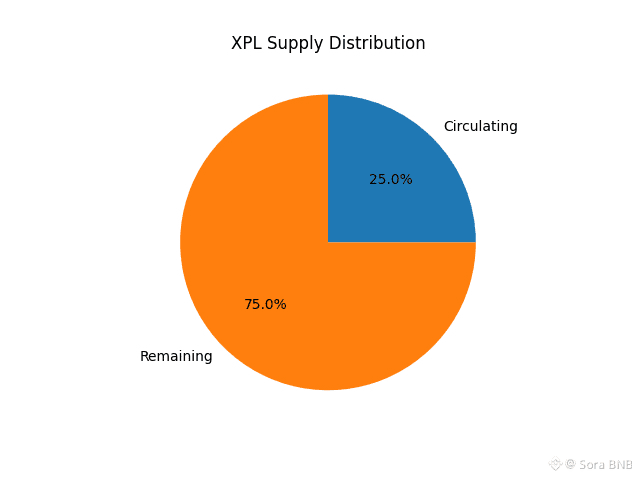

Token supply distribution reveals a lot about a project’s tokenomics strategy and potential price dynamics. XPL’s numbers show an aggressive approach to supply control that’s worth understanding before making any investment decisions.

Only 25% of total supply is currently circulating with 75% still locked or vesting. This is significantly tighter than most projects. For comparison, Dusk sits at roughly 50/50 distribution. XPL’s 25/75 split creates extreme scarcity in the short term but massive unlock risk in the long term.

The benefit of tight supply is obvious - scarcity drives price when demand exists. With only a quarter of tokens available, any buying pressure creates disproportionate price movement. This can generate impressive returns early on.

The risk is equally obvious - eventually that 75% needs to enter circulation. Whether through team vesting, investor unlocks, staking rewards, or ecosystem incentives, those tokens will hit the market. If demand doesn’t grow fast enough to absorb that supply, prices collapse. We’ve seen this pattern repeatedly with VC-backed projects that launch with tiny floats then get destroyed by unlock schedules.

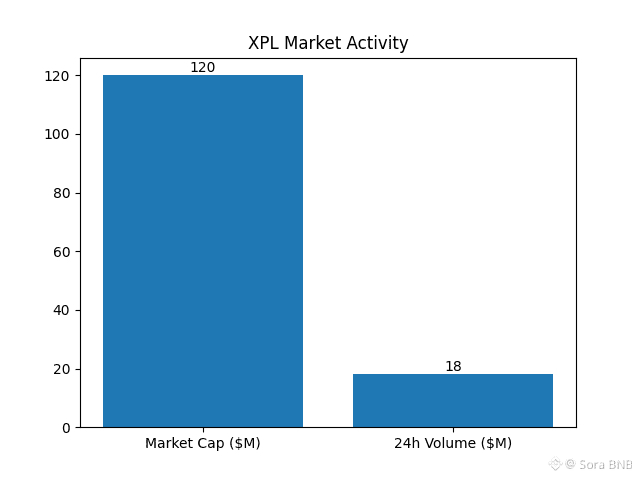

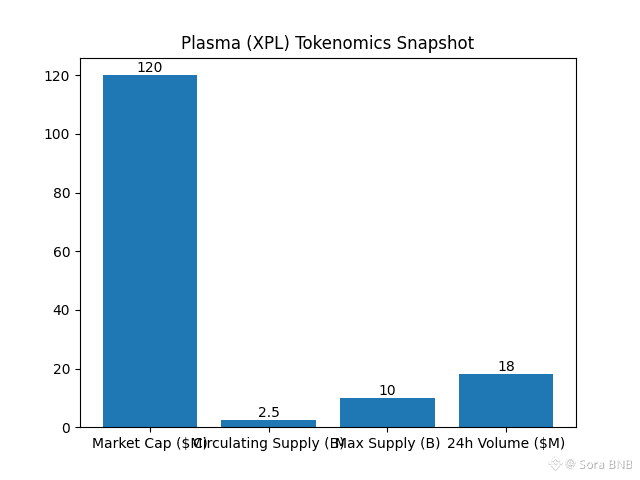

Current market cap is $120M with $18M in daily trading volume. That’s a 15% volume-to-market-cap ratio which suggests healthy trading activity without excessive volatility. For context, ratios below 5% indicate dead projects with no liquidity, while ratios above 50% suggest either pump-and-dump activity or significant price discovery happening.

The $120M valuation on 2.5 billion circulating tokens means each token is priced around $0.048. But total supply is 10 billion tokens. If all tokens were circulating at current price, fully diluted valuation would be approximately $480M. That gap between current market cap and fully diluted valuation represents the unlock risk - as more supply enters, either price drops or demand needs to quadruple to maintain current valuation.

The tokenomics snapshot shows the full picture - $120M market cap, 2.5B circulating supply, 10B max supply, and $18M daily volume. The max supply being 4x the circulating supply means current holders are betting that demand growth will outpace supply expansion as that remaining 75% unlocks.

This works if the project delivers real utility and adoption that drives organic demand. It fails spectacularly if hype fades and unlock schedules dump tokens into weak demand. The key variables to watch are unlock schedules and adoption metrics. How fast is that 75% entering circulation? Linear releases over five years create manageable pressure. Cliff unlocks quarterly create price crashes.

Is actual usage and adoption growing? More users, more transactions, more real utility creates organic buy pressure to absorb new supply. Stagnant metrics with increasing supply is a recipe for price decline.

XPL’s tight supply creates opportunity and risk. Understanding both is essential for informed decisions.