As blockchain technology evolves at a rapid pace, there’s a growing demand for platforms that combine security and decentralization with practical solutions for real-world adoption. Enter the Plasma project—not just another blockchain, but the first Layer 1 platform specifically built to serve as the backbone for global stablecoin settlements.

As blockchain technology evolves at a rapid pace, there’s a growing demand for platforms that combine security and decentralization with practical solutions for real-world adoption. Enter the Plasma project—not just another blockchain, but the first Layer 1 platform specifically built to serve as the backbone for global stablecoin settlements.

Vision: Bridging Traditional and Decentralized Finance

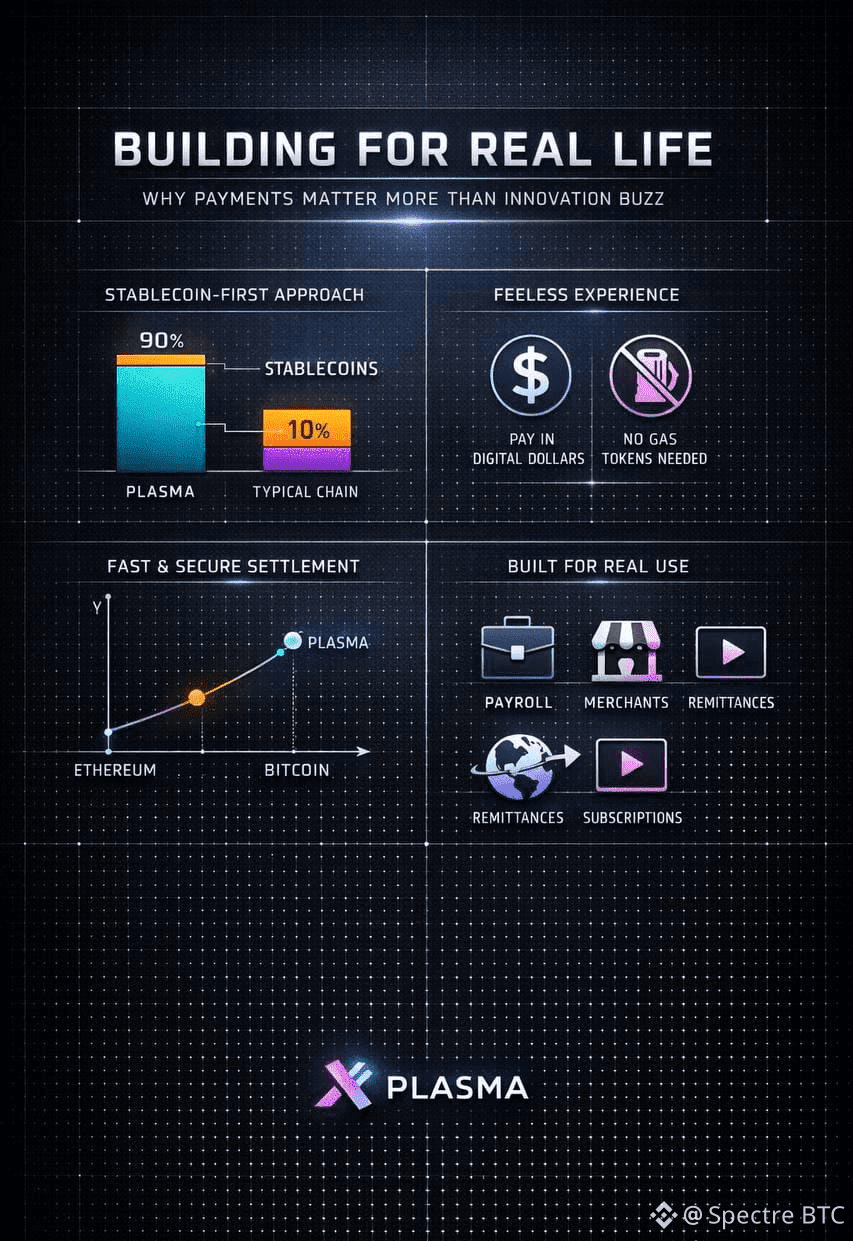

Stablecoins like USDT and USDC act as a crucial bridge in the crypto ecosystem. Yet, high transaction fees and slow processing have limited their use as everyday payment solutions. Plasma aims to transform this by creating a system that merges Ethereum’s compatibility, Bitcoin’s security, and the speed of centralized networks.

Technical Architecture: Power, Speed, and Security

Plasma’s infrastructure integrates three core components:

Reth Machine (Rust Ethereum): An enhanced Ethereum virtual machine ensures full smart contract compatibility, allowing developers to easily migrate projects from Ethereum.

PlasmaBFT Consensus: Enables near-instant transaction finality, meaning transactions are confirmed and immutable in a fraction of a second—a critical feature for financial institutions.

Bitcoin-backed Security: By linking to the Bitcoin network, Plasma ensures maximal neutrality, censorship resistance, and robust security.

Redefining User Experience: Gasless USDT Transactions

Plasma introduces a groundbreaking fee model: users can send USDT without holding the network’s native token. This “gasless” system eliminates a major barrier for newcomers, making crypto payments as seamless as traditional banking apps.

Target Audiences and Economic Benefits

Plasma focuses on two key segments:

Individuals in high-adoption markets: Particularly in regions with inflation or heavy reliance on cross-border remittances, Plasma offers a free and secure method of saving and payment.

Financial institutions: Companies in payments and finance gain a compliant, fast, and cost-efficient alternative to SWIFT and traditional blockchain solutions.

Conclusion

Plasma isn’t just competing in the Layer 1 space—it’s defining a new class of specialized networks. By prioritizing stablecoin liquidity while leveraging Bitcoin’s security and Ethereum’s flexibility, Plasma positions itself as a leading candidate for institutional adoption. This is the blockchain designed to appear not only in traders’ wallets but also in everyday payment apps, reshaping the global financial landscape.