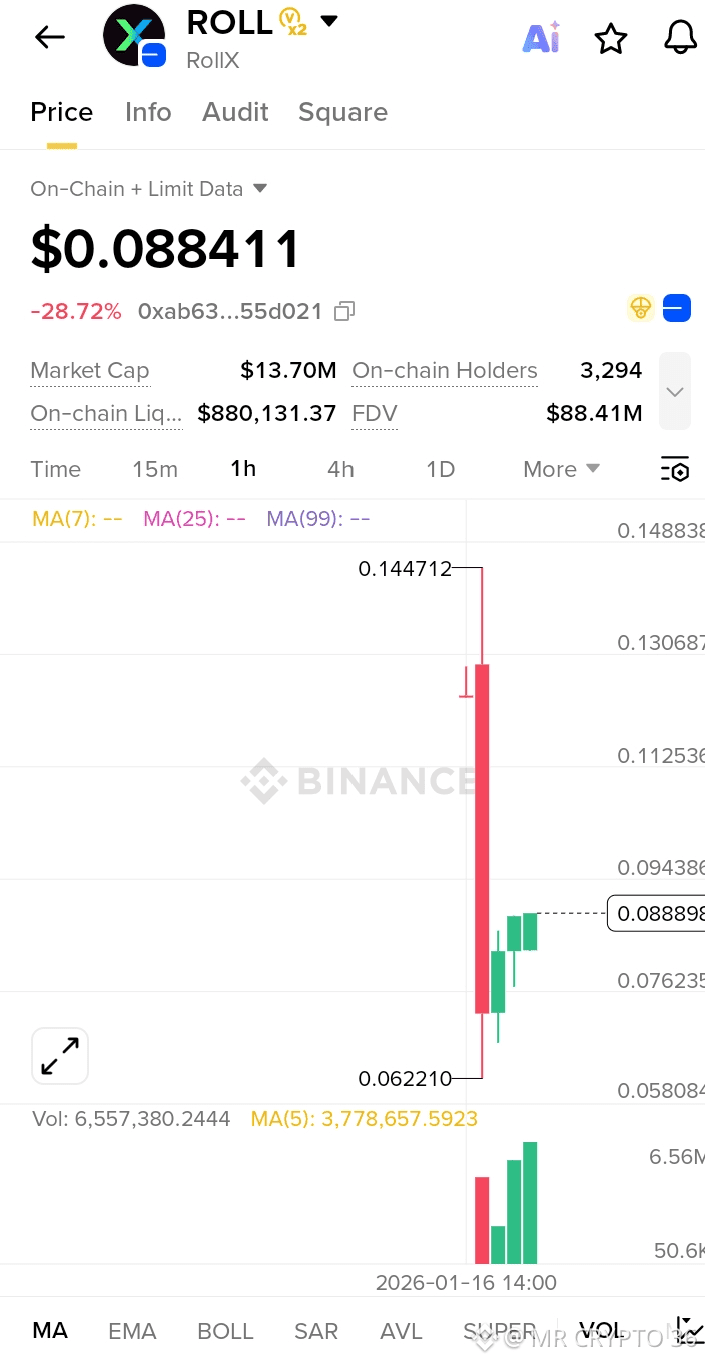

📊 Chart Structure Overview $ROLL

Massive impulsive move up to 0.1447, followed by a sharp sell-off (≈-55% dump).

Price found a local bottom near 0.0622, forming a long lower wick → strong demand / capitulation wick.

Current price is ~0.088, consolidating after recovery.

This is a classic pump → distribution → liquidity grab → stabilization structure.

🔍 Key Technical Levels

🟢 Support Zones

0.076 – 0.078 → Intraday demand + prior consolidation

0.062 – 0.065 → Major liquidity sweep & strongest support (invalidates bullish bias if lost)

🔴 Resistance Zones

0.095 – 0.100 → First supply / short-term rejection zone

0.112 – 0.118 → Mid-range resistance

0.130 – 0.145 → Major distribution / previous top

📈 Indicators & Momentum

MA(7) is turning upward → short-term momentum improving

Volume spike on the drop = forced liquidations, not organic selling

Rising volume on green candles = smart money accumulation

Current candles show higher lows → bullish micro-structure

🧠 Market Behavior (What’s Happening)

Big players likely dumped into retail FOMO, then re-accumulated lower

Price is now forming a base above 0.08

This is not trend reversal yet, but a recovery phase

🔮 Future Price Prediction (Scenarios)

✅ Bullish Scenario (Higher Probability if 0.076 holds)

Break & close above 0.095

Targets:

🎯 0.112

🎯 0.130

🎯 0.145 (full range reclaim)

Expect volatility and fake pullbacks

❌ Bearish Scenario (If support fails)

Loss of 0.076

Fast move toward:

⚠️ 0.068

⚠️ 0.062 (last strong demand)

Below 0.062 → trend turns fully bearish

🧾 Trading Insights (Educational)

Scalping bias: Buy dips near support, sell near 0.095–0.10

Swing bias: Only bullish above 0.10 with volume

Avoid chasing pumps — this asset is highly manipulated

⚠️ Final Verdict

Short-term: Neutral → Bullish recovery

Mid-term: Range-bound with high volatility

Trend flips bullish only above 0.112

#Roll #MarketRebound #BTC100kNext? #StrategyBTCPurchase #USDemocraticPartyBlueVault