Crypto loves to say it’s better than the traditional system: faster, borderless, programmable, more transparent, more efficient. Fine. Then let’s ask the uncomfortable question:

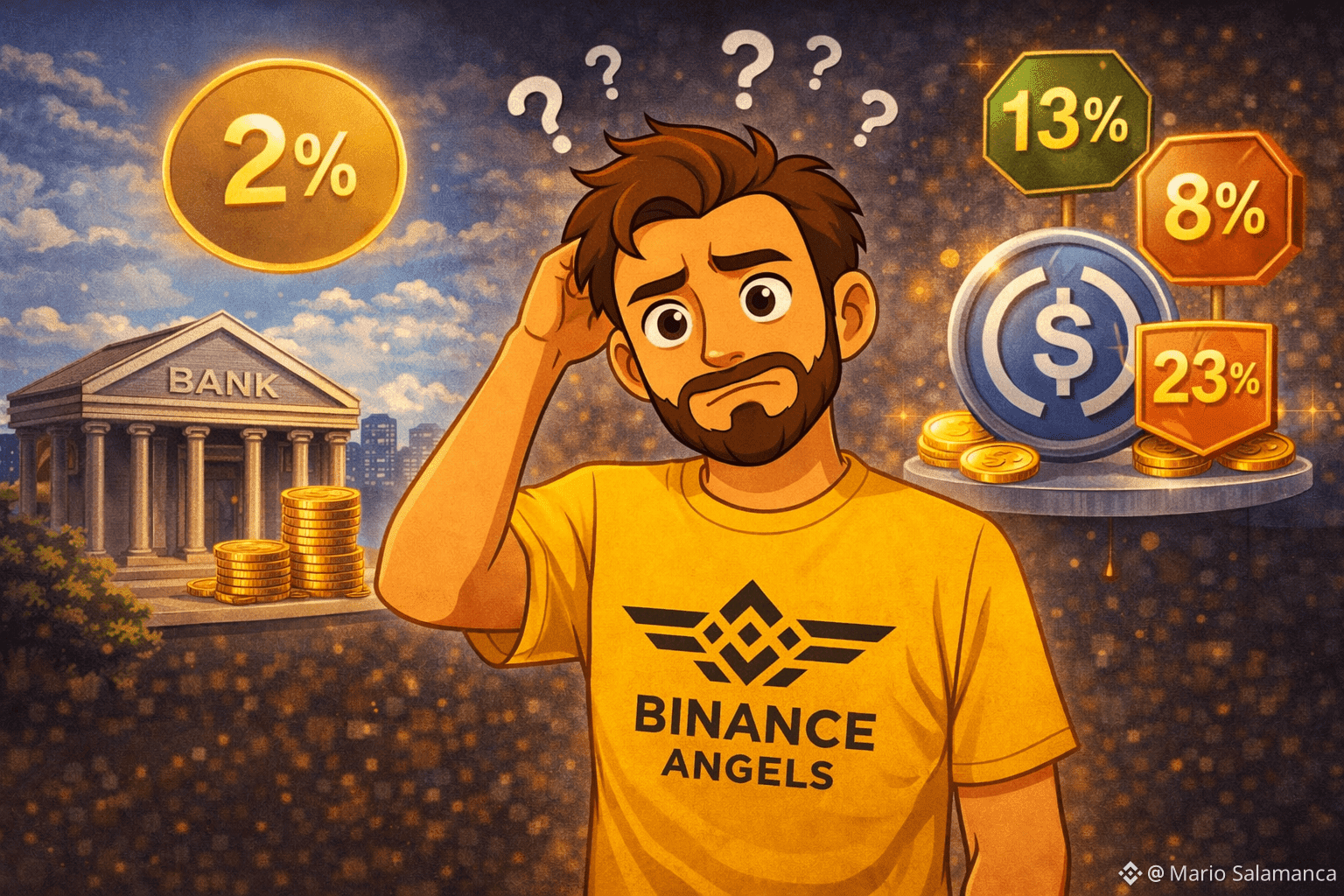

Why is it still hard to find a stablecoin offer that genuinely competes with the most basic, low-effort TradFi product — a simple 2% savings account?

