The moment I finally understood why privacy scares regulators had nothing to do with crypto charts. It came from hearing an ordinary compliance story at a bank where a simple transfer took weeks to investigate because the details were scattered across different systems. That was when it hit me. Privacy on its own is not the problem. Privacy without controls becomes chaos. And that is exactly why Dusk Network caught my attention as a trader who is tired of betting on tokens that collapse the moment policy gets involved.

Dusk is not built to hide in the shadows. It is built to give privacy a structure that regulators can still work with. That alone already separates it from most “privacy coins” that end up on watchlists. As I am writing this on January sixteen twenty twenty six, DUSK trades around the zero point zero six four to zero point zero seven dollar range, depending on the exchange. Daily trading volume is between thirteen and sixteen million dollars and the market cap is hovering around the thirty to thirty four million range. CoinMarketCap shows about zero point zero six four four with daily volume near thirteen point five eight million and a market cap slightly above thirty one million. Circulating supply is about four hundred eighty seven million out of one billion maximum. CoinGecko shows a small short term pullback of around three to four percent but a seven day move of more than twenty percent. To me this signals a rotation into real infrastructure rather than noise driven speculation.

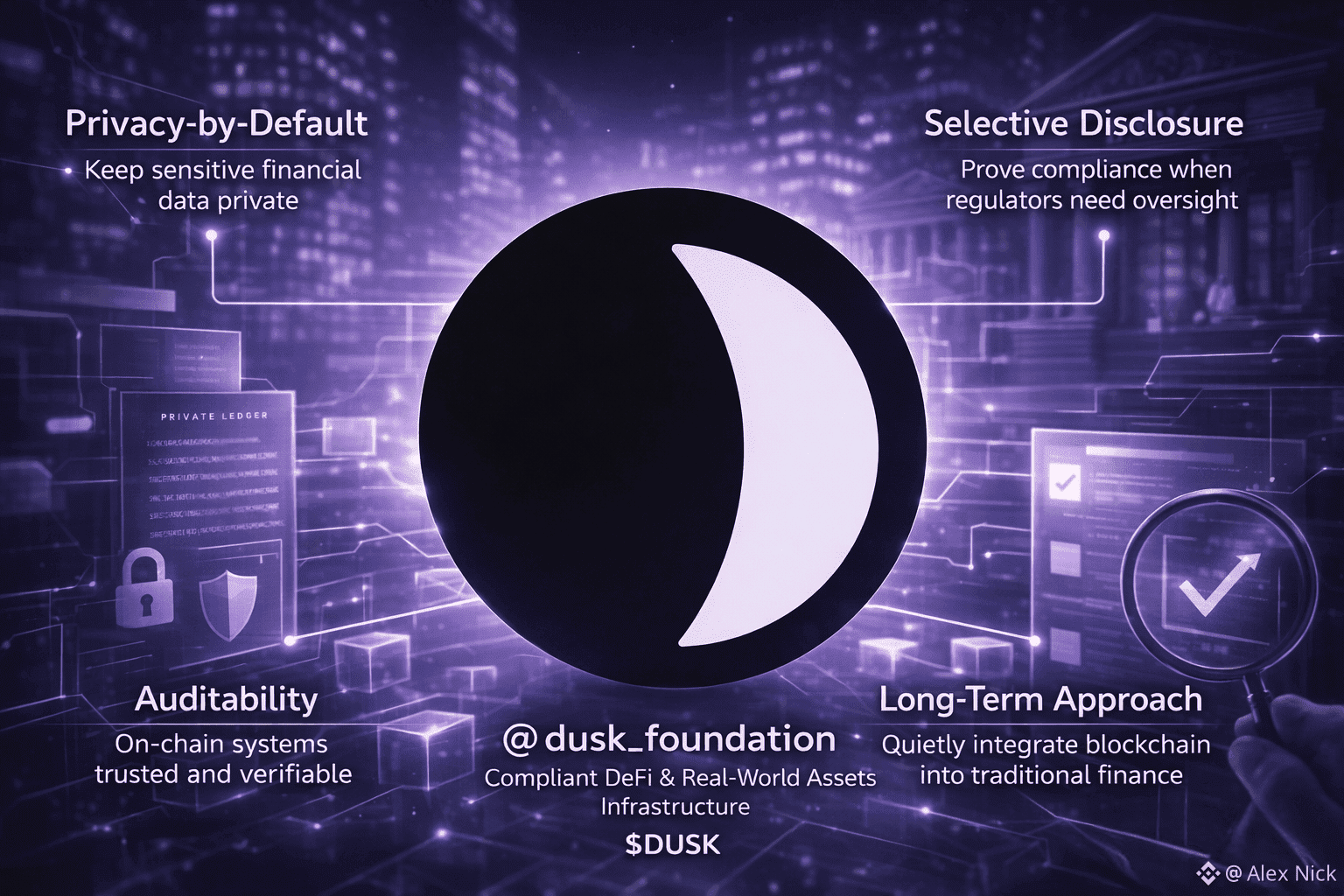

Now let me explain what “privacy meets regulation using zero knowledge proofs” actually means in plain language. Most privacy systems end up trapped at two extremes. Either everything is visible or nothing is visible. Regulators cannot work with “nothing.” Traders and ordinary users cannot work with “everything.” Zero knowledge proofs are the bridge in the middle. They let you prove something is correct without exposing the actual data behind it. No trust me messages. Just mathematical verification.

Think of common situations. You prove you are above eighteen without showing your birthday. You prove you are not on a sanctions list without revealing your full identity to the whole network. You prove you have enough assets to collateralize a trade without showing your entire balance history. Once you understand that, you understand Dusk’s entire purpose. Real finance cannot move on chain if everything is public. It also cannot move on chain if audits are impossible. Zero knowledge lets both sides get what they need.

