The trade didn’t fail. That’s the detail people miss.

Settlement completed. Finality landed. Blocks advanced normally. Yet capital stayed frozen longer than anyone modeled, and by the time it freed up, the opportunity window was gone.

That single slip rewrites balance sheets.

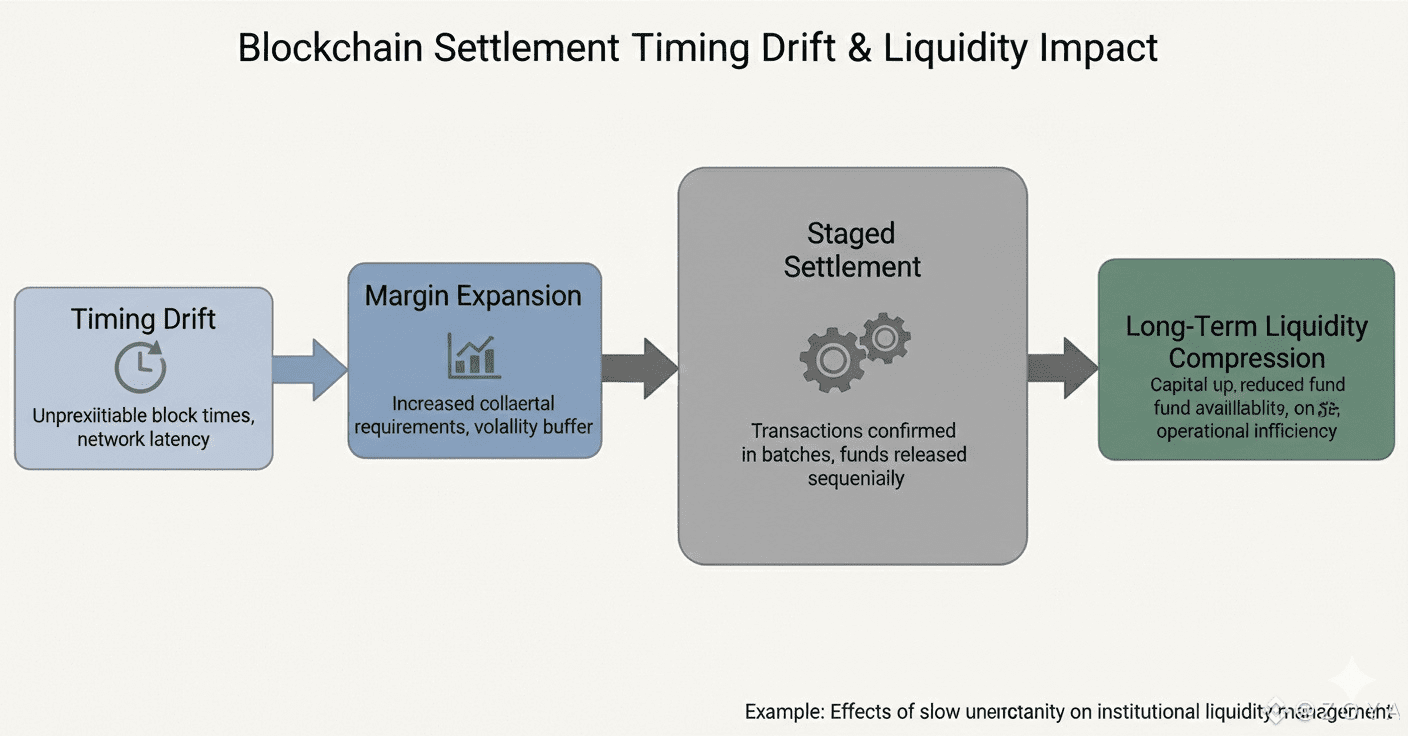

On Dusk, capital efficiency doesn’t break loudly. It erodes when timing drift forces margin assumptions to widen — not by policy decree, but by math. A few extra basis points of buffer here. A slightly higher prefund requirement there. Suddenly the same balance sheet clears fewer trades than it did last week.

Most chains assume liquidity is elastic. If one leg runs late, someone absorbs the gap socially and reconciles it later.

Dusk doesn’t allow that shortcut.

One delayed leg becomes a new risk coefficient. That coefficient hardens. Controls update. Capital efficiency compresses — permanently.

Nobody panics. Nobody files an incident. Someone just recalculates exposure and adjusts the book downward.

That adjustment is the real cost.

The industry still believes liquidity problems come from volatility spikes. In practice, they come from systems that pretend timing is free until it isn’t.

Dusk prices timing honestly. Capital remembers.