Many traders see price move fast on the chart and think it’s just volatility.

Smart traders see something else forming in the background — imbalance.

That imbalance is called a Fair Value Gap (FVG), and once you understand it, you’ll start seeing the market very differently.

Understanding Fair Value Gap in Simple Terms

A Fair Value Gap happens when price moves aggressively in one direction and leaves an area on the chart where very little trading occurred.

In that moment, buyers and sellers did not agree on a “fair” price.

One side completely dominated the other.

Because markets naturally seek balance, price often returns to that gap later to complete unfinished business.

In simple words:

Price moves fast → imbalance is created → market comes back → trading opportunity appears

This is why FVGs are powerful.

They show you where price is likely to react, not where it already reacted.

How a Fair Value Gap Is Formed (Step-by-Step)

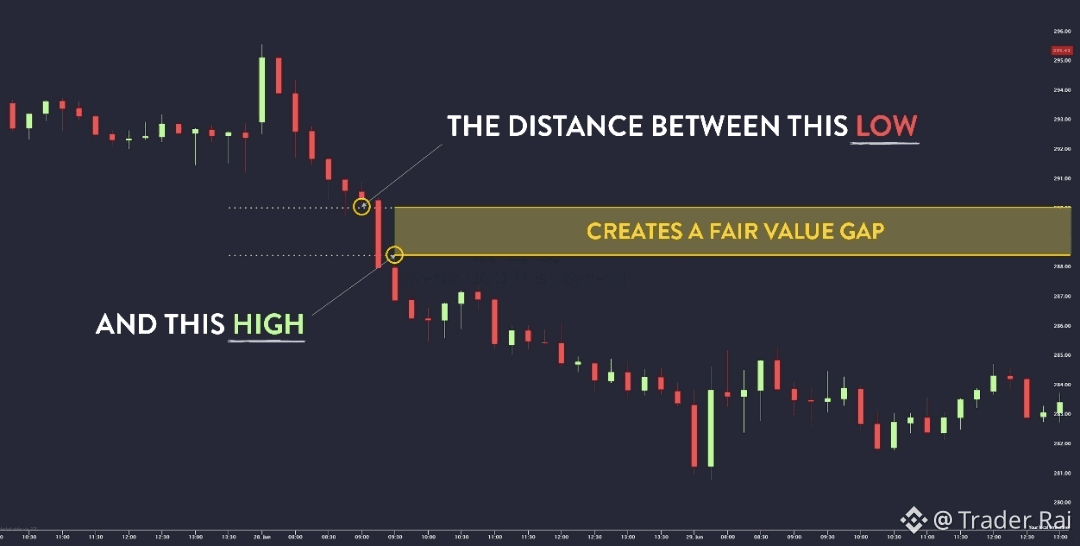

A classic FVG forms using three candles:

• In a bullish move:

The high of the first candle does not overlap with the low of the third candle

• In a bearish move:

The low of the first candle does not overlap with the high of the third candle

That “empty space” between them is the Fair Value Gap.

It represents inefficient price delivery — price moved too fast.

Markets don’t like inefficiency.

They come back to fix it.

