A useful way to think about Dusk is to look at the environments it is preparing for. Not open sandboxes where failure is part of the learning process, but financial settings where errors carry consequences. Legal consequences. Operational consequences. Reputational consequences. In those environments, systems do not get to rely on assumptions or best intentions. They have to behave correctly, every time.

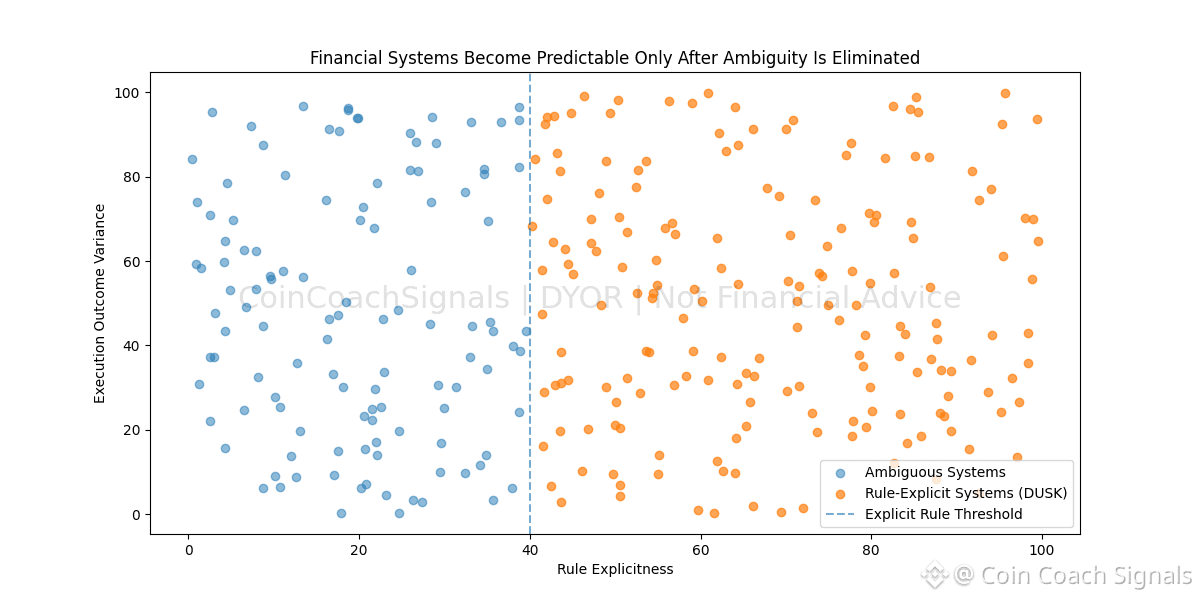

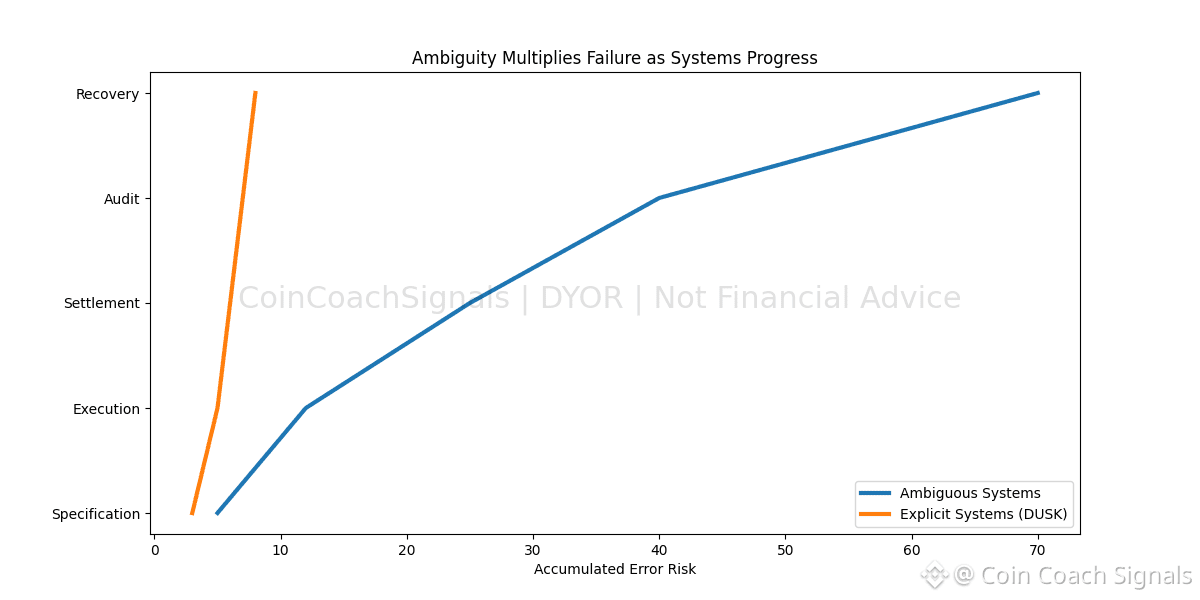

Most blockchains were not built with that expectation. They grew out of experimentation. Transparency was treated as a substitute for structure. If everything was visible, problems could be spotted later. That works when stakes are low. It stops working once real assets, institutions, and regulated participants are involved. Visibility does not prevent mistakes. It just makes them public after they happen.

Dusk Network takes a different approach. Instead of assuming exposure creates trust, it assumes correctness does. The system is designed so that sensitive activity can remain private, while outcomes remain provable. What matters is not in practice, who can see everything, but whether rules are enforced consistently.

This is where selective disclosure becomes important. On Dusk, transactions and asset states are not broadcast to everyone by default. At the same time, they are not unverifiable. When verification is required, cryptographic proofs can show that conditions were met. This mirrors how real financial oversight works. Auditors do not need constant access to all data. They need confidence that rules were followed when it counts.

That design choice changes how enforcement works. On transparent chains, enforcement is mostly reactive. Violations are visible after execution. On Dusk, enforcement happens during execution. Smart contracts operate on confidential state, but they are still deterministic. If an action breaks encoded rules, it simply does not go through. Prevention matters more than observation.

For builders, this creates a different mindset. Applications are not designed for maximum openness or viral composability. They are designed for clarity. Who can interact. Under what conditions. What must be provable. These rules are enforced by the protocol itself, not by offchain processes or trusted intermediaries. That matters in systems where mistakes cannot easily be undone.

