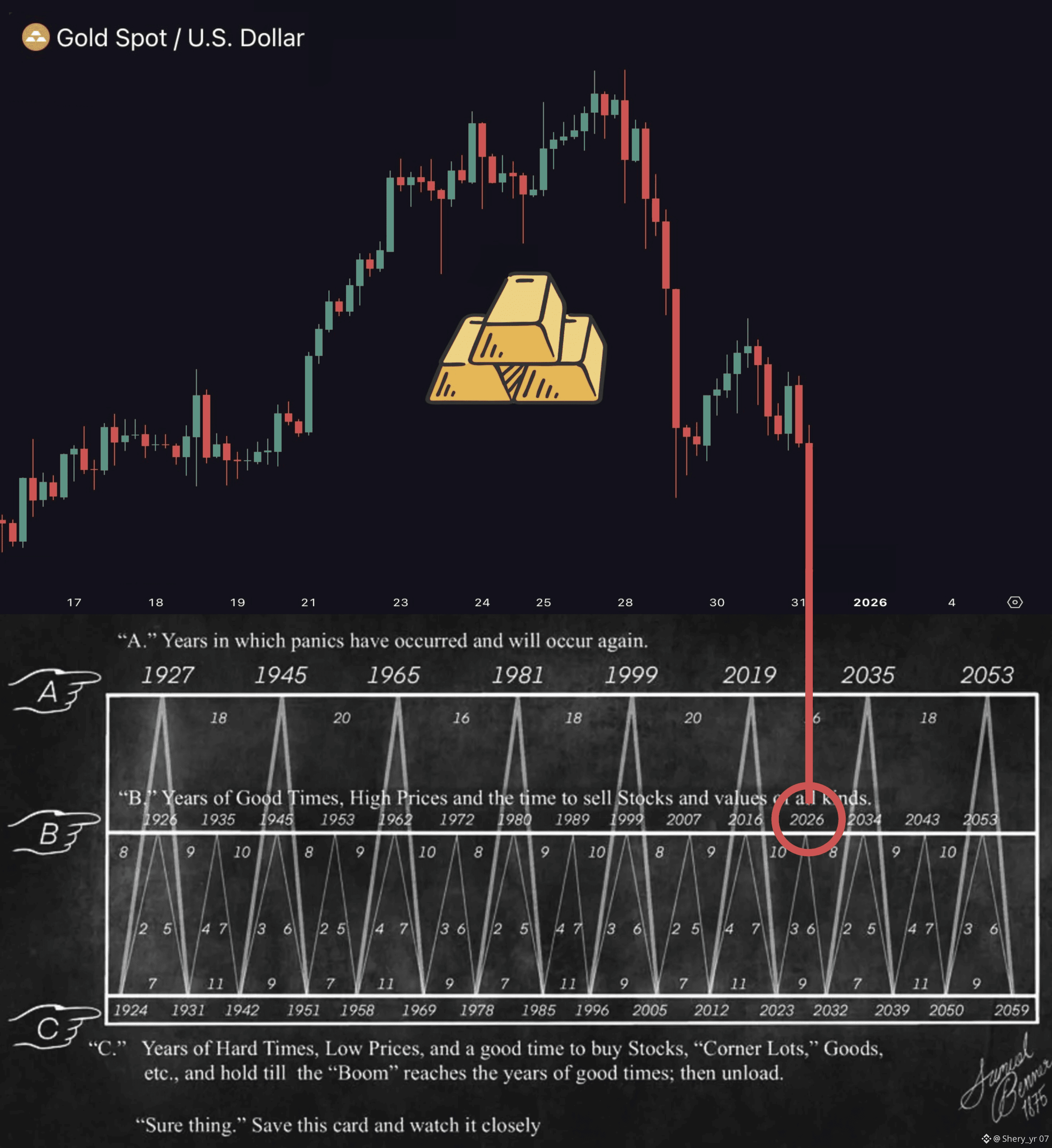

This isn’t some casual profit-taking.

Gold became a consensus macro bet…

And consensus always gets punished eventually.

Driven by inflation hedging, macro stress, and aggressive positioning.

Here’s what today’s drop is actually telling you:

1) MACRO PRESSURE IS BUILDING AGAIN

After the big rally, markets have started pricing in slower growth, sticky yields, and less aggressive rate cuts in 2026. Rising real yields or tighter financial conditions reduce the appeal of non-yielding assets like gold.

2) THIS DROP REFLECTS RISK REPRICING, NOT PURE PROFIT TAKING

When gold rallies on expectations of easier monetary policy, a sudden shift in rate expectations will reverse that logic quickly. Markets are now questioning how strong the next Fed loosening cycle will really be.

3) GOLD IS A PURE MACRO HEDGE

Unlike risk assets, gold does not rely on industrial demand. Instead, its price is driven by real yields, the dollar, and liquidity conditions. When expectations for policy easing weaken, gold comes under pressure immediately.

4) THE HYPE WAS MANUFACTURED

The gold run was fueled by positioning and macro narratives. But sharp drops like this show that speculative demand and positioning can unwind just as fast once macro signals shift.

The signal here is macro, not gold-specific.

Violent reversals in gold usually appear when positioning collides with harsher financial conditions.

Gold feels it early because it sits at the center of monetary trust and macro hedging.

You need to watch yields, the dollar, and liquidity.

And let me tell you — the price is moving for a reason.

#GOLD #Macro #trading #crypto $BTC