Bonds are among the oldest and most trusted financial instruments in the global economy. Long before modern stock markets and long before digital assets like cryptocurrencies existed, bonds were already being used by governments and institutions to raise capital and manage economic growth.

Today, bonds continue to play a central role in global finance. They help governments fund public spending, allow corporations to expand without diluting ownership, and give investors a relatively stable way to preserve capital while earning predictable income. Compared with stocks and cryptocurrencies, bonds are typically far less volatile, which is why they often serve as the foundation of long-term investment portfolios.

Understanding bonds is not only important for traditional investors. Bond markets strongly influence interest rates, liquidity, risk appetite, and market sentiment, all of which indirectly affect equities, commodities, and even crypto markets.

This article provides a deep, structured explanation of what bonds are, how they function, why they matter, and how they connect to broader financial trends — including digital assets.

Understanding Bonds at a Fundamental Level

At their core, bonds are a form of debt.

When you purchase a bond, you are not buying ownership in a company or network. Instead, you are lending money to an issuer. That issuer can be a national government, a local authority, or a private corporation. In exchange, the issuer makes a legal commitment to pay you interest at regular intervals and to return your original investment — known as the principal or face value — when the bond reaches maturity.

Because of this structure, bonds are often compared to a formal IOU with clearly defined rules. Unlike stocks, where future returns are uncertain, bonds provide investors with known cash flows, assuming the issuer remains solvent and does not default.

This predictability is what makes bonds especially attractive during periods of economic uncertainty.

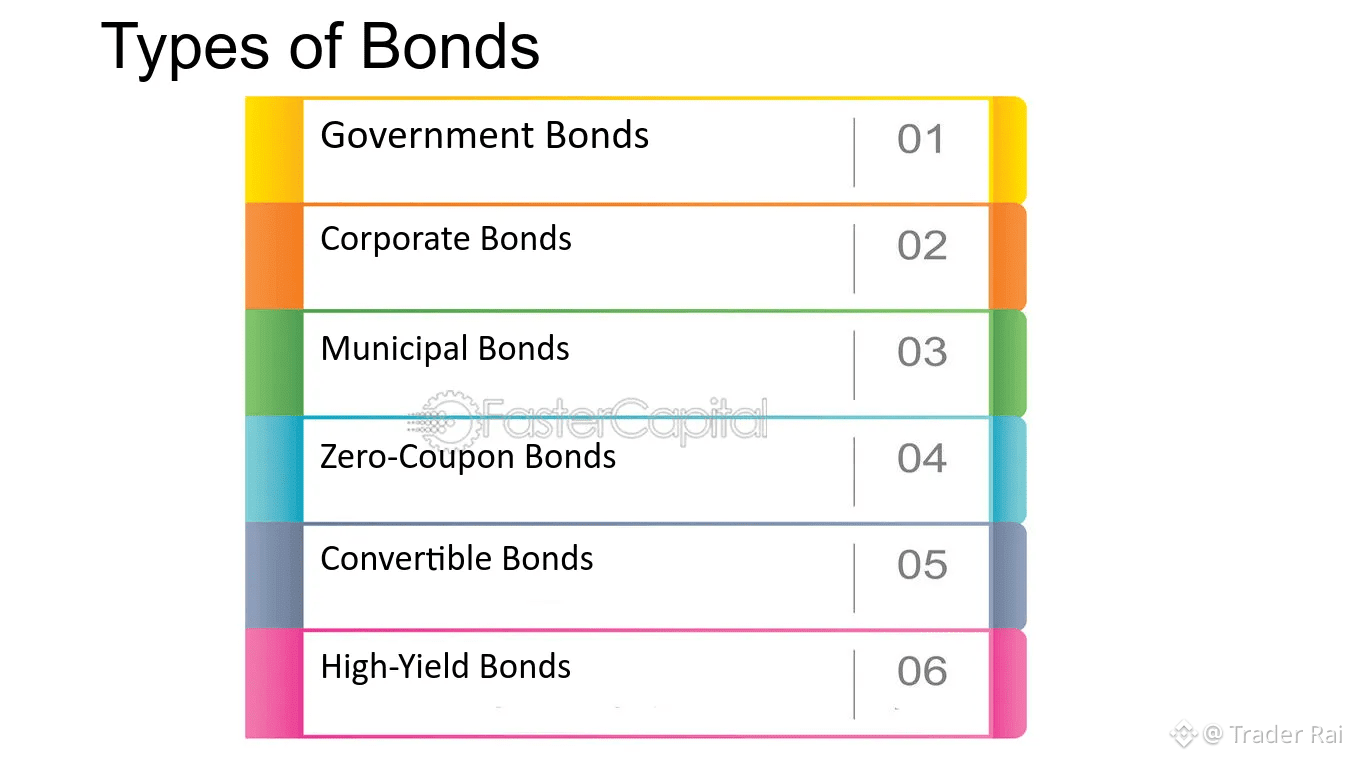

Major Types of Bonds

Although all bonds share the same basic structure, they differ significantly depending on who issues them and why.