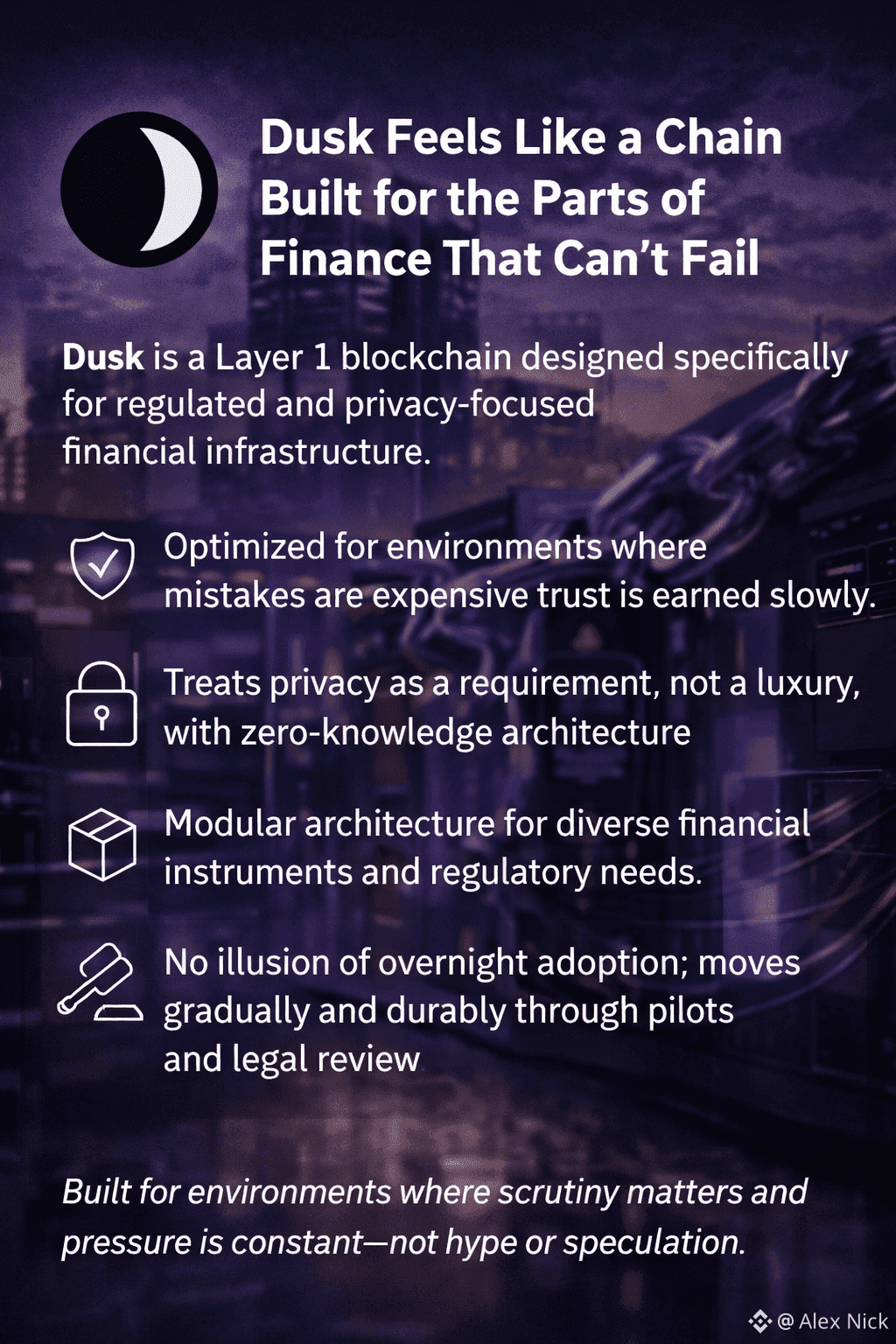

Dusk has been working on this vision since twenty eighteen. The market moved through meme cycles, yield explosions, NFT phases, and now the artificial intelligence trend. Dusk stayed focused on the same problem. And I think that is why it feels more serious today than most projects that change direction every few months. What I like most is that Dusk sees oversight as a requirement and not an enemy. That is not something most of the crypto crowd accepts easily, but it is exactly how real money thinks. Institutions do not want privacy for political reasons. They want privacy because positions, pricing, and strategies are sensitive information. At the same time, they need ways to prove they follow the rules for regulators and internal committees.

Let me give you a real world example to show how this works. Imagine a regulated exchange handling tokenized bonds. If everything is public, competitors watch each trade, track flows, and guess the exposure of each desk before quarterly reporting. That is unacceptable. If the system hides everything, regulators cannot check for wash trades, insider dealing, or restricted counterparties. That is also unacceptable. Zero knowledge gives you privacy in public and provability in private under approved procedures. That is what the phrase “privacy meets regulation” should mean when it is not being used as a buzzword.

Dusk’s token design also reflects this long term thinking. The maximum supply is one billion DUSK. Half existed at the start and the other half comes through staking rewards that release slowly over decades. Circulating trackers show about four hundred eighty seven million in circulation which is almost half of the maximum. To me that layout says the token is built for security, governance, and utility rather than quick speculation. That fits a network designed for regulated settlement, not for casino style volume.

If you look at liquidity today, Dusk does not have massive TVL figures yet. For example, the DUSK $USDT pool on Uniswap V3 holds around one hundred thirty five thousand in liquidity. That might sound unimpressive to someone used to reading DeFi charts only. But for regulated finance infrastructure, the signs of progress look different. They show up in better tools, stronger compliance features, integration across exchanges, and new listing venues. A recent example is Bitunix adding DUSK around January fourteen twenty twenty six.

So what is the real opportunity here from my point of view as a trader and investor? Dusk is betting that regulation will not kill innovation. It will force standards. And standards create defensible positions. That is a slower story than hype driven pumps. But it is also the kind of story that compounds if the tokenization trend gets serious. I think twenty twenty six is the year where the winners are not the loudest projects. They will be the chains that can survive legal scrutiny without exposing every detail to the world.

Dusk is making a very specific bet. It is not just trying to create private transactions. It is trying to create private transactions that can still satisfy regulators. If that works, it will not feel like rebellion. It will feel like infrastructure quietly becoming part of the system.

That is why when I look at DUSK, I do not see a meme chart. I see a wager that zero knowledge proofs can transform privacy from a conflict point into a compliance tool. That is not hype. That is engineering.