XRP price is trading above the zone of $2.0 following a period of stability after a lengthy period of compression that characterized the end of 2025. The change followed the general improvement of the crypto market environment, which underpins more stable liquidity of large-cap assets.

Meanwhile, the institutional infrastructure of RLUSD is expanded by the 150M partnership of Ripple and LMAX Group. Combined, the price structure and liquidity conditions have become the new environment that influences the XRP price behavior.

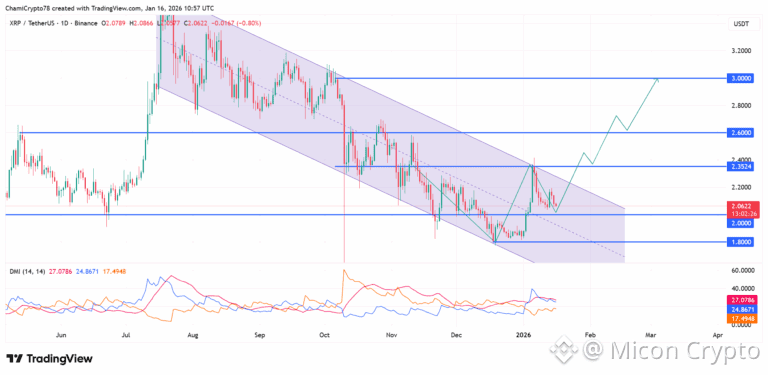

Channel Structure Defines the Path

XRP is confined to a several-month downward channel that has influenced the price action since the late July 2025 surge. The framework imposed low highs, curbing the upward movements. This is because sellers were in control in most part of the second half of the year. The downside momentum however faded around the $1.8 level whereby the buyers intervened and reduced the pace of the decrease and the price leveled off.

From that base, XRP reclaimed the $2.0 level, shifting short-term behavior. The move enabled a test of the channel’s upper boundary near $2.35 earlier this month. Sellers rejected price at that level, reinforcing it as a near-term ceiling. Then XRP has gone back to the $2.0 which is now acting as immediate support. At the time of writing, XRP market value sits around $2.06.

When buyers have the upper hand at about $2.0, prices may correct and re-test high at $2.35. A move above this level would open the path toward $2.6. Strength above $2.6 would place the $3.0 level back into focus, last tested in late October. This scenario is supported by momentum conditions with +DI at 24 still above -DI at 17 and ADX at 27 showing sustained directional pressure.