Most developers don’t choose a chain first. They choose a toolset. For smart contracts, that toolset is usually the EVM world: Solidity, standard wallets, common libraries, familiar deployment patterns. It’s the language people already speak when they want to ship.

@Dusk ’s bet is simple. If you want regulated finance to move on-chain, you can’t ask builders and institutions to start by unlearning everything. You meet them where they are, and then you change what the destination means.

That destination, in Dusk’s case, is not a “general purpose” chain optimized for maximum public transparency. It is a privacy blockchain for regulated finance. Dusk describes its mission in plain terms: institutions should be able to meet real regulatory requirements on-chain, users should have confidential balances and transfers instead of full public exposure, and developers should be able to build with familiar EVM tools alongside privacy and compliance primitives. That is the shape of the project, and it’s the reason DuskEVM exists.

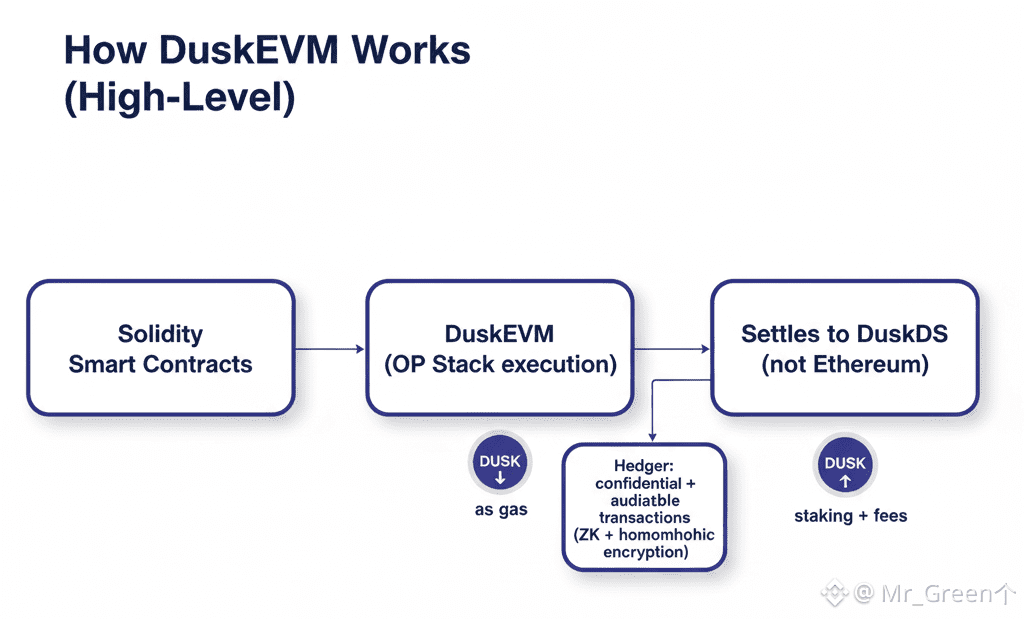

The phrase “EVM-compatible” gets used loosely in crypto, so it helps to be specific about what Dusk is doing. DuskEVM is presented as an EVM-equivalent execution layer built using the OP Stack. In simple language, the OP Stack is a framework that helps you run an EVM execution environment in a modular way. It’s a practical engineering choice, not a marketing badge. It lets Dusk inherit a mature execution design while focusing its own energy on the parts it cares about most: settlement, data availability, privacy, and compliance.

Now comes the “different destination” part. DuskEVM does not settle to Ethereum. Dusk’s documentation states that while DuskEVM uses the OP Stack architecture, it settles directly using DuskDS rather than Ethereum. DuskDS is the base layer in the stack. It is where settlement happens and where data availability is anchored. DuskEVM also leverages DuskDS to store blobs, so developers can keep using EVM tooling while relying on DuskDS for settlement and data availability.

