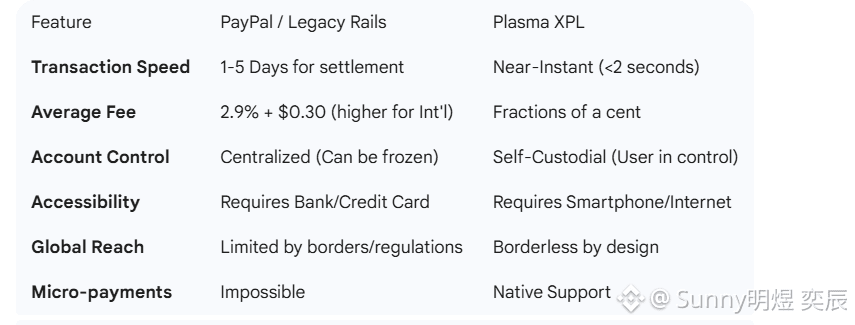

In an era where information travels at the speed of light, money still moves at the speed of bureaucracy. We live in a world where you can stream 4K video from a satellite to a handheld device in the middle of the Sahara, yet sending $100 from New York to Nairobi via traditional rails like PayPal or SWIFT can take three days and cost 5% to 7% in hidden spreads and fees.

The financial industry has long awaited a "broadband moment"—a transition from the dial-up speeds of legacy banking to the instantaneous throughput of the internet. While PayPal revolutionized the early web by putting a user interface on top of credit cards, it failed to change the underlying plumbing.

Enter Plasma XPL. Designed from the ground up as a specialized environment for Tether (USD₮) and stablecoin velocity, Plasma $XPL isn't just another blockchain; it is a dedicated payment lane. By stripping away the bloat of general-purpose smart contract platforms and the rent-seeking behavior of legacy processors, Plasma XPL is positioning itself as the true successor to PayPal for the global digital economy.

The PayPal Problem—The High Cost of Middlemen

To understand why Plasma XPL is necessary, we must first diagnose the "PayPal Tax." PayPal operates as a "walled garden" built on top of the legacy banking system (ACH, SEPA, and Credit Card rails).

The Friction of Legacy Rails

The Intermediary Chain: When you swipe a card or click "Pay with PayPal," you aren't just dealing with one company. You are paying the issuing bank, the acquiring bank, the card network (Visa/Mastercard), and the payment processor. Each takes a "byte" out of the transaction.

Settlement vs. Authorization: PayPal provides the illusion of instant payments. In reality, they are just authorizing a debt. The actual movement of money between banks takes days. This creates "settlement risk," which PayPal covers by charging high fees and frequently freezing user funds to prevent fraud.

Cross-Border Extortion: For international business, PayPal’s currency conversion spreads are notoriously aggressive. A business receiving USD in a non-USD country can lose up to 4% simply on the exchange rate, before a single transaction fee is even applied.

PayPal was a 20th-century solution to a 20th-century problem. It made the internet "shoppable," but it kept the gatekeepers in power.

Plasma XPL—Built for Velocity

Plasma XPL represents a paradigm shift. Unlike Ethereum, which tries to be a "world computer" for everything from NFTs to complex DAO governance, Plasma XPL is purpose-built for Stablecoin Payments.

The "Digital Cash" Philosophy

The core design philosophy of Plasma XPL is to mimic the properties of physical cash in a digital format:

Peer-to-Peer: Transactions go from Person A to Person B without a central clearinghouse.

Instant Finality: When you hand someone a dollar bill, the transaction is finished instantly. Plasma XPL mimics this with near-instant block times and settlement.

Negligible Cost: It shouldn't cost $2.00 to send $5.00. Plasma XPL’s architecture reduces gas fees to fractions of a cent, making micro-transactions viable for the first time.

Why USD₮?

