In the early days of blockchain, the narrative was simple: total transparency. Every transaction, every wallet balance, and every smart contract interaction was a matter of public record. For the cypherpunks, this was a feature—a way to ensure a trustless world. But as the industry matured and looked toward the "final boss" of global adoption—Institutional Finance—this transparency became a bug.

Enter Dusk Network. While the rest of the market spent years chasing "TPS" (transactions per second) or "Meme-coin" liquidity, the team behind Dusk was quietly obsessing over a different problem: How do you build a blockchain that is private enough for a bank, but transparent enough for a regulator?

As we move through 2026, Dusk has transitioned from a theoretical whitepaper into a functioning backbone for the tokenization of Real-World Assets (RWA). This article explores every facet of the DUSK ecosystem, from its "Phoenix" transaction model to its strategic partnership with European stock exchanges.

Part 1: The Core Philosophy – Why Does Dusk Exist?

To understand DUSK, you have to understand the Privacy Paradox.

In traditional finance (TradFi), privacy isn't just a preference; it’s a legal requirement. If a large investment fund moves $500 million into a specific stock, they don’t want the entire world to see their "hand" before the trade is settled. More importantly, laws like the GDPR in Europe mandate that personal financial data must be protected.

However, a "black box" blockchain (like Monero) is a non-starter for institutions. They cannot use a system that prevents them from proving to a regulator that they aren't laundering money.

The Middle Path: Auditable Privacy

Dusk is a Layer-1 blockchain designed specifically for financial services. Its "North Star" is a concept called Auditable Privacy. By using Zero-Knowledge Proofs (ZKPs), Dusk allows users to prove that a transaction is valid (e.g., "I have the money and I am not on a sanctions list") without revealing the actual amount or the identity of the sender to the public.

Part 2: The Technical Engine – How Dusk Works

Dusk isn't just another Ethereum fork. It is a custom-built stack designed from the ground up.

1. Segregated Byzantine Agreement (SBA)

Most blockchains use standard Proof of Stake (PoS). Dusk uses SBA, a more sophisticated evolution. SBA is designed to be energy-efficient and highly decentralized. It splits the work between "Block Generators" and "Provisioners," ensuring that no single entity can gain a monopoly over the network’s state.

2. The Rusk VM (Virtual Machine)

If Ethereum has the EVM, Dusk has Rusk. Rusk is the world’s first Zero-Knowledge Virtual Machine (ZK-VM). It allows developers to write smart contracts where the inputs and outputs are encrypted. In 2026, the launch of DuskEVM has bridged this world with Ethereum, allowing developers to use Solidity (the language of Ethereum) while still getting the privacy benefits of Dusk.

3. PLONK: The Cryptographic Secret Sauce

Dusk utilizes PLONK, a state-of-the-art Zero-Knowledge Proof system. PLONK is what allows the network to be fast. Previous ZK systems required a "Trusted Setup" for every single circuit, which was a logistical nightmare. PLONK allows for a universal setup, making it vastly more scalable for complex financial instruments like bonds or derivatives.

Part 3: Tokenomics – The Utility of $DUSK

The DUSK token is the lifeblood of the network. It isn't just a "governance" token that sits in a wallet; it is an active commodity.

Staking: To secure the network, users stake DUSK. Unlike many other chains, Dusk’s staking is designed to be accessible, allowing a wide range of participants to earn rewards.

Gas Fees: Every transaction on the network—whether it’s a simple transfer or a complex security issuance—requires DUSK to pay for the computational power (gas).

Deployment: To launch a new security (like a tokenized apartment building or a corporate bond), issuers must use DUSK.

The 2026 Supply Dynamics

With a capped supply and a 36-year emission schedule, DUSK is designed to be disinflationary. As institutional adoption grows and more RWAs are "locked" onto the chain, the "velocity" of the token changes, creating a supply-demand sink that favors long-term holders.

Part 4: The 2026 Milestone – Real-World Assets (RWA)

The year 2026 has been a "breakout" year for RWA, and Dusk is at the center of it.

The NPEX Integration

One of the most significant achievements for the Dusk Foundation is its collaboration with NPEX, a licensed Dutch stock exchange. This isn't just a "partnership" in the crypto sense (which often means a tweet and nothing else). This is a structural integration where €300M+ in regulated securities are being moved on-chain.

Through a platform called DuskTrade, investors can now trade fractionalized shares of European companies with the same ease as buying Bitcoin, but with the legal protections of a regulated exchange.

Why This Matters

Most RWA projects fail because they ignore the "R" (Real). They tokenize assets but have no way to legally enforce ownership. Dusk solves this by integrating Citadel, a ZK-KYC framework. This allows a user to prove they are a "verified European investor" without having to upload their passport to a public blockchain.

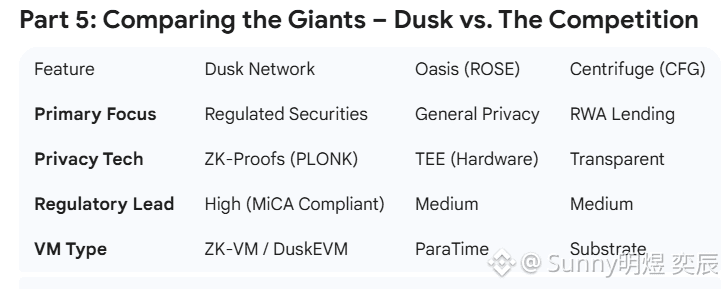

While Oasis offers privacy, it often relies on hardware-based solutions (TEE). Dusk’s reliance on pure mathematics (ZK-Proofs) is generally considered more "future-proof" and resistant to hardware vulnerabilities.

Part 6: Challenges and the Road Ahead

No project is without its hurdles. For Dusk, the challenge remains adoption. Building the most "compliant" blockchain in the world doesn't matter if the world’s banks are too slow to move.

However, the tide is turning. With the MiCA (Markets in Crypto-Assets) regulation now fully active in Europe, the legal "gray area" that once held back institutions has evaporated. Dusk was built for this exact regulatory environment.

What to Watch for in late 2026:

Cross-Chain Privacy: Using Chainlink’s CCIP to move private assets from Dusk to Ethereum.

Institutional Custody: More MiCA-compliant banks acting as "validators" on the Dusk network.

The "SME" Boom: Small and medium enterprises using Dusk to raise capital without the massive fees of a traditional IPO.

The Quiet Revolution

Dusk is not a "hype" project. You won't find many flashing lights or celebrity endorsements here. Instead, you find a team of cryptographers and financial experts building the plumbing for a new global economy.

As we look toward the future of finance, the question isn't whether assets will be tokenized—it’s where they will be tokenized. If an institution wants a platform that respects their privacy, satisfies their regulators, and scales with their needs, $DUSK is currently the only Layer-1 checking every box.