As of January 15, 2026 (around 4:40 PM PKT in Karachi), Bitcoin BTC is trading firmly in the mid-to-high $96,000s, with live data from major trackers showing prices hovering between $96,394 and $96,720 USD. The asset has posted solid gains of about 1.5 to 1.9% over the past 24 hours, with a weekly climb nearing 7%. After weeks of consolidation in the low-to-mid $90K range, BTC has reclaimed momentum, briefly touching highs near $97,700 to $97,900 in recent sessions its strongest level in over two months.

Here are some real-time glimpses of the bullish price action fueling the excitement:

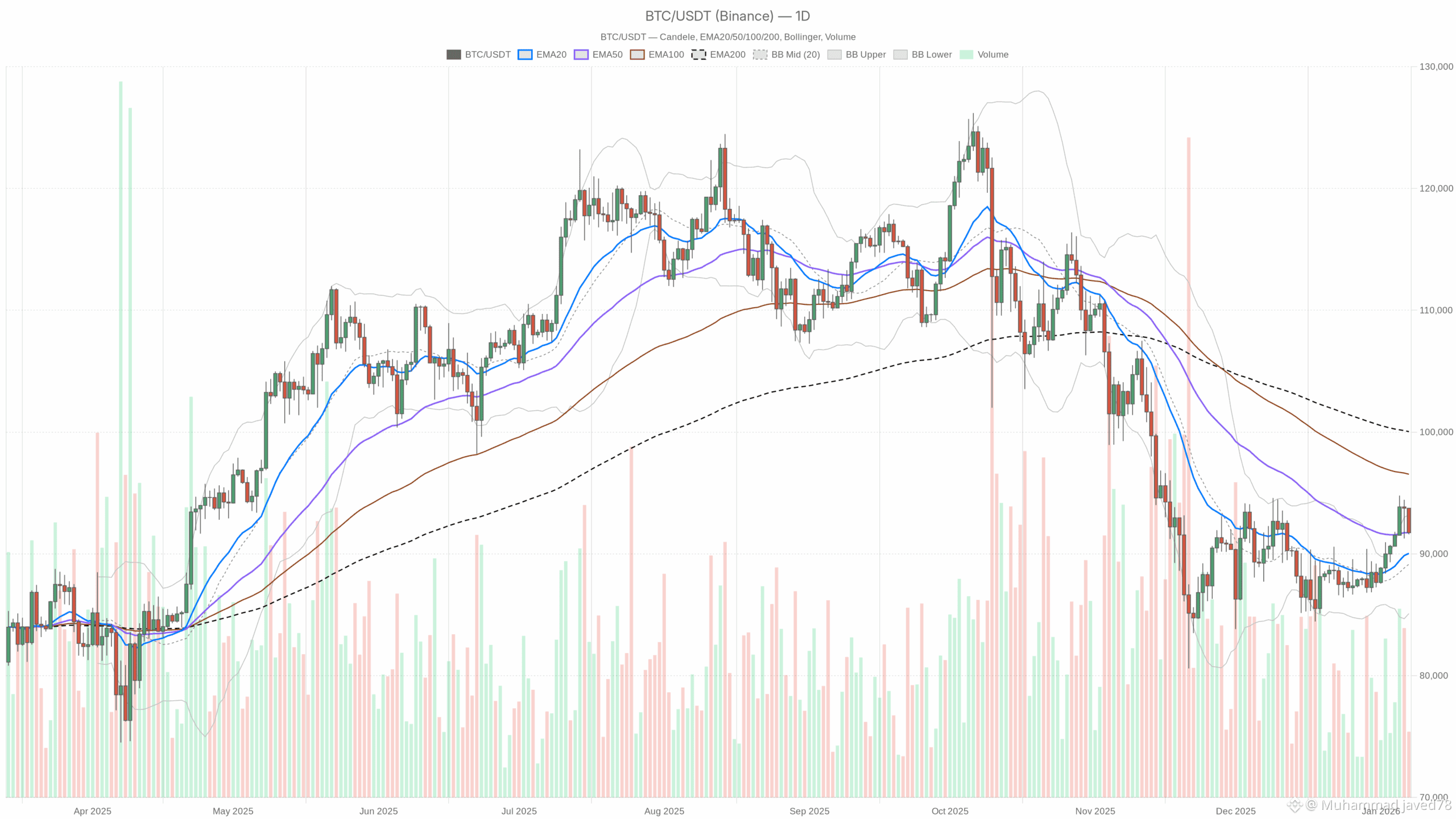

The Technical Setup: Resistance Ahead, But Bulls in Control

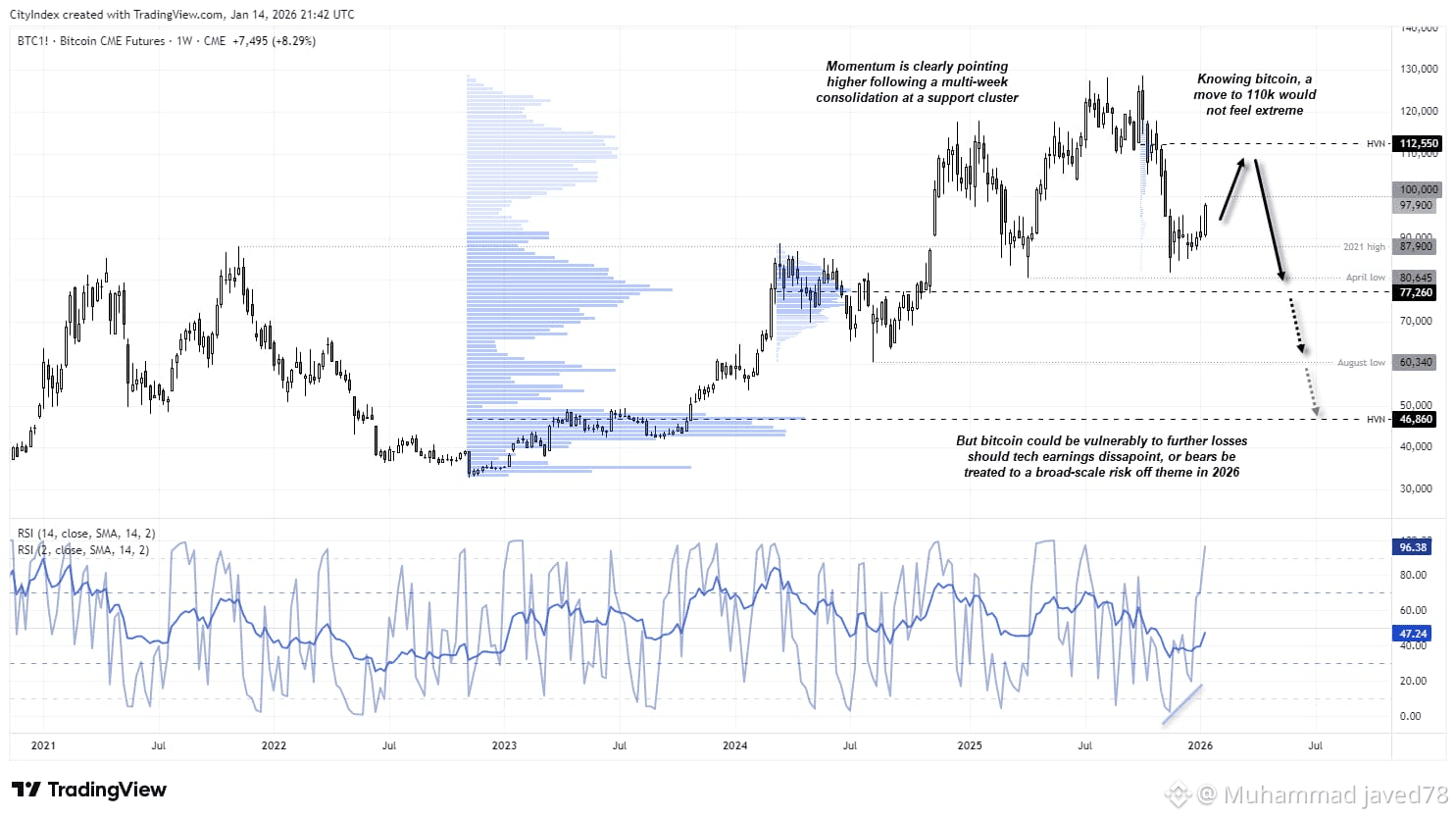

Bitcoin is now testing critical resistance in the $97,000 to $98,500 zone. A decisive close above this level could ignite the next impulsive leg higher, with many analysts eyeing $100,000 as the immediate psychological and technical magnet.

Support remains robust near $94,000 to $95,000, backed by recent accumulation from mid-to-large holders (on-chain data shows wallets holding 100–10,000 BTC adding tens of thousands of coins since early January). Volume has been healthy, and momentum indicators are leaning constructive after softer-than-expected inflation data boosted risk-on sentiment.

The broader market cap sits at around $1.93 trillion, with BTC dominance holding strong above 59% a sign that capital is still favoring the king over altcoins for now.

Key Catalysts Fueling the Push Toward $100K

Several factors are aligning for bulls:

