Key Takeaways

Plasma (XPL) is a purpose-built, EVM-compatible Layer 1 blockchain engineered specifically for stablecoin payments.

At launch, Plasma claimed throughput exceeding 1,000 transactions per second and block times under 1 second, placing it in the high-performance class of blockchain systems.

From an architectural perspective, Plasma layers its protocol into multiple cooperating components: an execution layer, a consensus/sequencing layer, and mechanisms for gas abstraction, paymaster logic, and bridging.

Plasma’s working logic is to combine fast consensus, gas abstraction, and stablecoin-native support into a unified system that treats USD-equivalent value as a first-class asset.

XPL Token Allocation

The XPL token allocation is structured as follows:

Public Sale: 10 % (1,000,000,000 XPL)

Ecosystem & Growth: 40 % (4,000,000,000 XPL)

Team (and future service providers): 25 % (2,500,000,000 XPL)

Investors / strategic backers: 25 % (2,500,000,000 XPL)

XPL Token Utility

The XPL token is at the heart of the Plasma ecosystem. With utilities as follows:

Gas and Transaction Fees

Staking and Network Security

Validator Rewards and Incentives

Ecosystem Growth and Incentive Funding

Governance and Protocol Upgrades.

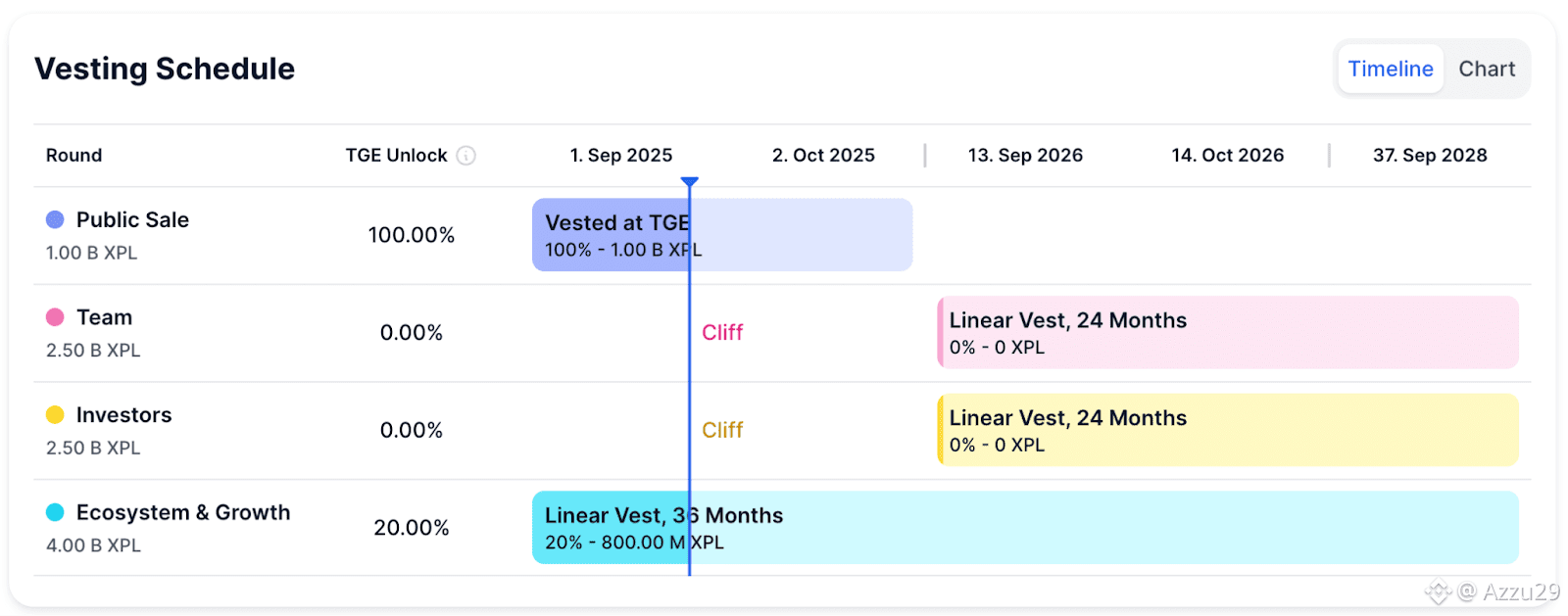

XPL Token Vesting Schedule

The XPL token vesting schedule is as follows:

Public Sale

Allocation: 1.00 billion XPL

Unlock: 100% vested at TGE (1.00 billion XPL released immediately)

Team

Allocation: 2.50 billion XPL

Unlock: 0% at TGE

Vesting: Cliff + linear release over 24 months

Investors

Allocation: 2.50 billion XPL

Unlock: 0% at TGE

Vesting: Cliff + linear release over 24 months

Ecosystem & Growth

Allocation: 4.00 billion XPL

Unlock: 20% at TGE (0.80 billion XPL), remainder vested over time.