This is a huge gap, and most people are not paying attention to it.

There are two 2 sources of US inflation data: One is the BLS CPI, which is the official number everyone follows.

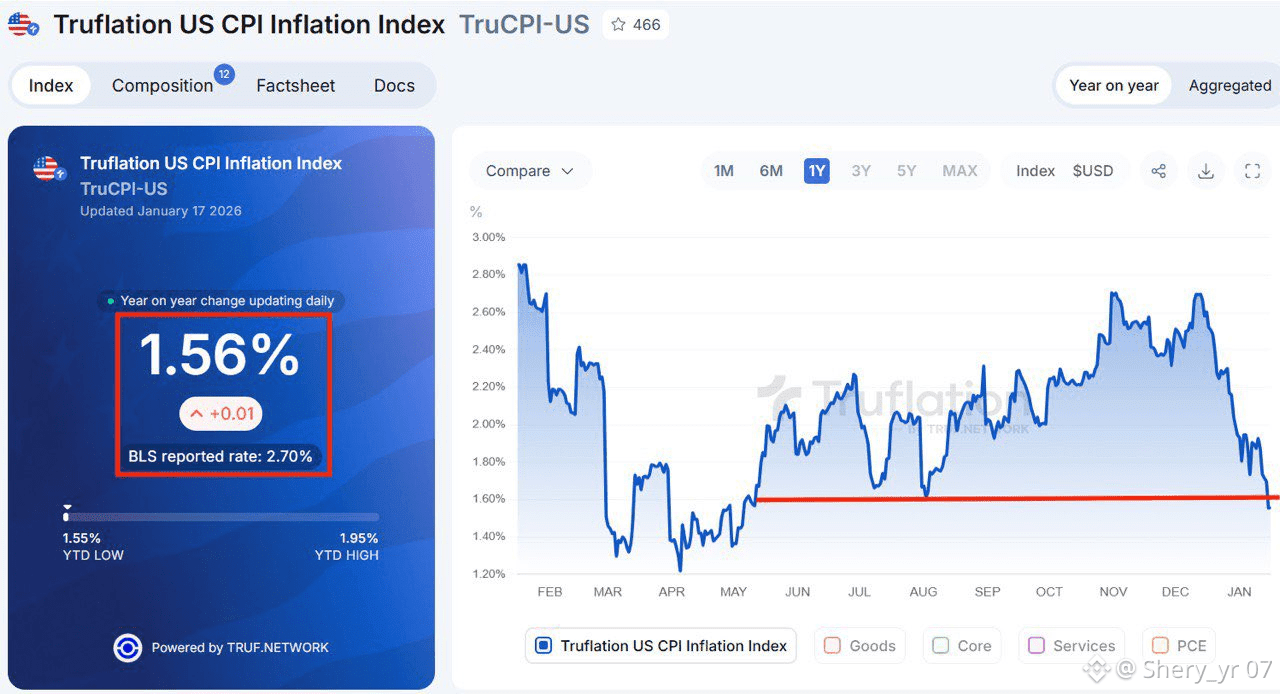

The other is Truflation, which tracks prices in real time.

BLS CPI is delayed. It shows what inflation was last month. True Inflation shows what inflation looks like right now.

- Today: BLS CPI = 2.7%

- Truflation = 1.57%

That is a massive difference.

It means inflation is already well below the Fed’s 2% target in real time, even though the official data still says inflation is “too high”.

This is not new.

Truflation has historically predicted US CPI accurately.

In 2021: BLS CPI was still showing 3–4%.

Truflation was already warning that inflation was much higher. Months later, BLS CPI exploded to over 8%.

The Fed panicked, hiked rates aggressively, and started QT.

Now the same thing is happening, but in reverse.

Truflation is showing: Inflation is falling fast. It is already near 1.5%.

That means BLS CPI is likely to fall toward 2% or lower in the next few months.

This completely changes the Fed story.

Right now the Fed is still acting like inflation is a problem. But real time data shows inflation is already gone.

At the same time, the economy is getting weaker: ISM is below 50.

Bankruptcies are rising and growth is slowing.

So now the Fed has a problem: Inflation is dropping fast, but growth is also slowing fast.

That is exactly the situation where central banks are forced to ease.

This is why 2026 is shaping up to be an easing year:

- Rate cuts

- Liquidity injections

- Support for markets

Everyone is watching the 2.7% CPI number and thinking that inflation is still too high.

But real time inflation is already much lower.

By the time the official CPI catches up, the policy shift will already be late.

This is how the Fed always reacts: They move based on backward looking data.

Markets move based on forward looking reality.

Right now, forward-looking inflation is already telling us: The inflation fight is basically over and more easing will happen in 2026.

This also explains why Trump keeps pushing the Fed to cut rates faster.

He has said many times that rates are being held too high while the economy is already slowing. If real inflation is closer to 1.6%, then the Fed is reacting to old data, not current conditions.

That makes the pressure on Powell more about timing than politics.