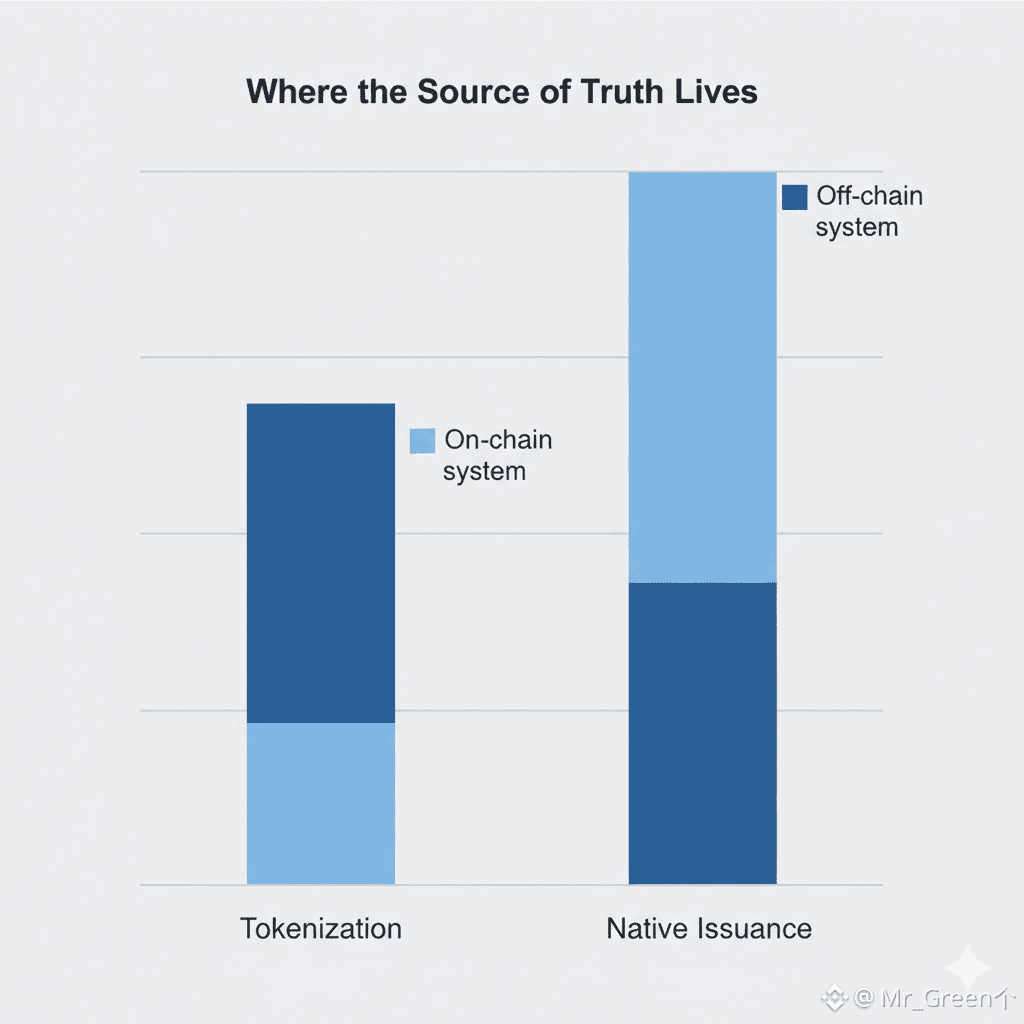

Tokenization is often described like a magic trick. You take something from the real world, you “put it on-chain,” and now it lives in a wallet. It sounds clean. In practice, most tokenization is a label, not a rebuild. The original asset still lives in the old system. The old rules still run the show. The old settlement still decides what is final. The blockchain becomes a mirror, sometimes a useful one, but still a mirror.

Dusk is pushing for a different idea. It calls it native issuance. Native issuance is a simple phrase. It means the asset is not just represented on-chain. It is created on-chain. Its rules are written into the instrument from day one. Issuance, ownership changes, and lifecycle events live where the ledger lives. The asset is “born digital,” not translated after the fact.