Government bonds are issued by national governments to fund public spending, manage debt, or stabilize the economy. In developed countries, these bonds are generally considered among the safest investments available. U.S. government bonds, for example, are often used as global benchmarks for “risk-free” returns.

Municipal bonds are issued by cities, states, or local governments. These bonds are commonly used to finance infrastructure projects such as roads, schools, hospitals, and utilities. They are popular with conservative investors seeking steady returns tied to public development.

Corporate bonds are issued by private companies to raise capital for expansion, research, acquisitions, or refinancing existing debt. Compared to government bonds, corporate bonds usually offer higher interest rates to compensate investors for increased risk.

Savings bonds are typically designed for retail investors. They are issued in smaller denominations, emphasize capital protection, and prioritize simplicity over high returns. These bonds are often held to maturity rather than actively traded.

How Bonds Actually Work in Practice

Every bond is defined by three essential components:

Face value is the amount the investor will receive when the bond matures. Most bonds are issued with standard face values, such as $1,000.

Coupon rate determines how much interest the bond pays. A bond with a 5 percent coupon rate on a $1,000 face value pays $50 per year.

Maturity date is the point at which the bond expires and the issuer repays the principal.

Bonds are initially sold in the primary market, where investors buy directly from the issuer. After issuance, most bonds trade in the secondary market, where prices fluctuate based on interest rates, economic conditions, inflation expectations, and the issuer’s creditworthiness.

This secondary market is what gives bonds liquidity. Investors are not forced to hold bonds until maturity — they can sell earlier if market conditions change.

Interest Rates, Bond Prices, and the Inverse Relationship

One of the most important concepts in bond investing is the inverse relationship between bond prices and interest rates.

When interest rates rise, newly issued bonds offer higher yields. Older bonds with lower coupon rates become less attractive, so their prices fall.

When interest rates fall, existing bonds with higher coupon rates become more valuable, and their prices rise.

This relationship makes bond markets extremely sensitive to central bank policy, inflation data, and macroeconomic trends. As a result, bond movements often lead other markets, acting as early indicators of economic shifts.

Why Bonds Matter in Financial Markets

Bonds serve several critical functions within the global financial system.

First, they act as safe-haven assets. During periods of market stress, investors often move capital out of riskier assets and into government bonds to preserve value.

Second, bonds are essential for portfolio diversification. While stocks and crypto assets can deliver higher growth, they also introduce volatility. Bonds help smooth portfolio performance by providing steady income and lower risk.

Third, bond markets help signal economic expectations. Yield movements, credit spreads, and yield curve dynamics offer insight into inflation outlooks, recession risk, and monetary policy direction.

Few markets reflect collective investor psychology as clearly as bonds.

Bonds and Market Sentiment

Bond markets are closely watched for signals about future economic conditions.

One of the most well-known indicators is the yield curve, which compares yields on short-term and long-term bonds. When short-term yields rise above long-term yields, the curve becomes inverted — a pattern historically associated with economic slowdowns or recessions.

Investor behavior also plays a key role. During optimistic periods, capital often flows out of bonds and into growth assets. During uncertainty or fear, demand for bonds increases, pushing prices higher and yields lower.

This constant movement makes bonds a powerful barometer of global risk sentiment.

The Connection Between Bonds and Crypto Markets

Although bonds and cryptocurrencies appear very different on the surface, they are closely linked through macro conditions and capital allocation decisions.

When bond yields are high and stable, investors may prefer predictable income over speculative assets, reducing demand for crypto.

When interest rates are low or real yields are negative, investors often search for alternative sources of return. In such environments, crypto assets may benefit from increased attention and capital inflows.

Many investors also use bonds as a risk-balancing tool. Holding bonds alongside volatile digital assets helps reduce portfolio drawdowns during sharp market swings.

In this way, bonds indirectly influence crypto markets even without direct interaction.

Final Thoughts

Bonds remain a cornerstone of the global financial system. They fund governments, support corporate growth, provide investors with stability, and offer crucial insight into economic direction and market sentiment.

Even as digital assets continue to evolve and gain adoption, bonds still shape how capital flows across markets. Understanding how bonds work — and how they interact with interest rates, risk appetite, and macro trends — allows investors to make more informed decisions and build portfolios that are resilient across economic cycles.

In a world of rapid innovation and volatility, bonds continue to represent structure, predictability, and balance.

#Binance #FinanceEducation $BTC $ETH $BNB