Hey crypto fam, IBRINA ETH here!

As someone who's always been intrigued by how blockchain can blend seamlessly with real-world regulations without sacrificing user privacy, Dusk has really caught my eye. Built as a Layer 1 blockchain by the Dusk Foundation, this project is all about creating a secure environment for regulated financial activities. It's not just another chain; it's designed from the ground up to handle things like tokenizing real-world assets (RWAs) while keeping everything compliant and private. In this personal take, I'll share my thoughts on Dusk's core technology, how its features stand out to me, and why I see it as a thoughtful solution for the evolving world of decentralized finance. Let's unpack the architecture, from zero-knowledge proofs to its modular setup, and explore what makes it tick.

At the heart of Dusk is its commitment to privacy through zero-knowledge proofs (ZKPs). These aren't just buzzwords; they're the tech that allows transactions and smart contracts to remain confidential while still being verifiable. In my experience following privacy-focused projects, this balance is tricky, but Dusk pulls it off by integrating ZKPs directly into its protocol. For instance, when you're dealing with sensitive financial data—like trading tokenized stocks or bonds—you don't want everything exposed on a public ledger.

Dusk ensures that only the necessary proofs are shared, keeping the details hidden. This resonates with me because it mirrors how traditional finance protects client info, but in a decentralized way. The foundation's focus on compliant privacy means it aligns with regulations like MiCA in Europe, which I think is smart for long-term adoption.Diving deeper into the tech stack, DuskEVM is a standout feature. It's an EVM-compatible layer that lets developers build scalable applications without starting from scratch. What impresses me is how it combines this familiarity with enhanced privacy tools. Developers can deploy smart contracts that handle confidential operations, and the modular architecture allows for upgrades without disrupting the network.

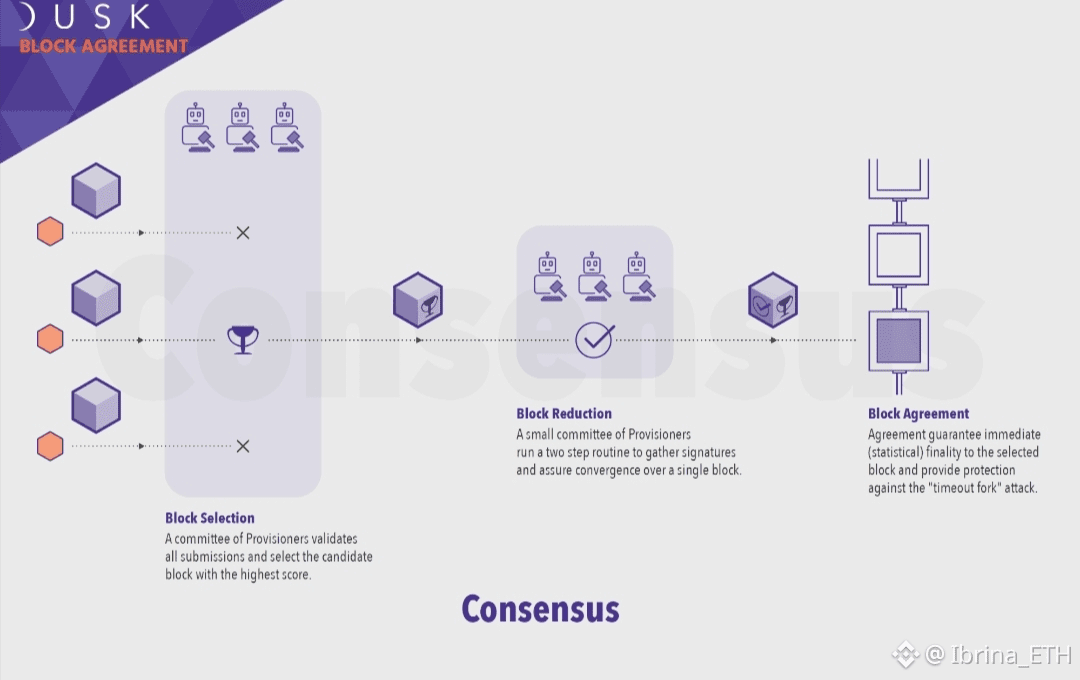

Take Hedger, for example.it's a tool that enables private balances and transactions on the EVM layer. In my view, this makes Dusk accessible for builders who want to create apps for regulated markets, like private equity funds or bond issuances. The alpha launch of Hedger in early 2026 opened it up for public testing, and from what I've seen in community discussions, it's improving performance and usability, which is crucial for real-world testing.Another aspect I appreciate is Dusk's approach to consensus and scalability. The protocol uses a proof-of-stake mechanism with staking incentives that secure the network while rewarding participants. With governance tied to the $DUSK token, holders can vote on decisions, giving the community a real say. This decentralized governance model feels empowering, as it aligns incentives for long-term growth.

The foundation has been methodical in its upgrades.back in July 2025, they enhanced ZKP mechanisms and consensus for better efficiency. Personally, I think this iterative approach builds trust; it's not about rushing features but ensuring they're robust. For RWAs, Dusk provides tools for on-chain issuance and settlement, which could streamline processes that are clunky in traditional systems.From a security standpoint, Dusk's zero-trust custody solutions are noteworthy. Partnering with entities to develop things like Dusk Vault allows for institutional-grade storage of tokenized assets.

In my perspective, this is key for attracting bigger players who need assurance that their assets are safe. The mainnet rollout in early 2025 was a milestone, starting with immutable blocks on January 7, and it set the stage for more advanced features. The upcoming Q1 2026 upgrade, focusing on EVM activation, seems poised to expand its capabilities further. I've pondered how this positions Dusk in the broader ecosystem—it's not competing on speed alone but on compliant functionality.Community-wise, Dusk fosters engagement through clear communication and tools like SDKs for private smart contract development. The foundation's shift in 2023 to emphasize regulated DeFi shows a mature mindset.

In my take, this isn't flashy it's foundational. As someone who values projects that prioritize execution over hype, Dusk's business-oriented strategy from pilots to adoption feels refreshing. It's funded by thoughtful investors, which adds to its credibility. Overall, Dusk's architecture inspires confidence in a privacy-respecting future for finance. What tech feature grabs you? Let's chat!