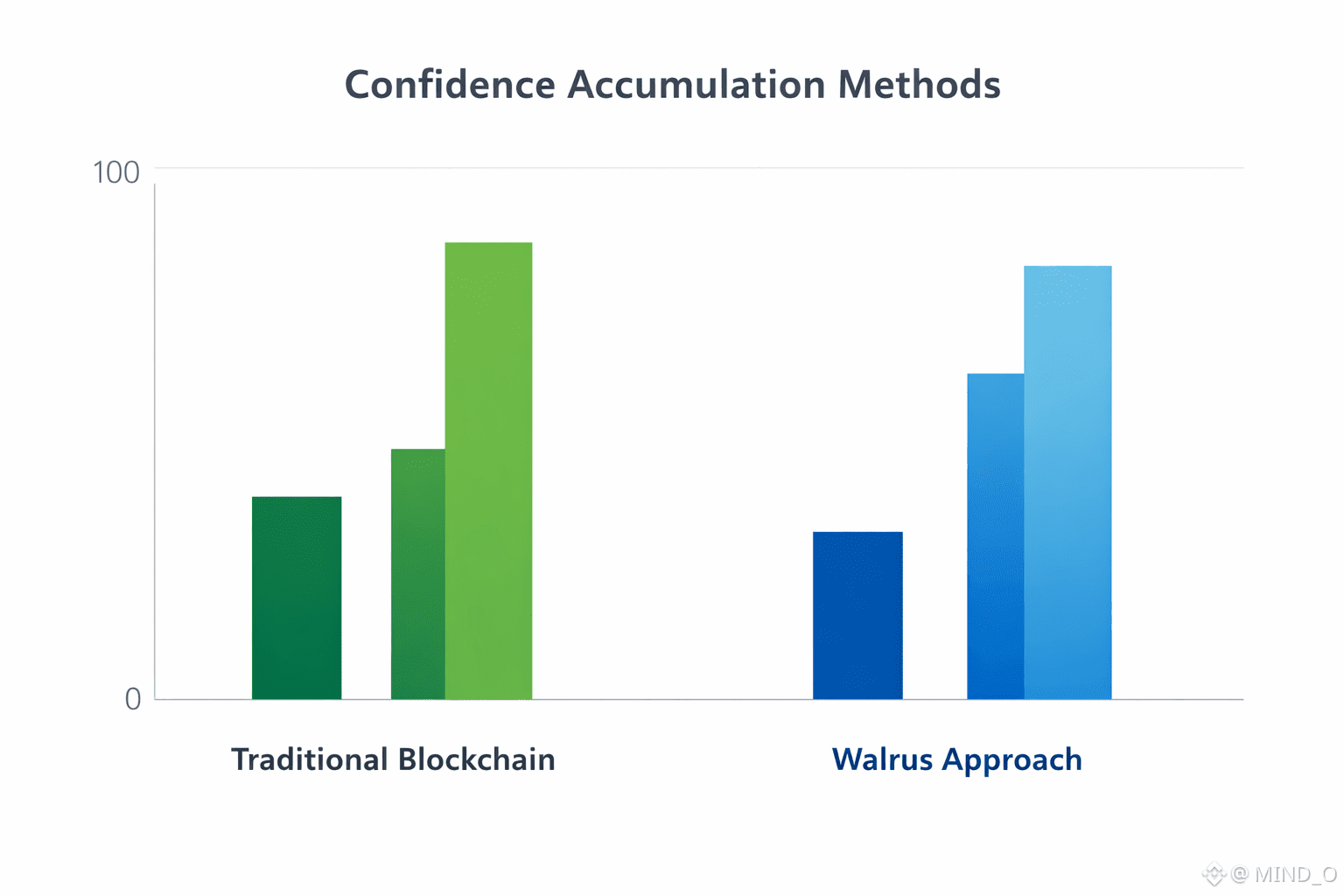

Walrus enters the blockchain landscape from an unusual starting point by treating information flow rather than transaction flow as the primary unit of institutional trust. Instead of assuming that financial confidence emerges after settlement Walrus assumes that confidence must exist before settlement through continuous visibility into how data is stored maintained and economically enforced. This inversion matters because modern financial systems are no longer defined by execution alone but by the ability to observe risk exposure in real time. Walrus positions itself as infrastructure where trust is accumulated gradually through measurable behavior rather than asserted through ideology or reputation.

Walrus is architected around the assumption that institutions think in terms of systems not applications. Storage capacity data availability duration and economic guarantees are expressed as onchain state objects that persist independently of any single application context. This creates an environment where participants can analyze obligations and exposures as living variables rather than historical artifacts. Data is not simply written and forgotten but remains economically alive throughout its lifecycle. For institutions this directly addresses a core friction in blockchain adoption which is the inability to model ongoing operational risk once data leaves the execution layer.

