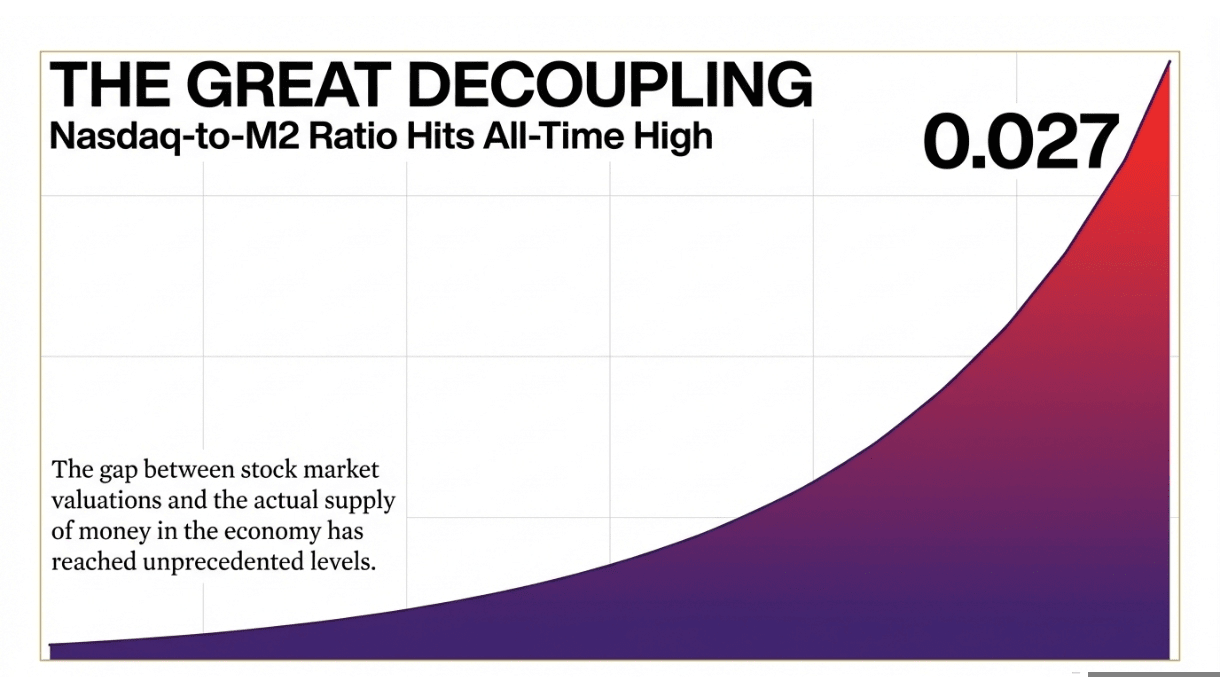

The gap between stock market valuations and the actual supply of money in the economy has reached unprecedented levels. New data reveals that the Nasdaq 100 to M2 Money Supply ratio has surged to a record 0.027. This metric, which tracks the value of technology stocks relative to the total liquidity in the US economy, suggests that equity valuations have completely decoupled from monetary fundamentals.

❍ A Ratio That Has Doubled

The speed of this expansion is historically significant. Since the bear market lows of 2022, this ratio has more than doubled. This indicates that for every dollar of liquidity in the system, the market is pricing technology assets at twice the premium it did just a few years ago.

