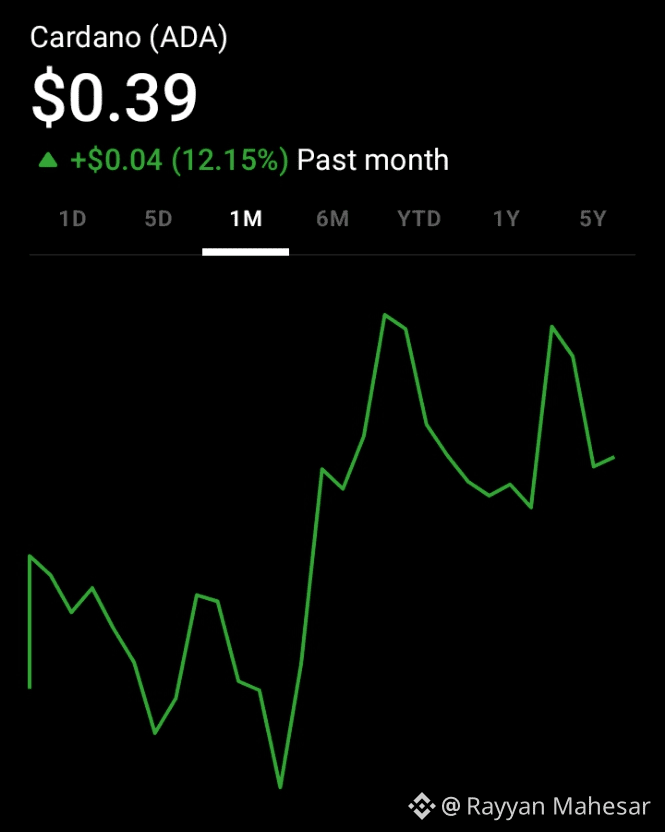

At the start of 2026, ADA is trading in a consolidation phase following prolonged weakness throughout late 2025. Technical indicators show a neutral market sentiment, with some early signs of accumulation but no clear breakout yet. Recent forecasts suggest ADA has significant resistance and support levels that traders should watch closely. �

CoinCodex +1

📉 Technical Landscape

Support levels around key price floors near $0.34–$0.46 range remain vital; losing these could lead to deeper sell-offs. �

Blockchain News

Resistance barriers at roughly $0.46–$0.50 are the first hurdles for any meaningful upside momentum. Breaking above these could signal a shift toward bullish sentiment. �

Blockchain News

The RSI indicates neither oversold nor overbought conditions, showing a market resting and waiting for direction. �

CoinCodex

📆 Price Expectations for Q1 2026

Analysts offer a range of scenarios based on technical patterns, macro momentum, and fundamental catalysts:

🟡 Conservative View

Price may trade roughly between $0.40 and $0.60 in Q1 2026, with gradual strength if buyers step in. �

CoinCodex

🟢 Base Bullish Case

Some forecasts project ADA reclaiming levels closer to $0.70 by the end of Q1 2026 if the market stabilizes and broader crypto sentiment improves. �

Blockchain News

🟣 Optimistic Breakout Scenario

In favorable conditions (more volume, market confidence, ETF tailwinds), ADA could push toward $0.75+ range. �

Coin Edition

💡 Drivers That Could Influence ADA in Q1

Bullish catalysts

Regulatory clarity (e.g., US classifications or ETF approvals) could attract institutional capital. �

Coin Edition

Large staking base and ecosystem scaling solutions may build long-term confidence among holders.

Improved crypto market structure and Bitcoin/Ethereum support trends could lift altcoins broadly.

Bearish risks

Macro downturns or crypto sell-offs may push ADA back toward lower support with high volatility.

Failure to break key resistance levels can trap price sideways or slide lower.

📈 Summary for Q1 2026

Cardano appears to be in a stabilizing phase, with strong support levels acting as price floors.

Positive momentum is possible but not guaranteed — ADA likely needs broader crypto strengths to accelerate uptrend.

Traders should monitor key technical levels, volume trends, and macro catalysts to assess breakout probabilities.