What makes DuskEVM genuinely fascinating is how it handles privacy for regulated finance. There’s this thing called Hedger that acts like a privacy module for the EVM, letting you keep transaction details secret while still being able to prove everything is legit. Your balances and transfer amounts stay hidden, but auditors can verify correctness using fancy cryptography like zero-knowledge proofs and homomorphic encryption. This matters because regulators aren’t actually allergic to privacy itself, they just hate systems they can’t audit when things go sideways. Most privacy-focused projects fail precisely because they give you secrecy but forget to build the audit trails that regulators demand. Dusk’s approach is selective disclosure, which means users get confidentiality while oversight gets verification.

I’m According to recent updates, Hedger Alpha is already out there for public testing. People can send confidential transactions with private balances while still meeting audit requirements. The bigger message is crystal clear: financial privacy doesn’t have to mean everything is buried in an impenetrable black box. It can mean protected by default but verifiable when necessary. This is a massive selling point in a world where data breaches happen every other Tuesday, especially for institutions handling sensitive financial operations.

Partnerships are another huge part of the DuskEVM story. Dusk mentions working with licensed and regulated entities, which signals they’re not building in some regulatory fantasy land. Examples include NPEX, a Dutch exchange, Quantoz for issuing the EURQ stablecoin, Cordial Systems for compliant custody solutions, and TradeOn21x as a player in the DLT-focused marketplace. These partnerships tell you something important: Dusk isn’t trying to dodge regulators but actually align with them. As regulations like MiCA reshape Europe’s crypto landscape, networks that can comply with requirements while still offering meaningful privacy could have a serious strategic advantage.

Then there’s the interoperability angle. Dusk is adopting Chainlink standards as a way to move tokenized assets across different blockchains securely. With tools like CCIP and oracle standards, assets on DuskEVM become more composable, meaning they can plug into larger DeFi systems and liquidity networks. This matters because tokenization without liquidity is basically pointless, and closed ecosystems don’t scale. Cross-chain connectivity is one of the fastest ways an RWA-focused chain can evolve into an actual financial network instead of an isolated island.

Finally, there’s the application layer bringing regulated assets onto the blockchain. Dusk has created DuskTrade, a flagship RWA application on DuskEVM that’s a licensed Dutch exchange designed to tokenize substantial volumes of assets in a regulated environment. This isn’t just tokenization for the sake of saying you did it, but tokenization that can actually plug into real markets with faster settlement and organized compliance frameworks. If this works as intended, Dusk moves from theory into actual financial infrastructure.

Beyond the main narrative, ecosystem updates provide additional context. Community interest is growing around DEXs and trading applications on DuskEVM. There’s also a DRC20 standard for fungible tokens being developed to make integrations and tooling alignment smoother. These are the foundational building blocks needed if DuskEVM wants to attract serious developers. They’re also encouraging grassroots activity through campaigns and content creation, which is typical of ecosystems trying to expand visibility during major technical shifts.

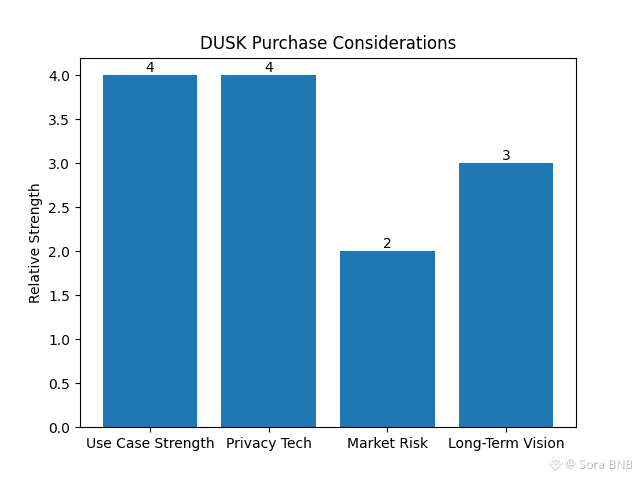

Overall, DuskEVM looks like a smart play: combining EVM familiarity with privacy-by-design architecture and compliance-ready infrastructure. If Dusk can successfully onboard developers, scale its privacy modules, and keep building credible partnerships, it could establish itself as a leader in regulated DeFi and tokenized real-world assets.

Challenges obviously remain. Developers need to actually ship products, users need to trust the technology, and regulatory environments keep shifting. But as a concept, DuskEVM addresses a practical gap in crypto: the need for systems that can deliver privacy, performance, and auditability all at once.

If DuskEVM delivers on these promises, twenty twenty-six might be the year when compliant DeFi and RWAs stop being buzzwords and start becoming actual mainstream financial infrastructure, and Dusk could be one of the networks helping make that transition happen.