❍ The Great Divergence: +141% vs. +5%

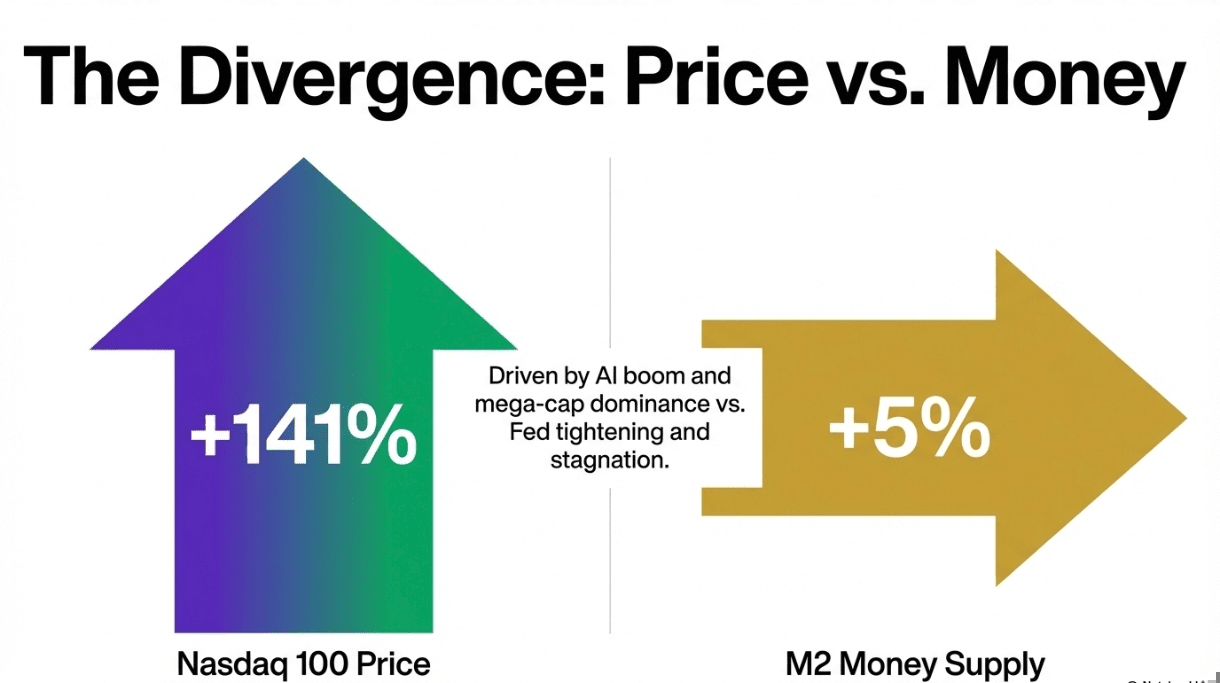

The driver of this record ratio is a massive divergence between asset prices and money creation.

Nasdaq 100: During this period, the tech-heavy index has rallied by +141%, driven by the AI boom and mega-cap dominance.

M2 Money Supply: In stark contrast, the US money supply has increased by a meager +5%.

Unlike the 2020-2021 rally, which was fueled by the "money printer" (rapid M2 expansion), the current rally is being driven almost entirely by valuation expansion. Investors are bidding up prices without a corresponding increase in the underlying supply of money.

