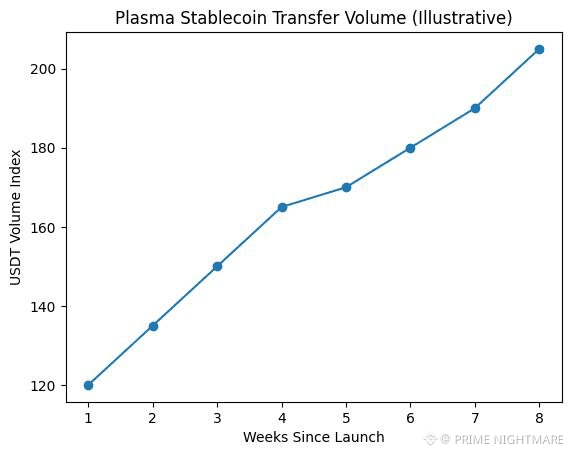

Plasma Is Quietly Becoming a Stablecoin Powerhouse Here’s What the Data Tells Us In crypto, the loudest narratives don’t always win. The strongest ones are often built quietly on usage, efficiency, and consistency. Plasma is beginning to fit that pattern. Rather than chasing short-term hype, Plasma appears to be focusing on what actually matters: stablecoin movement, low cost execution, and a sustainable post launch market structure. When you analyze the trends together, the picture becomes increasingly compelling. The first chart shows a stable rise in stablecoin transfer volume on Plasma following launch. While the numbers are explaining the direction is important.Instead of sharp spikes followed by drop offs, the growth curve is gradual and persistent. This is often what early real adoption looks like users testing the network, finding it reliable, and continuing to move value through it. Stablecoins are the lifeblood of crypto infrastructure. They power trading, payments, remittances, and on chain liquidity. When stablecoin transfers grow consistently it signals trust in settlement speed, cost, and reliability. Plasma appear to be income that trust step by step.

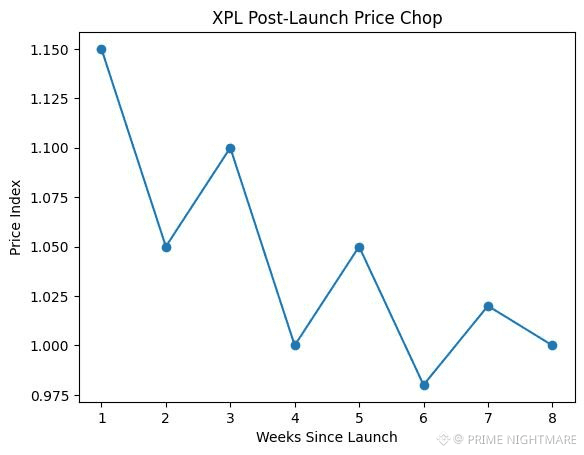

The first chart shows a stable rise in stablecoin transfer volume on Plasma following launch. While the numbers are explaining the direction is important.Instead of sharp spikes followed by drop offs, the growth curve is gradual and persistent. This is often what early real adoption looks like users testing the network, finding it reliable, and continuing to move value through it. Stablecoins are the lifeblood of crypto infrastructure. They power trading, payments, remittances, and on chain liquidity. When stablecoin transfers grow consistently it signals trust in settlement speed, cost, and reliability. Plasma appear to be income that trust step by step.  The post put to see price actions of $XPL tells a adult story for a teenage token. Rather of an unsustainable pump and dump rotation, the chart give back controlled volatility and consolidation. This kind of price chop is often misunderstood but in reality, it suggests active price discovery and distribution to longer term holders. For builders and users, this matters. A relatively stable token environment reduces friction, encourages experimentation, and supports organic ecosystem growth. Plasma appears to be laying that groundwork early.

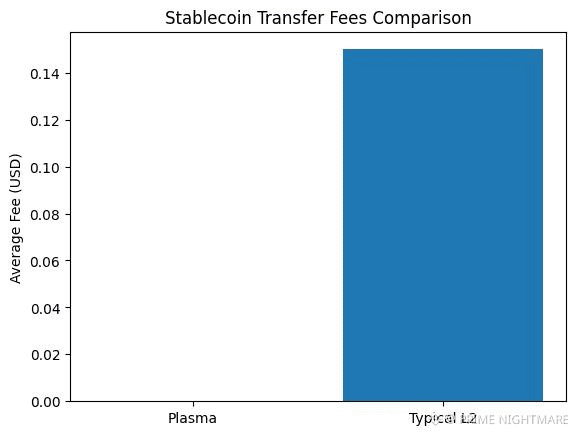

The post put to see price actions of $XPL tells a adult story for a teenage token. Rather of an unsustainable pump and dump rotation, the chart give back controlled volatility and consolidation. This kind of price chop is often misunderstood but in reality, it suggests active price discovery and distribution to longer term holders. For builders and users, this matters. A relatively stable token environment reduces friction, encourages experimentation, and supports organic ecosystem growth. Plasma appears to be laying that groundwork early. Fees are where Plasma’s advantage becomes obvious. Compared to a typical Layer 2, Plasma’s average stablecoin transfer fees are dramatically lower. This isn’t just a marginal improvement it’s a structural edge.Low fees unlock real world use cases: Frequent stablecoin transfers Micro payments Cross border settlements On-chain business operations At this point, Plasma starts to look less like a speculative network and more like financial infrastructure.

Fees are where Plasma’s advantage becomes obvious. Compared to a typical Layer 2, Plasma’s average stablecoin transfer fees are dramatically lower. This isn’t just a marginal improvement it’s a structural edge.Low fees unlock real world use cases: Frequent stablecoin transfers Micro payments Cross border settlements On-chain business operations At this point, Plasma starts to look less like a speculative network and more like financial infrastructure. What makes Plasma interesting isn’t any single metric it’s the alignment of all three: Rising stablecoin activity Disciplined post launch behavior for XPL Clear cost efficiency versus common L2s These are early indicators of a chain optimized for usage, not noise. As attention gradually shifts toward networks that actually move value efficiently, Plasma is positioning itself well ahead of that curve. This is still early but the foundation is being built. Follow the project, watch the on chain trends, and decide for yourself.

What makes Plasma interesting isn’t any single metric it’s the alignment of all three: Rising stablecoin activity Disciplined post launch behavior for XPL Clear cost efficiency versus common L2s These are early indicators of a chain optimized for usage, not noise. As attention gradually shifts toward networks that actually move value efficiently, Plasma is positioning itself well ahead of that curve. This is still early but the foundation is being built. Follow the project, watch the on chain trends, and decide for yourself.

Project: @Plasma

Token: $XPL