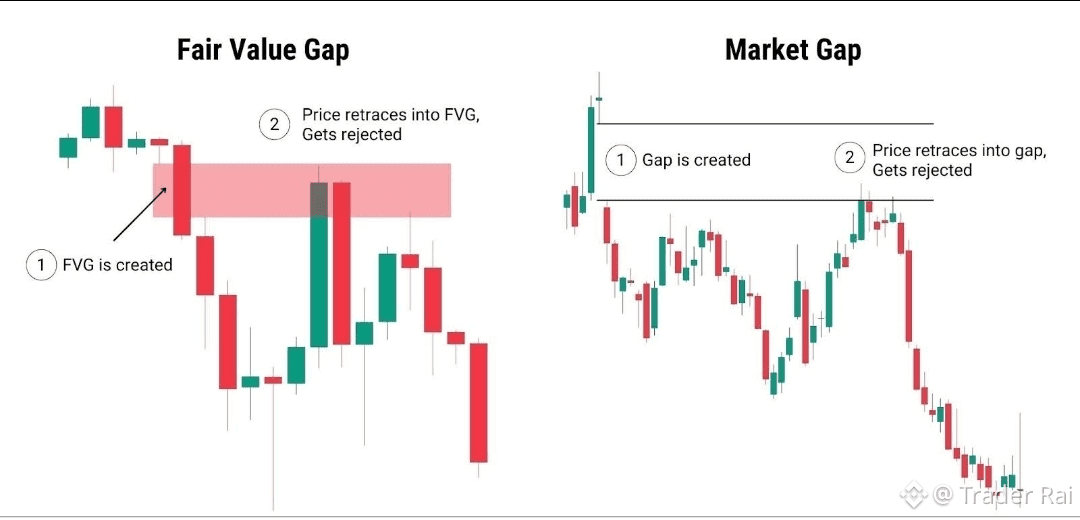

Bullish vs Bearish Fair Value Gaps

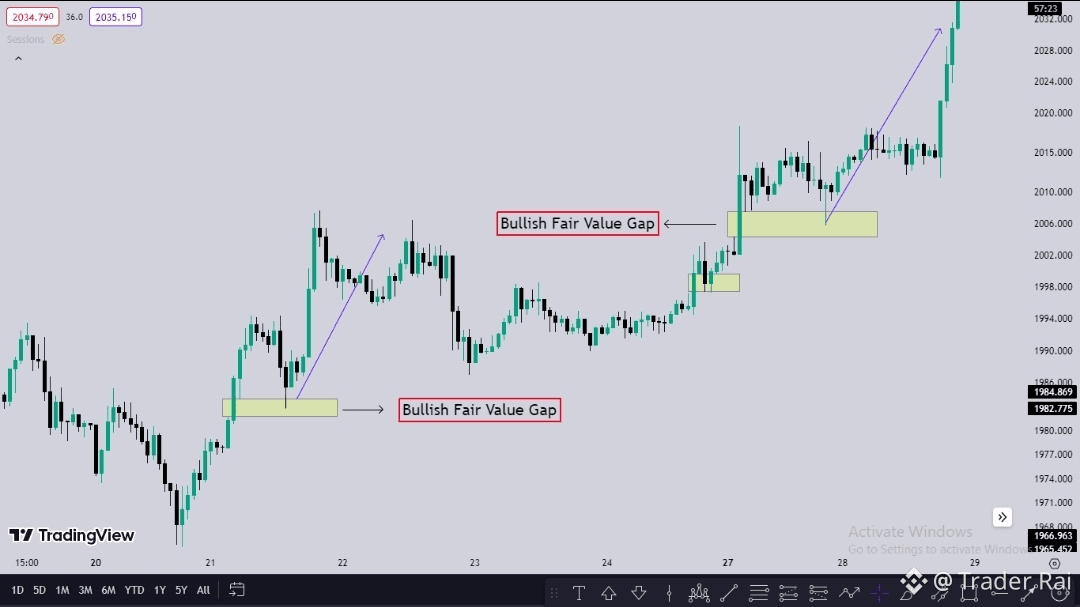

Bullish FVG • Created during strong upward moves

• Price often comes back down into the gap

• Acts as a support / buy zone

• Traders look for longs when price taps the FVG and shows confirmation

Bearish FVG • Created during strong downward moves

• Price often retraces upward into the gap

• Acts as a resistance / sell zone

• Traders look for shorts when price taps the FVG and shows rejection

Important note:

An FVG is a zone, not a single line. Treat it like an area, not a точ point.

Why Price Is “Attracted” to Fair Value Gaps

Think of the market like an auction.

If price jumps too fast, many orders are left unfilled.

Big players (banks, institutions, smart money) often wait for price to return to those levels to rebalance positions.

That’s why FVGs act like magnets.

Not every gap will be filled instantly, but many are filled eventually — especially when aligned with trend and structure.

How Professional Traders Use FVGs (Not Beginners)

Beginners mark every gap and expect magic.

Professionals are selective.

They use FVGs with context:

• Market trend (bullish or bearish)

• Higher-timeframe bias

• Liquidity above or below price

• Session timing (London / New York)

• Confirmation on lower timeframes

FVG alone is not a signal.

FVG + context = probability.

Simple Trading Strategy Using Fair Value Gap

Here’s a clean, professional approach:

1️⃣ Identify the trend on higher timeframe

2️⃣ Mark the Fair Value Gap in direction of that trend

3️⃣ Wait for price to return into the gap

4️⃣ Drop to lower timeframe

5️⃣ Enter only after confirmation (engulfing, break of structure, rejection)

6️⃣ Stop loss below/above the gap

7️⃣ Target liquidity or previous highs/lows

This keeps you patient and prevents emotional entries.

Common Mistakes Traders Make With FVG

• Trading every FVG without bias

• Entering blindly without confirmation

• Ignoring higher-timeframe direction

• Using tight stops inside the gap

• Forgetting that some gaps stay unfilled for a long time

Remember:

FVG shows opportunity, not certainty

Final Thoughts

Fair Value Gaps are not a “magic indicator.”

They are a reflection of how markets truly move — through imbalance and correction.

Once you train your eyes to see them, you’ll stop chasing price and start waiting for price to come to you.

That’s the mindset shift from retail trading to smart trading.

Price doesn’t move randomly.

It moves with purpose.

And FVG helps you understand that purpose.