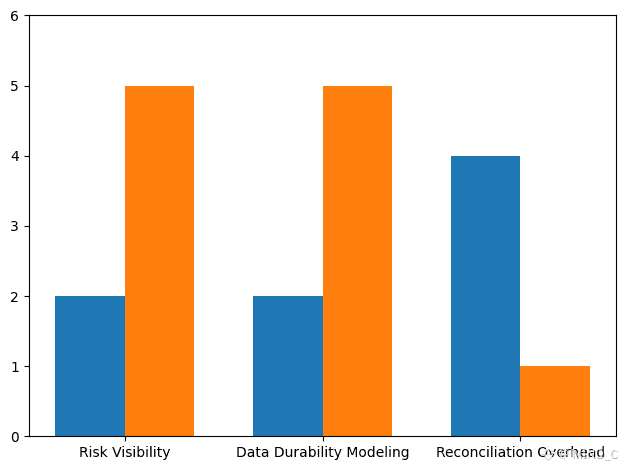

A defining feature of Walrus is that analytics emerge naturally from protocol mechanics rather than external dashboards. Every storage commitment has a time horizon every allocation has a cost profile and every operator action influences measurable network conditions. This allows analytical models to be built directly on canonical chain state without reconciliation across disparate data sources. In institutional settings this reduces reconciliation risk which is one of the most persistent sources of operational failure. The protocol itself becomes the single source of analytical truth.

The storage model of Walrus is particularly relevant to financial intelligence because it reframes durability as a probabilistic economic outcome rather than a binary promise. By distributing encoded data fragments across a decentralized operator set the network allows durability guarantees to be quantified and stress tested. Institutions can reason about resilience using observable parameters rather than contractual assurances. This mirrors how risk is managed in traditional finance where exposure is continuously measured rather than assumed to be static.

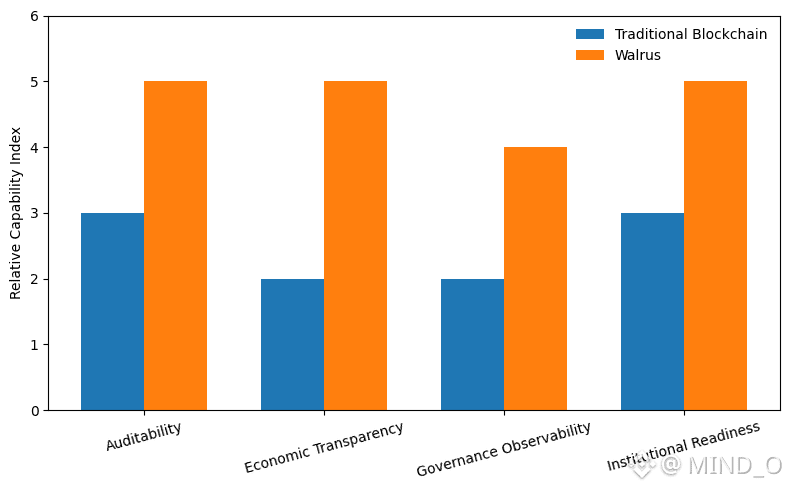

Compliance awareness in Walrus does not arise from constraint but from legibility. The protocol exposes sufficient structural information to allow auditors and regulators to reconstruct system behavior without requiring privileged access. Ownership timelines and economic enforcement are all visible at the protocol level. This aligns with regulatory frameworks that emphasize auditability over restriction. Walrus demonstrates that decentralization and compliance are not opposing forces when transparency is built into the system itself.

The economic layer of Walrus reinforces this transparency driven model. Staking is not merely a security mechanism but an information signal. Capital alignment with performance creates a feedback loop that reveals operator quality network concentration and systemic risk. Institutions evaluating participation can observe these dynamics directly rather than relying on offchain disclosures. This reduces informational asymmetry which is a prerequisite for institutional trust.

Governance within Walrus also benefits from this analytical orientation. Because protocol behavior is continuously observable governance decisions can be grounded in empirical performance rather than speculative debate. Parameter changes can be evaluated against real network outcomes. This shifts governance away from ideological alignment toward outcome driven decision making which is how mature financial systems operate.

Walrus ultimately represents a shift in how blockchain systems justify trust. Instead of asking participants to believe in decentralization as a principle it allows them to measure decentralization as a behavior. Instead of promising resilience it exposes the variables that produce resilience. This approach resonates with institutions because it mirrors how trust is built in existing financial infrastructure through transparency monitoring and accountability.

As blockchain systems evolve Walrus illustrates a path toward financial grade architecture where analytics are not an accessory but the foundation. By embedding data intelligence into its core design Walrus aligns decentralized infrastructure with institutional logic. It suggests that the future of blockchain adoption will belong to systems that do not merely execute transactions but continuously explain themselves through data.

#Walrus @Walrus 🦭/acc $WAL #walrus