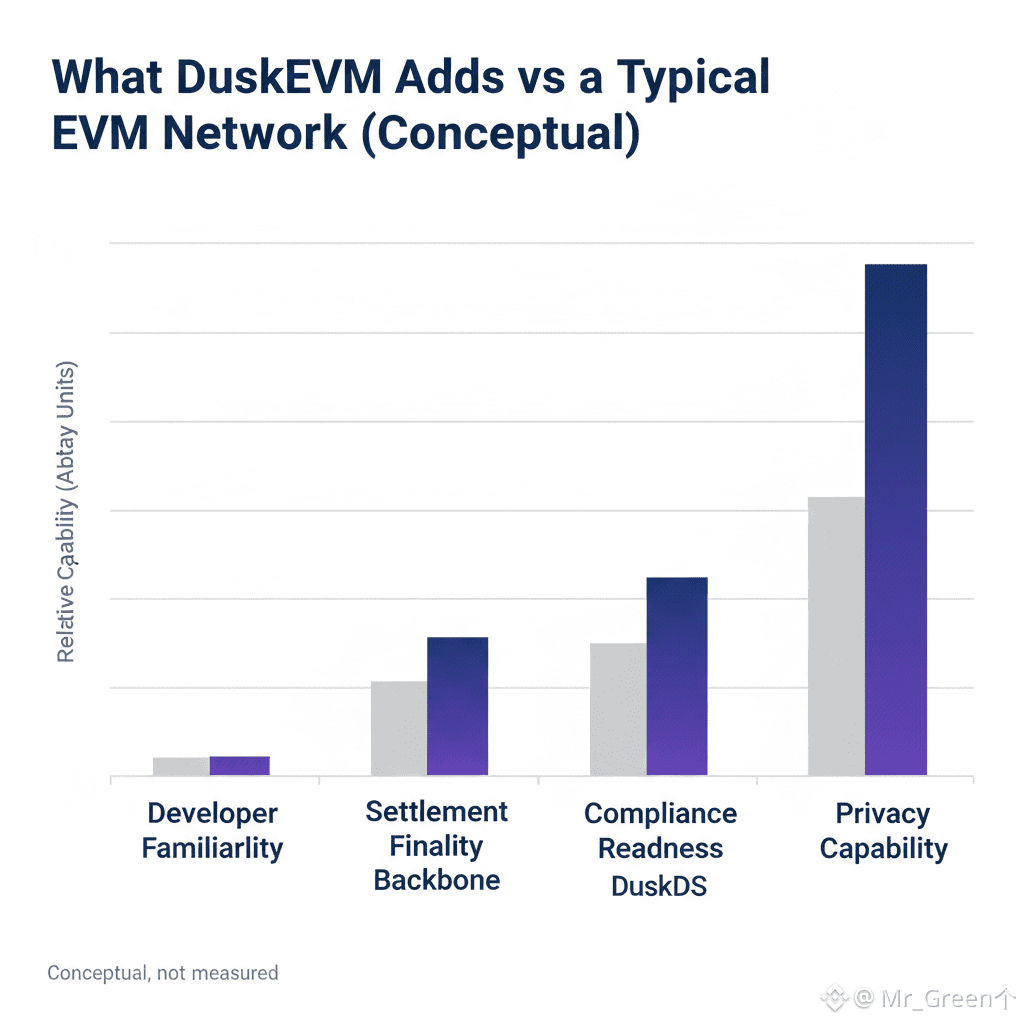

That one design choice changes the meaning of building “EVM apps on Dusk.” On Ethereum, the default mental model is open visibility. The chain is a public stage. Everything is watchable. That transparency can be useful, but it’s also the source of constant friction when you bring regulated assets into the picture. Real markets need verification, but they do not want every participant’s behavior permanently broadcast.

Dusk is trying to make a different default feel normal. It wants a world where confidentiality is built in, but auditability still exists when it is legitimately required. This is also why Dusk’s architecture is described as multilayer. Dusk’s own “multilayer evolution” write-up explains the stack in terms of specialized layers, with DUSK remaining the single native token across them. DuskDS uses DUSK for staking, governance, and settlement. DuskEVM uses DUSK as gas for Solidity apps and transaction fees. DuskVM, described as a privacy-preserving application layer, is also positioned to use DUSK as gas.

That matters because it turns the token into more than a trading symbol. It becomes the economic thread that keeps the stack coherent. The same asset that secures the settlement layer is also the asset used to pay for execution in the EVM layer.

You can see this in the bridge design too. Dusk describes a native, trustless bridge between DuskDS and DuskEVM, with no external custodians or wrapped assets required. In the public testnet guide, Dusk’s docs explain that when you bridge DUSK from DuskDS to DuskEVM, your DUSK becomes the native gas token on DuskEVM. That’s a subtle but important usability point. If builders have to juggle three different “fuel tokens,” they don’t build. If users have to learn a new fee asset, they hesitate. Dusk is clearly trying to avoid that friction. So far, that’s execution and settlement. But Dusk’s vision is not just “EVM on a new base layer.” It’s “EVM plus confidentiality that regulated markets can actually use.”

That’s where Hedger comes in. Dusk describes Hedger as a privacy engine built specifically for the EVM execution layer. The Hedger article says it brings confidential transactions to DuskEVM using a combination of homomorphic encryption and zero-knowledge proofs. The wording here matters. Hedger isn’t framed as “hide everything.” It’s framed as compliance-ready privacy for real-world financial applications. The intent is to let transactions remain confidential to the public while still enabling verifiable audit proofs when authorized.

This is the point where DuskEVM becomes more than a compatibility layer. It becomes a bridge between two worlds that usually clash. On one side is the developer ecosystem that already exists. Solidity, EVM tooling, normal workflows. On the other side is the market reality that institutions live in. Privacy, controlled disclosure, audit trails, and rules that cannot be optional.

DuskEVM is Dusk’s attempt to connect those sides without forcing either one to pretend. Developers get a familiar execution environment. The chain still aims to settle in a way that supports regulated finance constraints. Privacy doesn’t get treated as a bolt-on mixer. It becomes a first-class design target.

There’s also a quiet maturity in how Dusk communicates rollout. In the DuskEVM documentation, the network information table lists mainnet as “Live: No” while testnet is “Live: Yes,” alongside chain IDs and RPC endpoints. That kind of blunt status signal is useful. It sets expectations. It also reflects a mindset that fits regulated infrastructure: ship in stages, reduce risk, keep the story legible.

So what is Dusk doing now, and where can this go? Right now, the architecture is being positioned so that EVM apps can run without sacrificing the base chain’s identity. The bridge and token roles suggest Dusk wants a unified user experience across layers. Hedger signals that confidentiality is meant to reach the EVM layer, not stay trapped in a separate privacy-only corner. And the settlement choice, DuskDS as the finality and data availability backbone, signals that the end goal is not just another EVM network. It’s an execution environment pointed at a regulated, privacy-aware settlement layer.

The future, if Dusk’s direction holds, looks less like a sudden explosion and more like steady migration. Builders who already know Solidity can deploy into an environment that aims to support compliance and privacy realities. Institutions can evaluate a stack that doesn’t treat oversight as an afterthought. Users can interact with applications without having to accept full public exposure as the price of participation.

None of this is guaranteed. But the design is coherent. And that coherence is the most important thing a “regulated finance chain” can offer, because regulated markets don’t adopt vibes. They adopt systems that make sense under scrutiny.