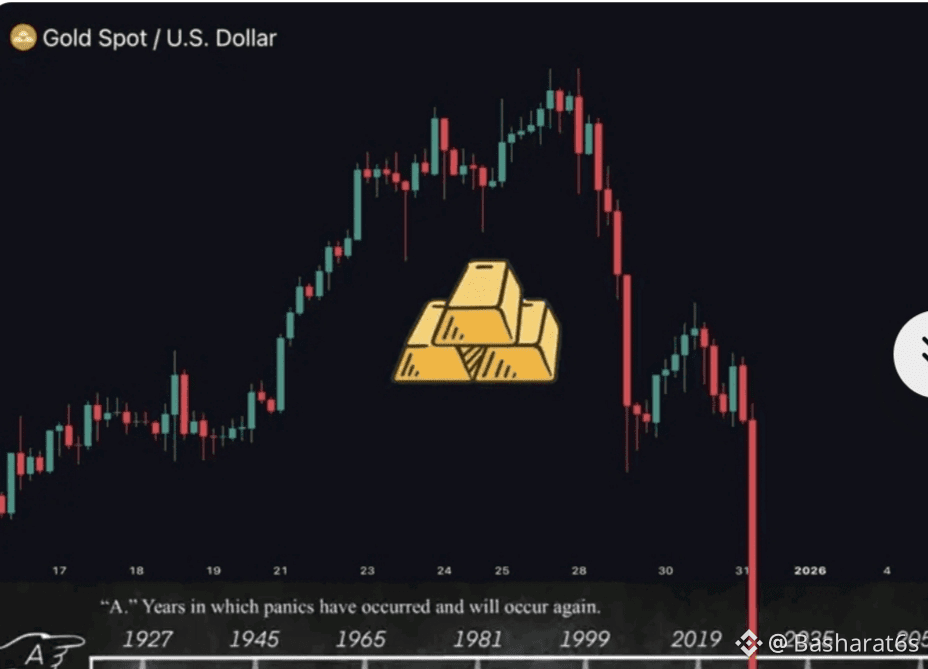

GOLD MARKET SHIFT UNDERWAY

$XAU Is Not Falling Randomly

This Move Reflects A Change In Macro Conditions

Gold Recently Turned Into A Crowded Hedge

And When A Trade Becomes Consensus, Repricing Follows

Here Is What The Market Is Signaling

→ Real Yields Are Firming

Higher Real Rates Reduce The Appeal Of Non-Yielding Assets Like Gold

→ Rate-Cut Expectations Are Cooling

Markets Are Questioning How Aggressive Future Fed Easing Will Be

That Shift Directly Pressures Gold

→ This Is Positioning UnwNarrative-Driven Trades Reverse Fast When Macro Signals Change

→ Gold Reacts Before Risk Assets

Because It Sits At The Center Of Monetary Trust

It Feels Liquidity Stress First

This Is A Macro Warning

Not A Gold-Specific Failure

Watch Yields

Watch The Dollar

Watch Liquidity Flows

Price Is Moving With Structureind

Not Panic Selling