As blockchain systems move closer to real financial use, the meaning of trust starts to change. In experimental markets, trust can be inferred from openness or social norms. In regulated finance, that is not enough. Systems are expected to hold up under review, explain their behavior clearly, and enforce rules consistently. Dusk is built with that expectation in mind. Trust is not something it hopes to earn later. It is something the system is designed to demonstrate by default.

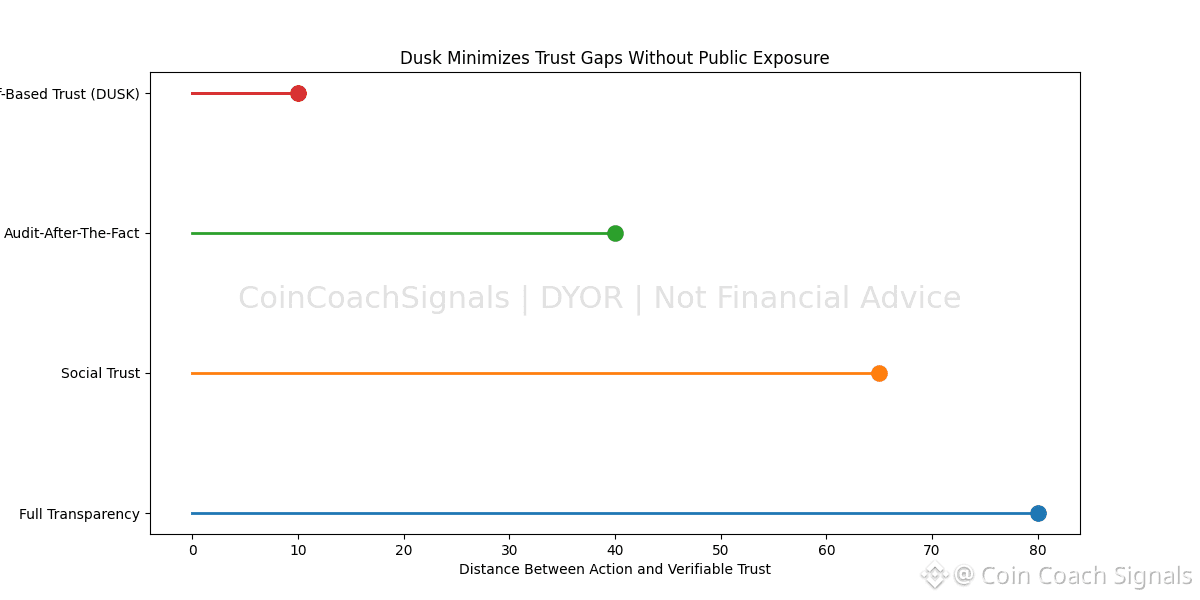

Early blockchains leaned heavily on transparency as a shortcut. If everything was visible, participants were expected to behave, and problems could be spotted after the fact. That model works when stakes are low. It becomes fragile as soon as systems begin handling regulated assets, institutional capital, or long-term obligations. Full visibility exposes sensitive information without guaranteeing correct behavior. Dusk takes a different view. It treats correctness as more important than exposure.

At the core of this design is verifiable confidentiality. On Dusk Network, transactions and asset states do not need to be public to be trustworthy. They can remain private by default, while still producing proofs that show rules were followed when verification is required. This reflects how trust works in the traditional finance. Auditors and regulators do not watch every action in real time. They step in when needed and verify the outcomes against defined rules. Dusk encodes that process directly into the protocol.

This distinction changes how accountability functions. On transparent chains, accountability is usually reactive. Something goes wrong, and everyone can see it after execution. Dusk shifts accountability earlier. Smart contracts operate on confidential state but remain deterministic. Rules are enforced during execution. If conditions are not met, the transaction does not happen. The system prevents violations instead of merely recording them.

For developers, this creates a more disciplined environment. Building on Dusk means being explicit from the start. Who can interact. Under what conditions. What must be provable. These constraints are enforced by code, not by offchain agreements or trusted intermediaries. That matters in financial systems where mistakes are costly and often irreversible. Correct behavior has to be designed in, not monitored later.

Tokenized assets make this especially clear. Real world assets are not simple tokens. They come with ongoing obligations. Ownership may need to stay private. Transfers may need restrictions. Legal requirements may change over time. Dusk’s architecture allows these realities to be expressed directly in how assets behave. Governance and compliance are not add-ons. They are part of the lifecycle.

The ecosystem forming around Dusk reflects this mindset. Builders are not optimizing for speed or attention. They are working on issuance frameworks, regulated DeFi components, and settlement systems that assume scrutiny. These teams design with audits in mind. Their systems are expected to keep working as rules evolve and oversight increases. Durability matters more than novelty.

Dusk also takes a grounded view of decentralization. Decentralization is often described as the absence of structure. In practice, financial systems need structure. The real question is who enforces it. Dusk removes discretionary enforcement by embedding rules into execution. Code applies constraints consistently, regardless of who participates. That reduces reliance on intermediaries while preserving necessary boundaries.

This makes participation more realistic for institutions and enterprises. Many are open to onchain infrastructure, but cannot operate in environments where sensitive operations are publicly exposed. Dusk lowers that barrier. Oversight becomes a matter of verifiable execution rather than constant visibility.

Usage on a network like this grows differently. It is not driven by hype or incentives. It grows through integration and reliability. Participants are drawn to predictability, privacy, and legal clarity. That kind of adoption is slower, but it tends to last.

From a technical perspective, Dusk applies zero-knowledge cryptography with restraint. The goal is not complexity. It is clarity. Proofs are used where they reduce ambiguity and risk. Financial infrastructure does not reward cleverness. It rewards systems that behave the same way tomorrow as they did yesterday.

What ultimately distinguishes Dusk is consistency. Privacy remains selective. Compliance remains native. Enforcement remains automatic. The network does not chase narratives or expand into unrelated problem spaces. That coherence builds credibility over time.

Dusk is not trying to make onchain finance louder or more flexible. It is trying to make it dependable under scrutiny. In environments where trust cannot be assumed, it has to be demonstrated. Dusk is building for exactly that.

For educational purposes only. Not financial advice. Do your own research.

@Dusk $DUSK #Dusk #dusk