In the crowded privacy coin landscape of 2026 Monero XMR Zcash ZEC Secret Network and Oasis ROSE still dominate discussions for anonymity and data protection. But if youre looking at long term real world utility especially in regulated finance and real world asset RWA tokenization Dusk Network $DUSK stands out as the smarter bet for institutional grade adoption.

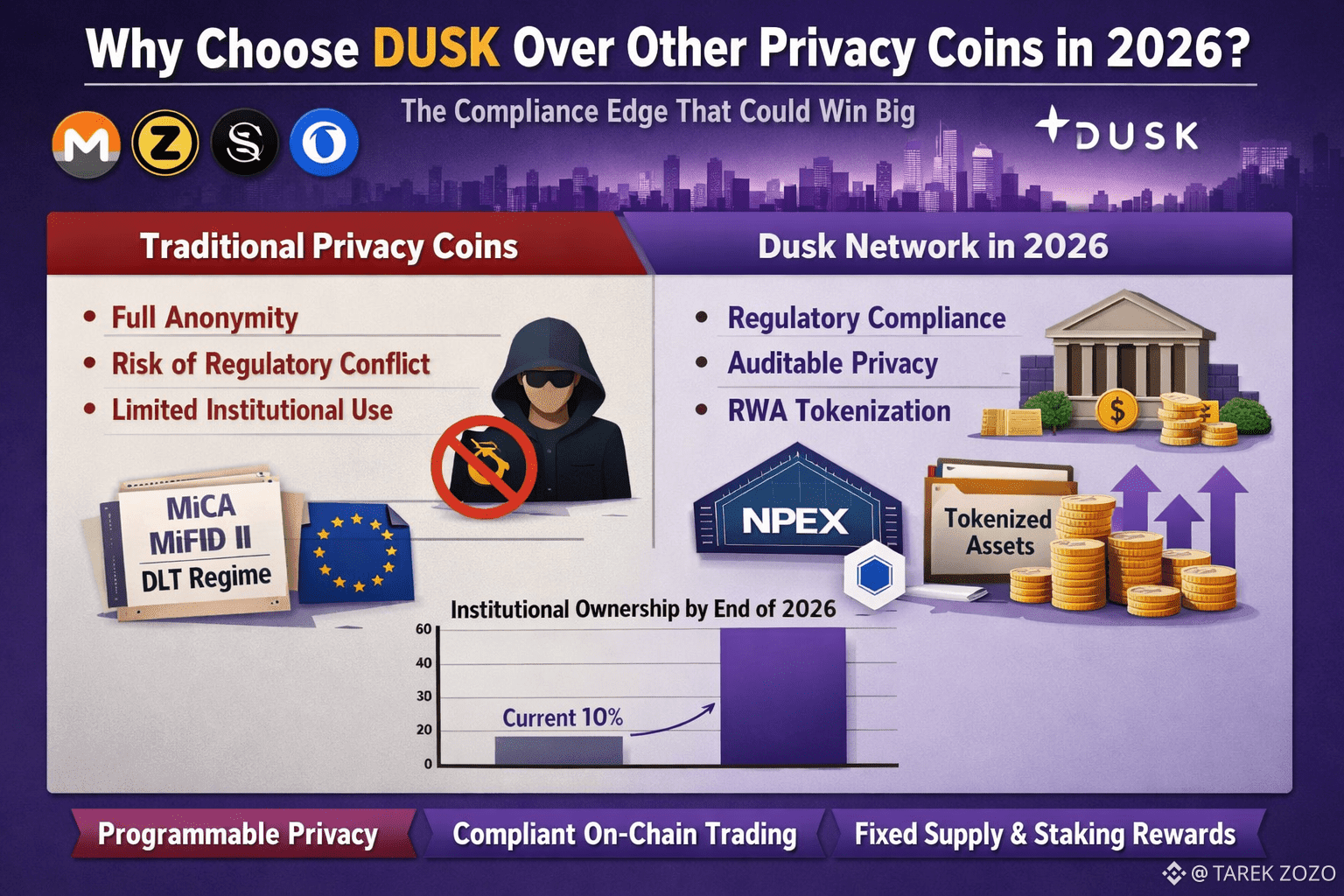

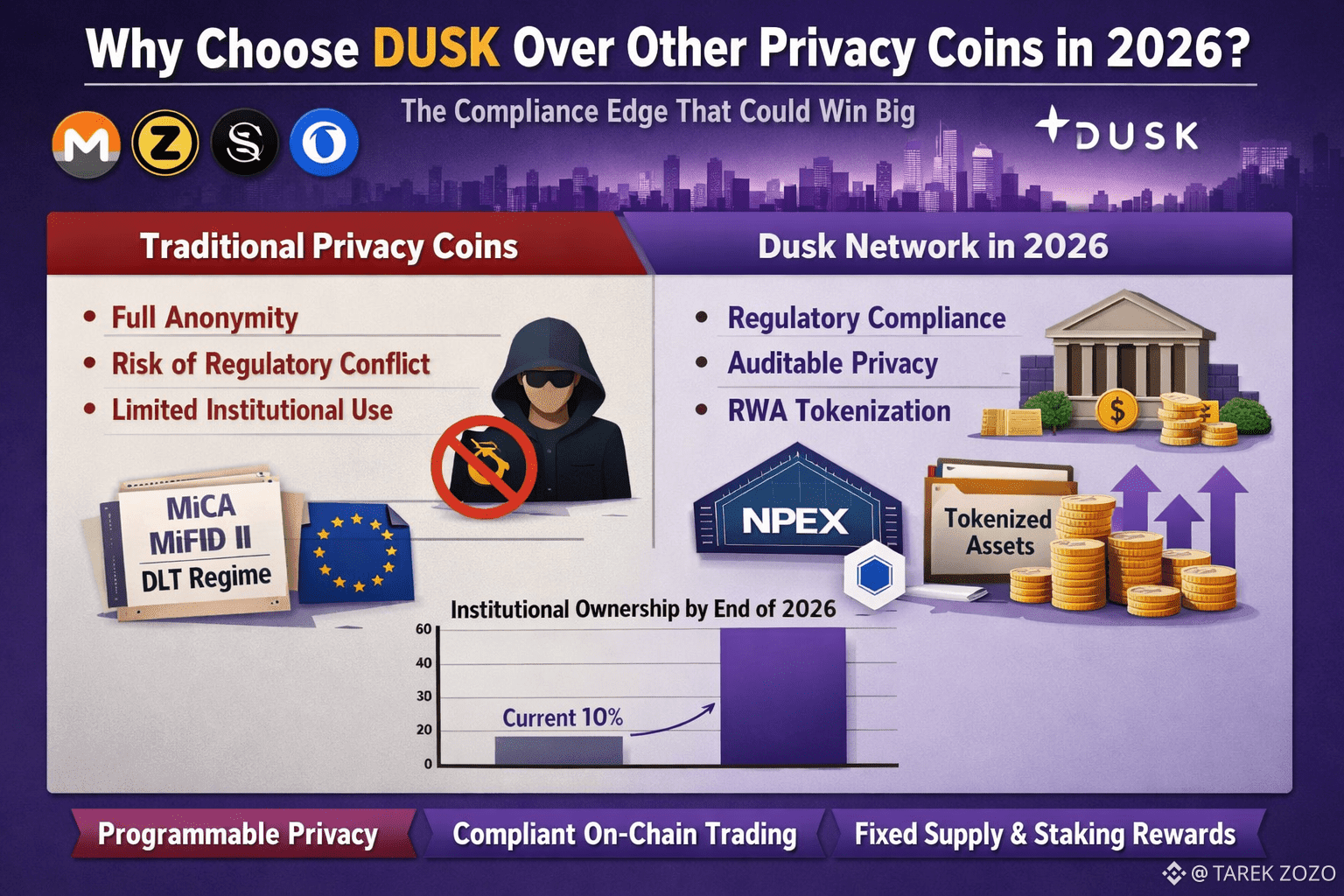

Most privacy coins prioritize full anonymity Monero offers default untraceable transactions Zcash provides optional shielded pools and networks like Secret or Oasis focus on privacy preserving smart contracts. These are powerful for personal use or DeFi but they often clash with strict regulations like EU MiCA MiFID II and the DLT Pilot Regime. Pure anonymity raises red flags for banks custodians and traditional finance players who need auditable compliance without exposing sensitive data.

This is where @Dusk shines. Dusk is purpose built as a Layer 1 blockchain for regulated decentralized finance. It combines zero knowledge proofs ZKPs with programmable privacy allowing confidential transactions and smart contracts that are fully auditable when required. Institutions can tokenize securities bonds equities or other RWAs while keeping competitive details private yet proving compliance to regulators. No more choosing between privacy and legality Dusk delivers both.

Key differentiators in 2026 include the recent mainnet launch after years of development bringing DuskEVM for Solidity compatibility Hedger for auditable ZK transactions and upcoming features like DuskTrade for compliant on chain trading. Partnerships such as with NPEX a regulated Dutch exchange aim to tokenize hundreds of millions in European securities with Chainlink oracles ensuring reliable data feeds. This positions Dusk as a bridge between TradFi and blockchain targeting the massive RWA market projected in trillions.

$DUSK powers it all network fees governance staking for security and rewards including hyperstaking programs. With a fixed supply and institutional ownership projected to rise sharply from current levels to potentially 70 percent by end of 2026 Dusk reduces volatility risks compared to hype driven privacy peers.

While Monero excels in pure anonymity and Zcash in optional privacy they lack the built in regulatory rails that Dusk offers. In a world where MiCA enforcement tightens and institutions pour into compliant RWAs Dusk isnt just another privacy coin its the infrastructure for the next era of on chain finance.

If youre reallocating from general privacy plays consider $DUSK for its real utility regulatory alignment and massive upside in tokenized assets. The quiet builder is now live and gaining traction fast.

What do you think will compliant privacy win over full anonymity in 2026 Drop your views below