Bitcoin $BTC continues to dominate the crypto world — not just as the biggest coin by market cap, but as the benchmark for the entire market. It’s trending hard right now, and here’s why traders worldwide are watching, buying, and trading Bitcoin today.

📊 1. What’s Driving Bitcoin’s Price Up Right Now?

👍 Strong Demand + Limited Supply

BTC has a capped supply of only 21 million coins — no more, ever. This built-in scarcity means that when demand rises, price pressure goes up. That’s basic supply and demand economics.

📈 Institutional Adoption & ETF Inflows

Big financial players — from hedge funds to Bitcoin ETFs — are buying BTC at scale. Spot Bitcoin ETFs allow investors to gain exposure without managing crypto wallets, funneling large capital into Bitcoin.

🧠 Macro Trends & Safe-Haven Narrative

In uncertain economic times — inflation fears, weak currencies, or geopolitical instability — many look at Bitcoin as digital gold, a hedge against traditional markets.

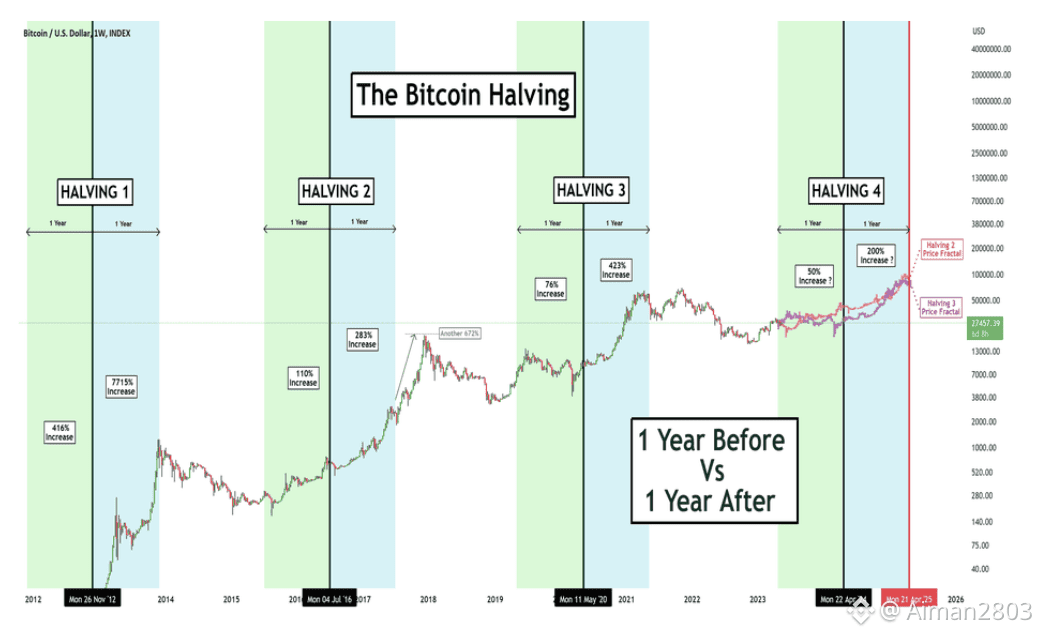

⏱️ Halving Effects

Bitcoin undergoes a “halving” roughly every 4 years, cutting miners’ reward in half — tightening future supply and historically kicking off major bull runs.

💹 2. Why Traders Love Bitcoin

📌 Liquidity & Market Depth

BTC is the most liquid crypto on Binance and every major exchange. That means:

✔ tighter spreads

✔ faster execution

✔ less slippage

All of which make BTC ideal for day trading, swing trading, and scalping.

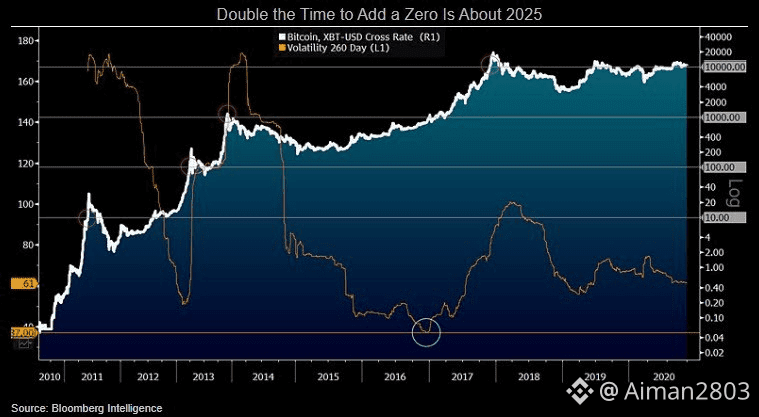

💵 High Volatility = Profit Opportunities

Price swings — sometimes double-digit moves intraday — attract traders looking for quick gains. For short-term traders, volatility is profit potential.

📚 Consensus & Sentiment Driven

Crypto prices react quickly to news — ETF flows, macro data, regulatory shifts, or whale accumulation — giving traders catalysts to base strategies on.

🧠 3. How People Trade Bitcoin

⚡ A. Technical Trading

Traders use charts like candlesticks, moving averages, RSI, MACD, and volume patterns to spot breakout or reversal signals.

📈 B. Trend Following

If BTC breaks major resistance (say $125k), traders could go long (buy) on momentum — expecting the trend to continue.

📉 C. Range Trading

When price stays between support/resistance, traders buy at support and sell near resistance.

💼 D. Hedging

Some traders hedge positions with futures or options to protect portfolios while still speculating.

🎯 4. Quick Tips Before Trading Bitcoin

✔ Always use stop-losses to protect capital

✔ Understand risk management (don’t risk more than you can afford)

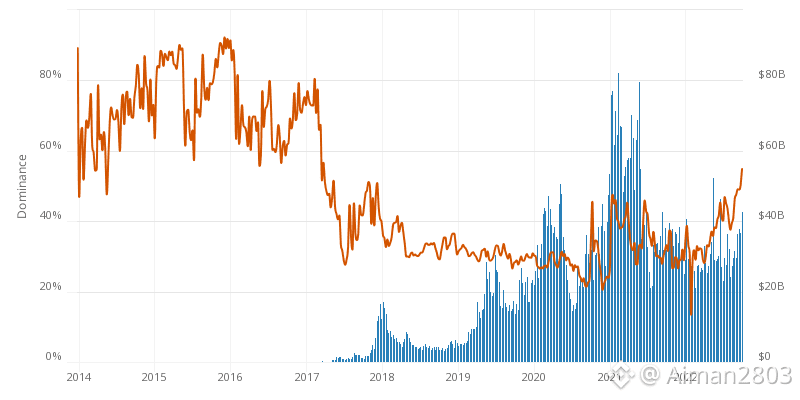

✔ Watch BTC dominance & broader market sentiment

✔ Follow news catalysts — ETF flows, macroeconomic shifts, or regulatory updates

📌 In Summary

Bitcoin isn’t just big — it’s the baseline of the crypto market.

It’s trending now because of institutional flows, limited supply, macro hedge demand, and historic price patterns tied to halvings. Whether you’re a swing trader, long-term holder, or short-term scalper, $BTC gives volume, volatility, and liquidity — the three core ingredients for trading success.

#MarketRebound #BTC走势分析 #bitcoin #WriteToEarnUpgrade

Trade smart, stay updated, and use charts to time your moves. 🚀