Take a well-known online bank as the baseline example: they advertise 2% TIN / 2.02% TAE on cash, paid monthly, in a format that regular people instantly understand.

No “tiers.” No hidden math. No “up to” that collapses the moment you deposit a real amount.

Now compare that with what crypto platforms often do with stablecoins like USDC: headline-grabbing promos that look amazing at first glance… until you read the fine print and realize the offer is mostly an illusion for anyone with more than pocket change.

The “Up To” Problem: Great Headline, Weak Reality

Let’s use a recent USDC example (because this pattern is common):

Binance announced “up to 6.5% APR” on USDC Flexible products.

Sounds competitive, right?

Then you read the tiers: 6.5% applies only to the first 500 USDC, and anything above 500 USDC earns around ~1.5% Real-Time APR.

That’s not a small detail. That is the offer.

And it gets even more extreme in EEA promos:

“Up to 20% APR for 10 days” sounds like a monster yield.

But it’s 20% only up to 1,000 USDC, and above 1,000 USDC it drops to ~1%.

So what happens in real life?

Most users don’t deposit 500 USDC. They deposit 5,000, 10,000, 50,000. And when they do, the “wow” offer becomes a 1%–1.5% experience on the majority of their funds.

Why This Backfires (Hard)

Here’s the psychological chain reaction this kind of marketing creates:

Attention spike: “6.5%! 20%! That’s insane.”

Curiosity click: the user opens the product page.

Fine print discovery: “Oh… only the first 500 / first 1,000.”

Emotional outcome: not disappointment — rejection.

And that rejection is important:

The user wasn’t angry before. They were neutral. The promo creates a negative feeling that didn’t exist.

Worse: if a user doesn’t read carefully and subscribes expecting the headline rate on their full amount, they can later feel misled when the earnings don’t match what they assumed. That’s how you lose trust fast.

A weak promo is worse than no promo.

Because no promo doesn’t trigger a “you tried to trick me” reaction.

The Real Question Crypto Should Answer

If stablecoins are supposed to be “digital dollars,” why can’t the market offer something simple like this:

A clear, stable, always-on base rate that competes with the boring TradFi benchmark (2% in EUR, for example).

No gimmicky tiers that collapse after the first small amount.

No “up to” games.

Because if crypto can’t beat a basic 2% savings account for stable value parking, then the superiority narrative starts looking like a meme instead of a product advantage.

“But Crypto Rates Are Variable” — Sure. That’s Not an Excuse.

Markets change. Rates change. Fine.

TradFi changes rates too. The difference is how honestly it’s communicated:

TradFi says: “Here’s the rate.”

Crypto often says: “Here’s the maximum rate you’ll barely get.”

That’s not innovation. That’s marketing gymnastics.

Binance Should Lean Into What It’s Already Strong At: Security + Transparency

This isn’t about questioning platform strength. If anything, crypto platforms should proudly emphasize what makes them credible.

Binance, for example, positions itself with Proof of Reserves (1:1 backing visibility) and a user-protection framework like SAFU as part of its security-first posture.

That’s exactly the kind of foundation you build on if you want to be the go-to home for stablecoin savings.

But the marketing has to match that maturity.

What Would a Better Offer Look Like?

If the goal is long-term adoption (not short-term clicks), here’s the higher-integrity approach:

Stop leading with “up to” as the main message.

Lead with the effective rate users actually get at common balances.Show a simple table:

500 USDC

1,000 USDC

10,000 USDC

And display the blended rate clearly.

Offer a credible baseline.

Even if it’s not flashy, a consistent “boring” rate is what wins trust.If there’s a promo, make it feel fair.

If the best rate only applies to a tiny amount, call it what it is: a bonus, not the headline.

Bottom Line

If crypto wants to be taken seriously as a superior financial system, it needs to compete where real users live:

Simplicity

Clarity

Consistency

Trust

Right now, when a “6.5%” offer becomes “1.5% for most of your balance,” you’re not winning users — you’re teaching them to distrust the category.

And that’s the kind of unforced error crypto can’t afford anymore.