This matters because finance is not only about ownership. It is about process. It is about how an instrument behaves over time, what it allows, what it forbids, and what it must report. Tokenization can move a “wrapper” around, but it often leaves the real process off-chain. Dusk’s argument is that true modernization comes when the process moves too.

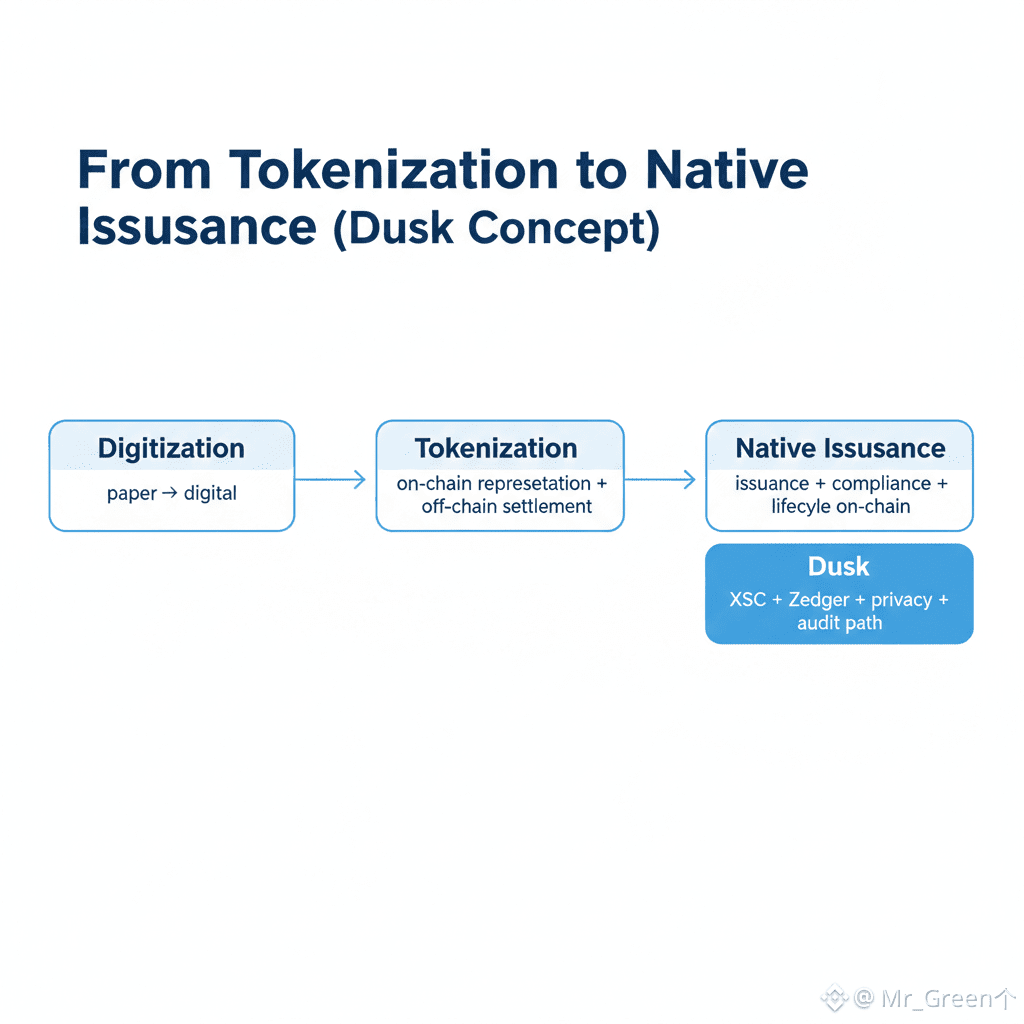

To make that concrete, @Dusk starts even earlier than tokenization. It separates digitization, tokenization, and native issuance as three different steps people confuse. Digitization is taking paperwork and making it digital. Tokenization is creating an on-chain representation of an asset that still depends on off-chain systems for the real source of truth. Native issuance is issuing the asset itself on-chain so the ledger is not just a display, but the operating system.

Once you see it that way, the design choices begin to make sense. If you want native issuance, the chain has to handle things that simple tokens avoid. It has to support restrictions. It has to support lifecycle actions. It has to support compliance checks. And if it wants to serve real markets, it has to do that without turning every investor into a public profile.