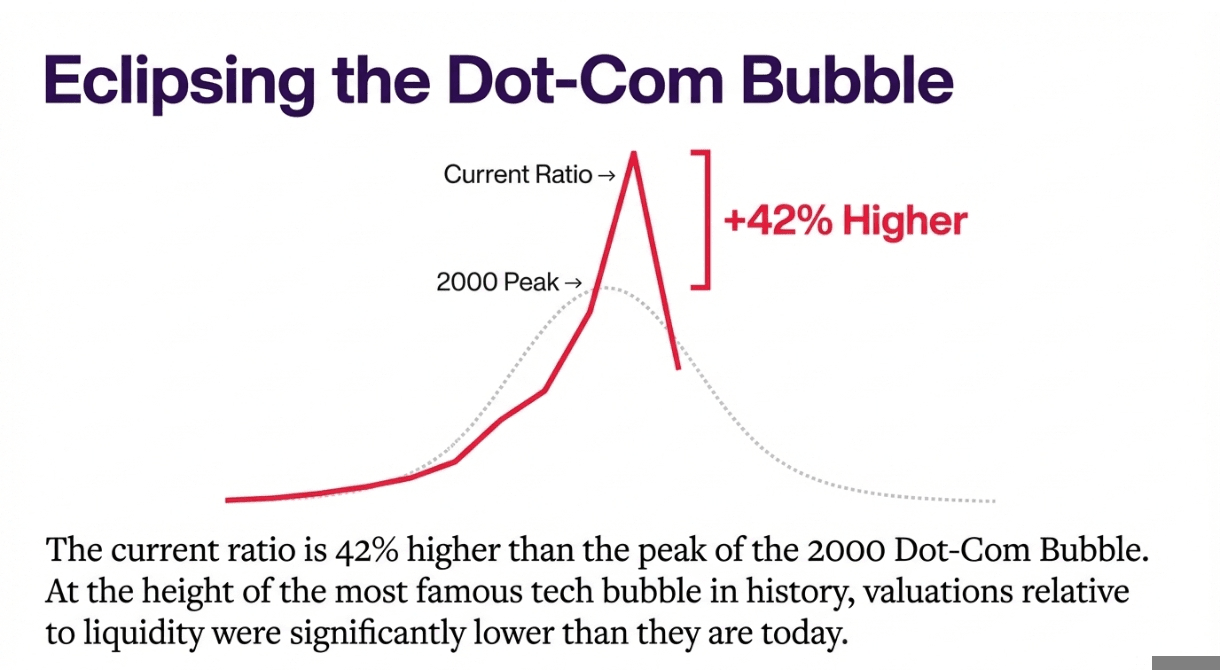

❍ Eclipsing the Dot-Com Bubble

To understand the magnitude of this disconnect, we must look at historical bubbles. The current ratio is now 42% higher than the peak of the 2000 Dot-Com Bubble. At the height of the most famous tech bubble in history, valuations relative to liquidity were significantly lower than they are today.

