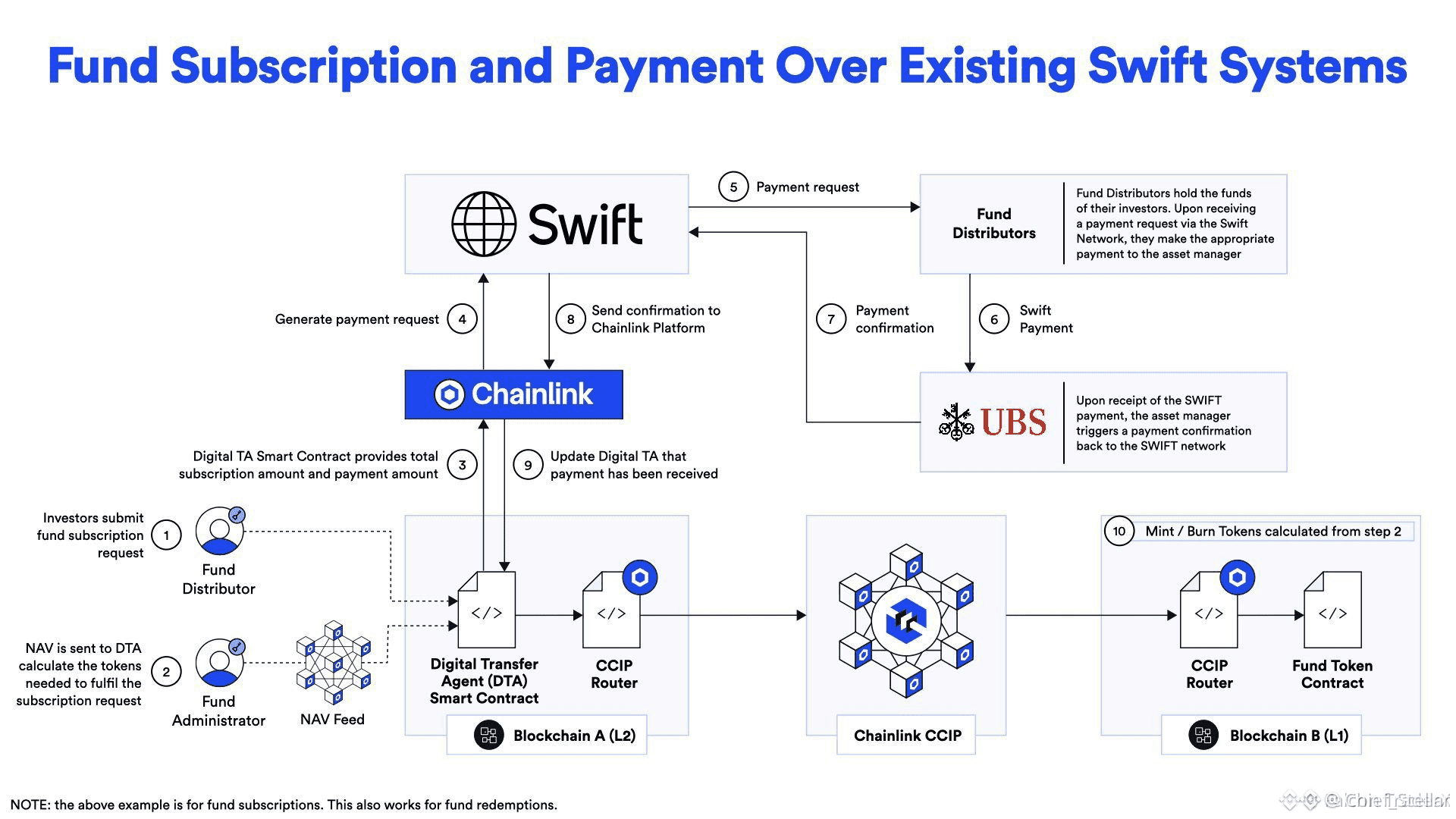

1· SWIFT remains the messaging layer and orchestrator between traditional finance and blockchain.

· In the example you shared, SWIFT is still used to send payment requests and confirmations between fund distributors and asset managers, while token minting/burning happens on-chain via Chainlink CCIP.

· This means SWIFT is bridging legacy systems with blockchain, not being replaced by $XRP or XLM's native settlement layers.

---

2. $XRP and #XLM designed as alternative settlement rails

Both were built to compete with or replace SWIFT’s slow, multi-day correspondent banking model by offering:

· Near-instant settlement

· Lower costs

· Direct asset transfer without intermediaries

But now, SWIFT is adopting blockchain interoperability itself, which could reduce the urgency for banks to migrate to entirely new rails like RippleNet (XRP) or Stellar (XLM).

---

3. Where XRP and XLM still have potential

· Niche corridors: Where SWIFT isn’t efficient or where local banking infrastructure is weak.

· CBDC and stablecoin interoperability: Both XRP and XLM are positioning themselves as bridges between digital currencies.

· Emerging markets and remittances: Where cost and speed matter more than integration with legacy SWIFT systems.

· If SWIFT’s blockchain integration remains slow or expensive, alternatives could still gain traction.

---

4. The real threat to XRP and XLM

It’s not just SWIFT — it’s the rise of institutional blockchain interoperability networks like:

· Chainlink CCIP (used in the trial shared)

· Polygon Supernets, Avalanche Subnets, etc.

· Private/permissioned ledgers by large banks

These allow traditional finance to use blockchain without needing a public crypto asset for settlement.

---

5. Bottom line

SWIFT adopting blockchain settlement doesn’t kill XRP or XLM, but it does:

· Reduce their first-mover advantage in bank adoption

· Show that banks prefer evolving existing infrastructure over migrating to new rails

· Push XRP and XLM to focus on use cases beyond competing with SWIFT — like CBDCs, micropayments, DeFi bridges, and emerging market finance

---

Final thought:

The future of payments will likely be multi-rail — SWIFT will coexist with blockchain networks, CBDCs, and maybe even public crypto rails like XRP and XLM in certain corridors.

But for now, SWIFT’s move into tokenization shows that interoperability, not replacement, is the path of least resistance for traditional finance.