Tokenized assets make this especially clear. Real world assets are not static tokens. They come with ongoing obligations. Ownership may need to stay private. Transfers may need restrictions. Jurisdictional rules may change over time. Dusk is built to support those realities directly, rather than forcing assets into abstractions that do not fit.

The ecosystem around Dusk reflects this seriousness. Teams are not chasing fast launches or short-term traction. They are building issuance frameworks, in practice, regulated DeFi components, and settlement layers that assume scrutiny from day one. These builders think in terms of durability. Their systems need to keep working as oversight increases, not just when conditions are ideal.

Dusk also reframes decentralization in a practical way. Decentralization is not the absence of rules. Financial systems need rules. The real question is who enforces them. By embedding enforcement into code, Dusk removes discretionary control while preserving necessary constraints. Rules apply the same way to everyone.

This makes participation more realistic for institutions and enterprises. Many are open to onchain systems, but cannot operate in environments where sensitive activity is public by default. Dusk lowers that barrier. Oversight becomes something that happens through verification, not constant exposure.

Usage on a network like this grows differently. It is not driven by hype or incentives. It grows through integration and reliability. Participants are drawn to predictability, privacy, and legal clarity. That kind of adoption is slower, but it tends to last.

Technically, Dusk uses zero-knowledge cryptography with restraint. The goal is not complexity. It is precision. Proofs are used where they reduce risk and ambiguity. Financial infrastructure does not reward cleverness. It rewards systems that behave the same way tomorrow as they did yesterday.

What stands out most is consistency. Dusk does not shift narratives every cycle. Privacy remains selective. Compliance remains native. Enforcement remains automatic. That coherence builds trust over time.

Dusk is not trying to make onchain finance louder or more flexible. It is trying to make it exact. When ambiguity is expensive, clarity becomes the feature.

For educational purposes only. Not financial advice. Do your own research.

@Dusk $DUSK #Dusk #dusk