By focusing on USD₮ (Tether), Plasma XPL taps into the most liquid stablecoin in the world. USD₮ is the "reserve currency" of the crypto-economy. By optimizing the network specifically for USD₮ transfers, Plasma XPL eliminates the "computation overhead" that makes sending stablecoins on Ethereum or other Layer 1s expensive during times of high traffic.

The Technical Edge—Why It’s Faster and Cheaper

Most users don't care about the "how," they care about the "how much." However, the "how" is why Plasma XPL wins.

Optimized Throughput

Traditional blockchains are often clogged because they process thousands of different types of tokens and complex scripts. Plasma XPL utilizes a streamlined execution environment. Because it is optimized for simple value transfers (sending USD₮), the network can process a significantly higher number of Transactions Per Second (TPS) than legacy rails or overburdened Layer 1 blockchains.

Removing the "Gas" Friction

One of the biggest hurdles to crypto adoption is the "Two-Token Problem"—the need to hold ETH to send USDT, or MATIC to send USDC. Plasma XPL aims to simplify the user experience. By lowering the barrier to entry, it allows users to experience the "invisible" nature of the technology, much like how a PayPal user doesn't need to understand the underlying ACH protocols.

The Global Implications of $0 Fees

The true power of Plasma XPL is realized in the developing world and the "gig economy."

Empowering the Unbanked

Over 1.4 billion adults remain unbanked globally. However, most have access to a smartphone. PayPal often requires a linked bank account or a credit card—gateways that remain closed to the unbanked. Plasma XPL only requires a digital wallet. This allows a graphic designer in the Philippines to receive full value for her work from a client in London without losing 10% to intermediaries.

Micro-payments and the New Internet

Current payment systems kill micro-payments. You cannot tip a writer 10 cents on PayPal because the fixed fee (usually $0.30) exceeds the transaction value. Plasma XPL enables a "pay-per-use" internet. Imagine paying $0.05 to read a single premium article or $0.01 per minute of ad-free music. This is only possible when the "tax" on money is removed.

Security and Trust in a Decentralized Model

Critics of crypto often point to security. However, PayPal’s "centralized trust" is a double-edged sword. PayPal can—and does—freeze accounts for 180 days without warning, often crippling small businesses.

Censorship Resistance

Plasma XPL operates on a decentralized ledger. Your "account" is your private key. No central corporation can "de-platform" you because of your political views, your geographic location, or the nature of your legal business. This is "neutral money."

Transparency vs. Privacy

While PayPal's ledger is a black box accessible only to them and state actors, Plasma $XPL provides a transparent, immutable record of transactions. This reduces fraud and allows for automated accounting, while still providing the user with the autonomy of a self-custodial wallet.

The Roadmap to Mass Adoption

For Plasma XPL to actually replace PayPal, it must solve the "User Experience (UX) Gap."

Mobile-First Design: The next billion users will not use Chrome extensions or hardware wallets; they will use mobile apps that feel like Venmo or CashApp.

On-Ramps and Off-Ramps: The bridge between "Old Money" (Fiat) and "New Money" (USD₮ on Plasma) must be seamless. As more merchants accept USD₮ directly, the need to "cash out" disappears, creating a circular economy.

Institutional Integration: By providing an API-first approach, Plasma XPL can allow existing fintechs to "plug in" to its low-cost rails, essentially using Plasma as the backend for the next generation of payment apps.

The End of the Middleman

The history of civilization is the history of reducing friction. We moved from bartering to gold, from gold to paper, and from paper to digital entries in a bank's database. Each step made commerce faster and more expansive.

Plasma $XPL is the final step in this evolution: the decoupling of money from the institutions that profit from its movement. By creating a dedicated, high-speed, low-cost environment for USD₮, Plasma XPL provides the world with what PayPal promised but couldn't deliver—True Digital Cash.

The transition won't happen overnight, but the math is undeniable. In a fair fight between a system that charges 3% and takes 3 days, and a system that charges 0% and takes 3 seconds, the latter always wins. Plasma XPL isn't just a new way to pay; it’s a new way for the world to work.