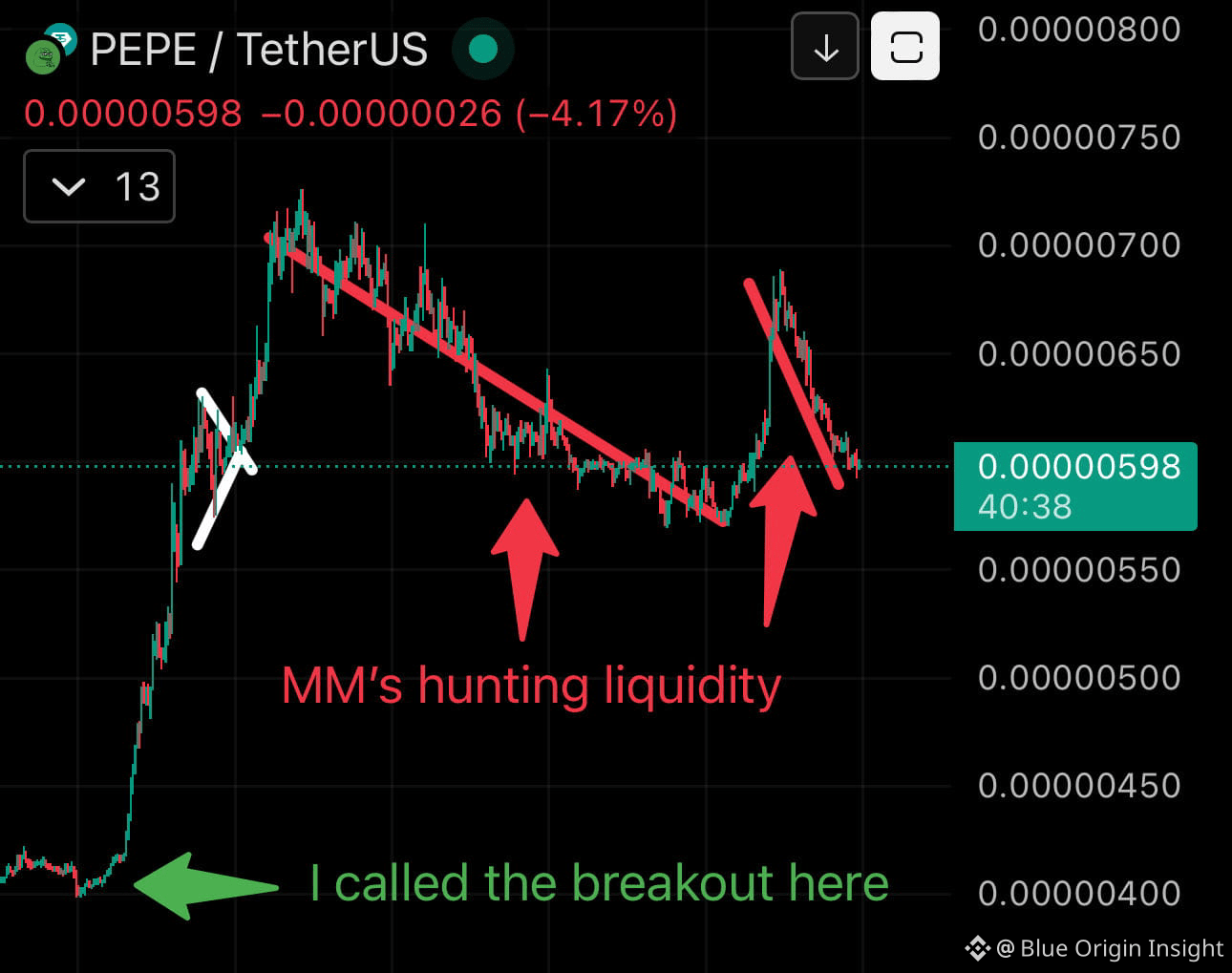

Market structure across high-beta assets is signaling an approaching expansion phase, and $PEPE is no exception. The recent surge in volatility should not be misread as a trend reversal this is a deliberate liquidity sweep engineered by market makers to remove over-leveraged retail positions before true price discovery begins.

This type of shakeout price action strengthens the bullish thesis, not weakens it.

Large players cannot build meaningful positions without liquidity. To access it, they force stop-losses, exploit crowded leverage, and absorb sell pressure at key levels. Once weak hands are cleared and the order book is thinned, resistance above price diminishes, paving the way for continuation.

For traders using leverage in this environment, risk management is non-negotiable:

Avoid Compounding Risk Do not recycle unrealized profits to aggressively increase margin during volatility. This raises your effective entry and leaves you vulnerable to routine liquidity hunts.

Eliminate Emotional Bias Revenge trading after a loss ignores structure and flow. Emotional decisions are statistically the fastest way to lose capital.

Discipline Over Impulse Define invalidation before entry. If price hits your stop, the thesis is wrong exit cleanly and reassess.

Pay close attention to the long rejection wicks on the $PEPE chart. These wicks often mark zones where smart money absorbs panic selling, signaling accumulation rather than distribution.

Volatility is the weapon. Structure is the signal.

Those who survive the shakeout are the ones positioned for the move.

#PEPE #MarketRebound #TrendingTopic