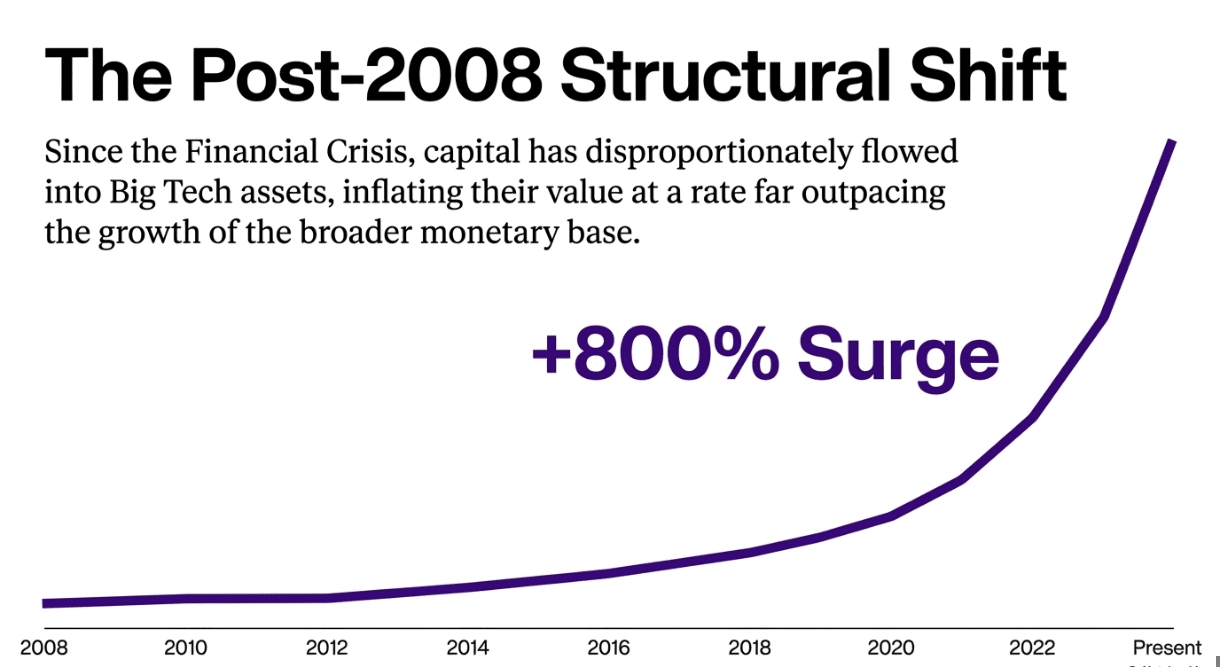

❍ A Post-2008 Surge of +800%

Taking a longer view, the trend is exponential. Since the 2008 Financial Crisis, the Nasdaq 100 to M2 ratio has surged by +800%. This confirms a structural shift in the economy where capital has disproportionately flowed into and inflated the value of Big Tech assets, far outpacing the growth rate of the broader monetary base.

Some Random Thoughts 💭

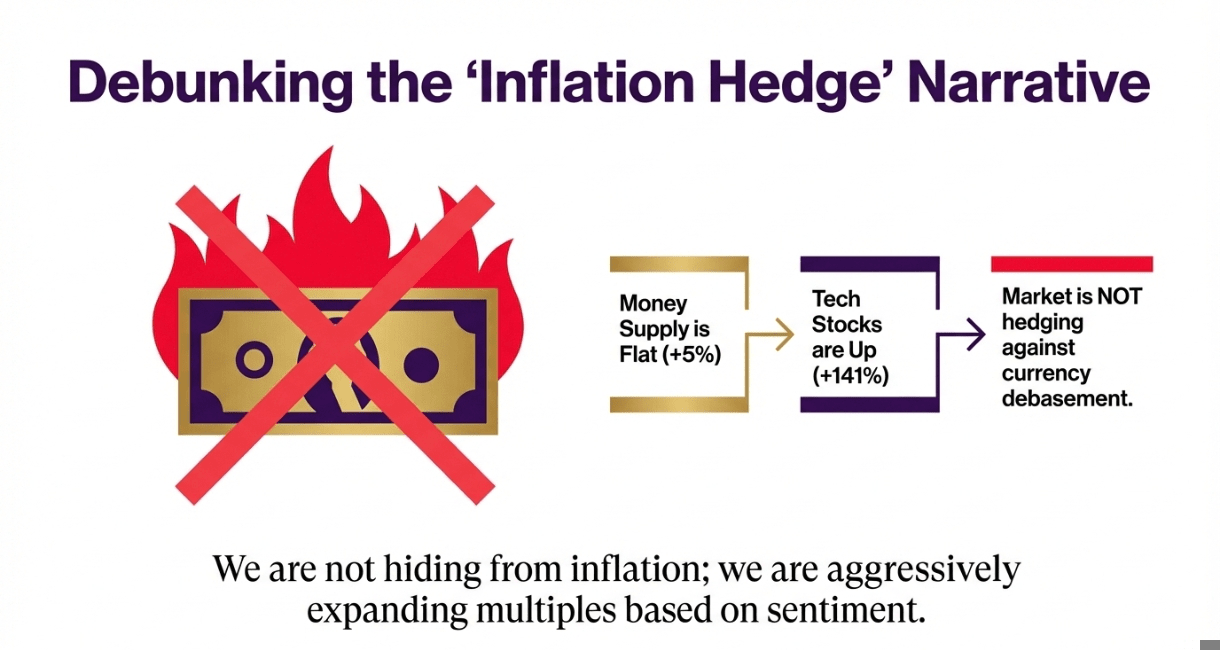

This data challenges the popular "inflation hedge" narrative. If the money supply is flat (+5%) but tech stocks are up +141%, the market isn't hedging against monetary debasement; it is aggressively expanding multiples. We are effectively trading on "future money" that hasn't been printed yet. When the ratio is 42% higher than the Dot-Com peak, it implies that investors believe today's tech giants are not just better businesses than their 2000 counterparts, but that they have permanently transcended the constraints of available liquidity.