Bitcoin holders have entered their first sustained period of realized losses in more than a year, as rising geopolitical tensions and renewed trade-war fears push investors toward traditional safe-haven assets like gold.

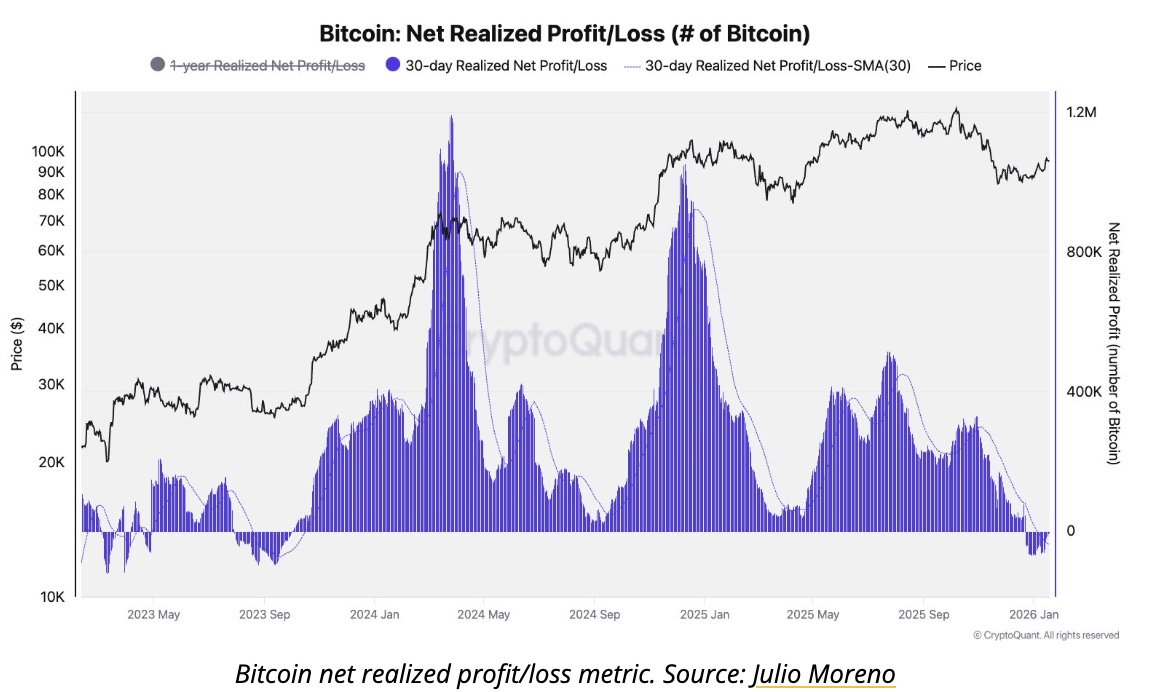

According to on-chain data from CryptoQuant, Bitcoin’s 30-day realized profit and loss metric has turned negative, marking the first such occurrence since late 2023 after more than two years dominated by realized profits.

Bitcoin holders begin realizing losses

CryptoQuant head of research Julio Moreno said the shift indicates that coins moved on-chain over the past month were sold below their original purchase prices.

“Bitcoin holders have been realizing losses for a 30-day period since late December — the first time this has happened since October 2023,” Moreno wrote on X.

The realized profit and loss metric tracks whether BTC being spent is moving at a profit or loss relative to its acquisition cost. While a negative reading does not automatically signal a market bottom, it typically reflects increasing stress among late buyers and a transition in market sentiment.

Historically, extended periods of realized losses have tended to appear during mid-cycle corrections or late-stage consolidation phases, rather than during strong bull-market expansions.

Gold surges above $4,700 as investors seek safety

While Bitcoin struggled, gold rallied sharply, reaching a new all-time high above $4,700 per ounce on Tuesday.

Spot gold briefly touched $4,701.23, while U.S. gold futures also printed record levels. Silver followed closely, trading near historic highs after briefly hitting $94.72 per ounce.

The rally in precious metals comes as investors reassess global risk following renewed geopolitical tension and escalating trade rhetoric from the United States.

Market sentiment deteriorated after U.S. President Donald Trump warned of potential new tariffs against several European allies unless Denmark agreed to negotiations involving Greenland — reviving fears of a broader transatlantic trade conflict.

Bitcoin-to-gold ratio drops sharply

The diverging performance between Bitcoin and gold has pushed the BTC-to-gold ratio down more than 50% from its peak, according to Bitfinex analysts.

“Last time we were at these levels, Bitcoin eventually went on to outperform gold,” Bitfinex noted. “This cross is worth watching as liquidity conditions evolve in 2026.”

Historically, sharp declines in the BTC/gold ratio have often preceded periods of crypto underperformance, followed later by rotation back into digital assets once macro conditions stabilize.

Spot Bitcoin ETFs see renewed outflows

Pressure on Bitcoin was reinforced by ETF flows.

U.S.-listed spot Bitcoin ETFs recorded $394.7 million in net outflows on Monday, according to SoSoValue data, snapping a four-day inflow streak that had brought more than $1.8 billion into the products.

Valr co-founder and CEO Farzam Ehsani said escalating trade-war rhetoric is driving investors back into defensive positioning.

“President Trump’s aggressive tariff language is pushing markets into full de-risking mode,” Ehsani said in comments shared with Cointelegraph.

He added that historically, tariff threats and retaliatory measures have created significant headwinds for risk assets, including cryptocurrencies.

Market context: correction, not capitulation

Despite the rise in realized losses, analysts note that current conditions differ sharply from full bear-market capitulation phases.

Long-term holder selling remains limited

Derivatives leverage has already been flushed

Spot demand has weakened, but not collapsed

This suggests the current drawdown may reflect macro-driven risk aversion rather than a structural breakdown in Bitcoin’s long-term trend.

As global markets remain sensitive to trade developments and geopolitical headlines, Bitcoin’s near-term direction may continue to track broader risk sentiment — particularly relative to gold and U.S. dollar liquidity conditions.

For now, the return of realized losses marks a notable shift in market psychology — and a reminder that even in structurally stronger cycles, Bitcoin remains deeply intertwined with global macro stress.