That is where Dusk’s core identity becomes clearer. Dusk positions itself as privacy-first infrastructure for regulated finance, with the idea of being “private by design” while still allowing authorized disclosure when required. In the real world, privacy and compliance are not opposites. They are both normal. Markets need oversight, but they do not need public surveillance of every participant.

Dusk ties native issuance to a contract standard called XSC, short for Confidential Security Contract. The important word is “security,” because regulated instruments are not just “things you transfer.” They come with rules and responsibilities. Dusk describes XSC as a standard for creating and issuing privacy-enabled tokenized securities, and it frames the goal as bringing the asset management lifecycle on-chain while maintaining end-user privacy.

Behind that standard sits an asset protocol Dusk calls Zedger. In Dusk’s own documentation, Zedger is presented as the component that enables digital representation, native issuance, and management of securities in a privacy-preserving way. It is also described as supporting compliant settlement and lifecycle needs such as redemption, dividend distribution, and voting, including controls like capped transfers. These are not decorative features. They are the kind of mechanics that make an instrument behave like an instrument.

If tokenization is often “a token that points somewhere,” native issuance is closer to “a token that is the somewhere.”

That shift changes what the blockchain is responsible for. It is no longer just tracking a moving symbol. It is enforcing a living set of rules. It is tracking events that matter legally and financially. It is keeping a coherent record of ownership changes because that record is part of what makes the asset real in a market context.

Now the hard part shows up: compliance. Most people treat compliance as a gate that blocks innovation. Dusk treats it as a reality that decides whether regulated assets will ever move on-chain in scale. In its native issuance framing, Dusk explicitly ties the on-chain system to KYC, AML, and compliance being baked into the way issuance works. The goal is not to remove checks. The goal is to make the checks part of the rail, so the market can operate without constant manual reconciliation.

There is also a quieter reason to do this on-chain. Traditional compliance can lead to oversharing. The same identity data gets copied and stored in too many places. Dusk’s broader privacy direction is an attempt to reduce unnecessary exposure while still meeting obligations. The idea is not “no oversight.” It is “oversight without turning private life into public data.”

Native issuance also changes the meaning of settlement. When an instrument is born on-chain, settlement can be designed as part of the system, not as an external dependency. Dusk’s own description of native issuance emphasizes faster settlement and around-the-clock access compared to legacy market hours and delays. This is not a promise that every market instantly becomes frictionless. It is a claim about what becomes possible when issuance and settlement are built into the same digital environment.

So where does the $DUSK token fit into this? If Dusk is building rails for regulated instruments, it still needs the basic fuel that keeps the rails running. Dusk’s tokenomics documentation describes DUSK as the network token used for staking and for paying fees, with a supply model that starts from an initial supply and then emits additional tokens over a long period to reward stakers, with a capped maximum supply. In plain terms, this is the security budget. If you want real instruments to settle on-chain, the chain must be secure and economically maintained.

In a native issuance world, that matters more than people think. Because the chain is no longer hosting “apps.” It is hosting assets with obligations. Security is not a nice-to-have. It is the floor. And then there is the future, which is where native issuance stops being a concept and becomes a timetable.

Dusk has been explicit that it is building toward regulated market structure, not just crypto-native experimentation. In a Dusk update about key priorities, the team describes pursuing a DLT-TSS route with partners as part of creating an “easy route to on-chain native issuance.” It also describes a trading platform built on DuskEVM intended to provide access to regulated assets such as stocks, bonds, and money market funds. Those are big words, but the direction is simple: build issuance, trading, and settlement as a coherent system rather than scattered pieces.

So when you write about “native issuance vs tokenization” in the Dusk context, you are really writing about a choice of where reality lives.

Tokenization often leaves reality off-chain and brings a copy on-chain. Native issuance tries to put reality on-chain from the start, with rules embedded, privacy respected, and audit paths available when required. It is harder work. It also fits the world that regulated assets actually live in.

If Dusk succeeds, it will not feel like a magic trick. It will feel like boring infrastructure done correctly. The kind that reduces paperwork, reduces reconciliation, shortens settlement, and still respects privacy. That is what modernization looks like when it is meant to last.