For a long time, the idea of running financial markets on blockchain sounded exciting, but rarely practical. Most systems still rely on paperwork, intermediaries, delayed settlement, and manual enforcement. Even when assets are tokenized, the real logic of how markets work often sits outside the chain.

Dusk was designed to change that from the ground up.

What makes Dusk stand out is its focus on building infrastructure for real financial markets, not just creating another place to trade tokens. The goal is simple but ambitious: make financial assets truly digital by handling settlement, compliance, ownership, and enforcement directly onchain.

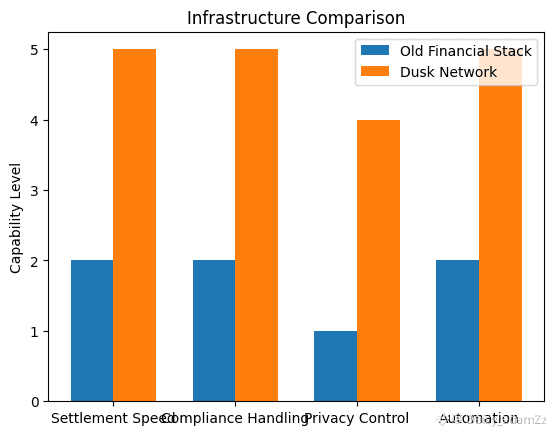

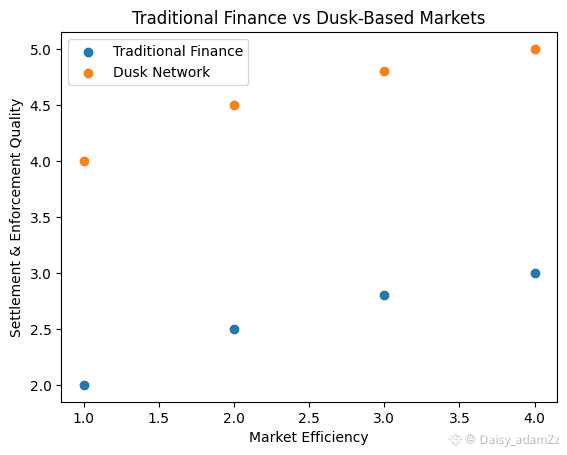

On Dusk, rules are not written in legal documents and enforced later. They are embedded into how transactions work. Compliance is part of execution itself. If a transaction does not meet the required conditions, it simply cannot happen. This removes ambiguity and reduces the need for external checks.

Settlement on Dusk happens in seconds and is final. Once a transaction is complete, there is no waiting period and no reversal. This kind of deterministic settlement removes a lot of uncertainty that exists in traditional financial systems and simplifies how assets move between participants.

Privacy is another core part of Dusk’s design. Financial markets need transparency, but they also require confidentiality. Dusk supports selective and verifiable privacy, allowing the right parties to see what they need to see without exposing sensitive information publicly. This balance makes it possible for both decentralized users and regulated institutions to operate on the same network.

Because of this structure, securities on Dusk can function as real digital assets. They are not just representations or certificates. They can be used for lending, collateralization, automated corporate actions, compliant trading, and institutional strategies entirely onchain. The rules governing these assets move with them, instead of living in separate systems.

Dusk brings all of this together in one unified, modular network. Core settlement and data live at the base layer. Programmable markets run in an EVM environment, making it easier to build and deploy applications. Privacy tooling is integrated directly into the system, allowing compliance and confidentiality to coexist instead of conflict.

For more advanced use cases, Dusk supports deeper privacy execution without breaking the rest of the network. Everything is modular, but everything is connected, which allows the system to scale without becoming fragmented.

What Dusk is building feels less like a product and more like infrastructure. It does not try to move fast by cutting corners. Instead, it focuses on getting the fundamentals right: final settlement, encoded rules, verifiable privacy, and real ownership.

This is likely where financial markets are heading. Assets issued directly onchain. Global access without unnecessary friction. Instant settlement. Clear ownership. Rules enforced automatically by code, not by slow processes.

Dusk does not promise shortcuts or quick wins. It focuses on building the rails that markets actually need. If financial systems are going to move fully onchain, foundations like this are what will make it possible.

That’s why Dusk feels less like another blockchain and more like the groundwork for how future markets could operate.