Macro tailwinds Cooling U.S. CPI readings have revived expectations for favorable monetary policy, making Bitcoin attractive as a hedge.

Institutional flows Spot Bitcoin ETFs continue to see steady inflows, while whale accumulation signals confidence.

Sentiment shift The Fear & Greed Index has moved into neutral-to-greedy territory, and traders are positioning for upside.

Analysts are increasingly vocal about $100K as the next realistic milestone. Some forecasts suggest a potential push into the $100K–$105K range in the coming weeks if momentum holds, with longer-term 2026 targets ranging from $110K to as high as $150K+ in optimistic scenarios driven by continued adoption and regulatory clarity.

Of course, crypto remains volatile a rejection at current resistance could trigger a quick retest of $94K support. But the overall structure looks bullish, with the market absorbing dips and rewarding patient holders.

The Big Question: $100K Next?

With BTC knocking on the door and fresh weekly highs in sight, the million-dollar (or rather, hundred-thousand-dollar) question is whether we finally flip $100K in the days or weeks ahead. The setup feels primed, and many in the community believe it's only a matter of time.

Are you stacking sats in anticipation, or waiting for that clean breakout confirmation? The next few sessions could be decisive stay tuned, because if history is any guide, Bitcoin loves to surprise when the crowd least expects it. 📈

What do you think moon mission incoming, or one more shakeout first? Let's watch it unfold together! 🚀