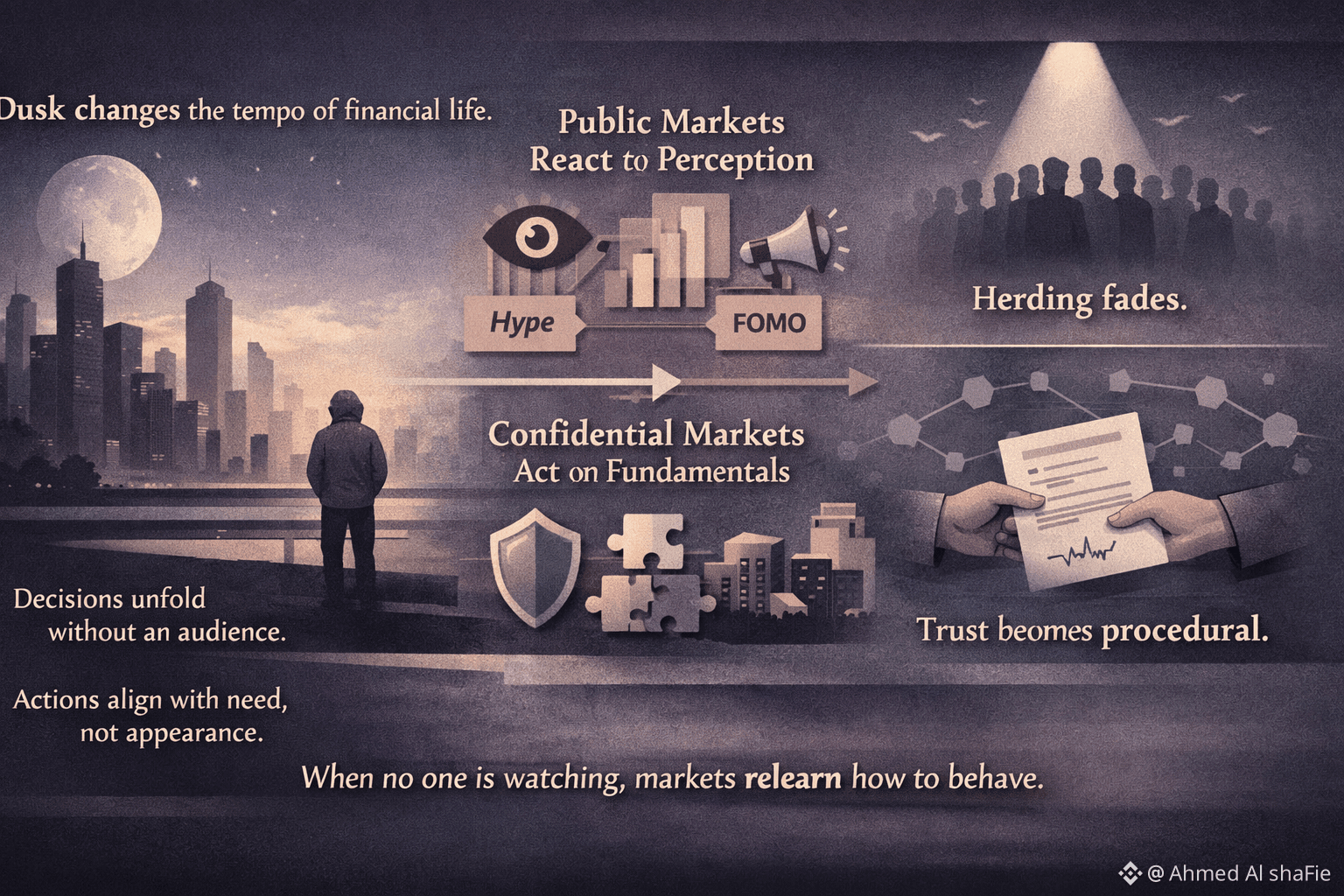

In transparent financial systems, behavior is shaped by anticipation of observation. Even when users claim indifference, they optimize subconsciously for visibility. They stagger actions, split transactions, delay decisions, or over-signal compliance because they know every move is legible. Over time, this creates a market where strategy is not only about capital allocation, but about narrative management.

Dusk removes that narrative layer by default. Not by obscuring data in a way that demands constant trust, but by normalizing confidentiality so that hidden transactions no longer imply exceptional intent. This is subtle. In many privacy systems, confidentiality is opt-in, conspicuous, or costly. Using it signals something. On Dusk, confidentiality is structural. It fades into the background.

The consequence is not that users hide more. It’s that they perform less.

As confidentiality becomes routine, a different pattern emerges. Financial actors stop timing disclosures for optics and start aligning actions with internal constraints instead of external scrutiny. This changes the cadence of financial behavior. Transactions cluster around real needs rather than public events. Liquidity moves earlier. Risk is distributed more evenly, not because users are altruistic, but because the incentive to delay for reputational reasons diminishes.

This is where Dusk’s design reveals its deeper impact. Confidential transactions don’t just protect information; they flatten the social gradients that transparency unintentionally creates. In public ledgers, large actors accumulate not only capital but psychological influence. Smaller participants react to visible moves, amplifying volatility. Over time, this leads to herding effects that have little to do with fundamentals.

On Dusk, those signals are muted. Large transactions do not cast long shadows. Smaller participants are less likely to anchor decisions to visible whales because those whales are no longer performative entities. The market begins to behave more like a collection of independent decision-makers and less like an audience responding to a stage.

This is not immediately obvious. Early on, observers may even mistake the network for being quiet or inactive. Fewer public signals can look like reduced engagement. But over time, the quality of interaction changes. Governance discussions become more procedural. Financial products are evaluated on outcomes rather than optics. Institutions that require discretion stop treating privacy as an exception and start treating it as infrastructure.

There is a compounding effect here. As confidentiality becomes assumed, compliance itself changes shape. Instead of proving legitimacy through exposure, actors prove it through structure. Audits, proofs, and attestations become deliberate moments rather than continuous performances. This lowers cognitive load across the system. Participants spend less time managing how they look and more time managing what they do.

Dusk’s support for confidential financial transactions also reshapes trust boundaries. In transparent systems, trust is outsourced to visibility. In confidential systems done poorly, trust collapses into blind faith. Dusk occupies an in-between space where trust is procedural rather than voyeuristic. You don’t trust because you can see everything; you trust because the system constrains what can go wrong.

Over time, this produces a calmer financial environment. Not less competitive, but less reactive. Volatility doesn’t disappear, but it becomes less performative. Movements feel more organic, driven by underlying shifts rather than cascades of imitation. This is a second-order effect that only emerges once enough participants internalize that their actions are no longer being constantly watched.

The quiet limitation, if there is one, is patience. These effects cannot be forced or marketed aggressively. They only appear after prolonged use, once users stop thinking about confidentiality as a feature and start experiencing it as an absence. An absence of pressure. An absence of signaling. An absence of unnecessary exposure.

Dusk supports confidential financial transactions, but what it really supports is a different tempo of financial life. One where discretion is not defensive, but normal. One where strategy unfolds without an audience. One where markets slowly relearn how to behave when no one is watching.

And once that behavior settles in, it becomes difficult to go back.