There is a kind of token design that does not rush to explain itself. It waits for you to slow down. When I look at XPL, I do not get pulled by slogans or timelines. I get pulled by structure. It feels like something shaped by people who have spent years thinking about settlement risk, throughput ceilings, and how incentives behave when attention fades. It is not loud. It is infrastructure first, quietly building under the surface, where most durable systems tend to form.

distribution, the shape of ownership

When I dig into XPL distribution, I notice how little drama there is in it.

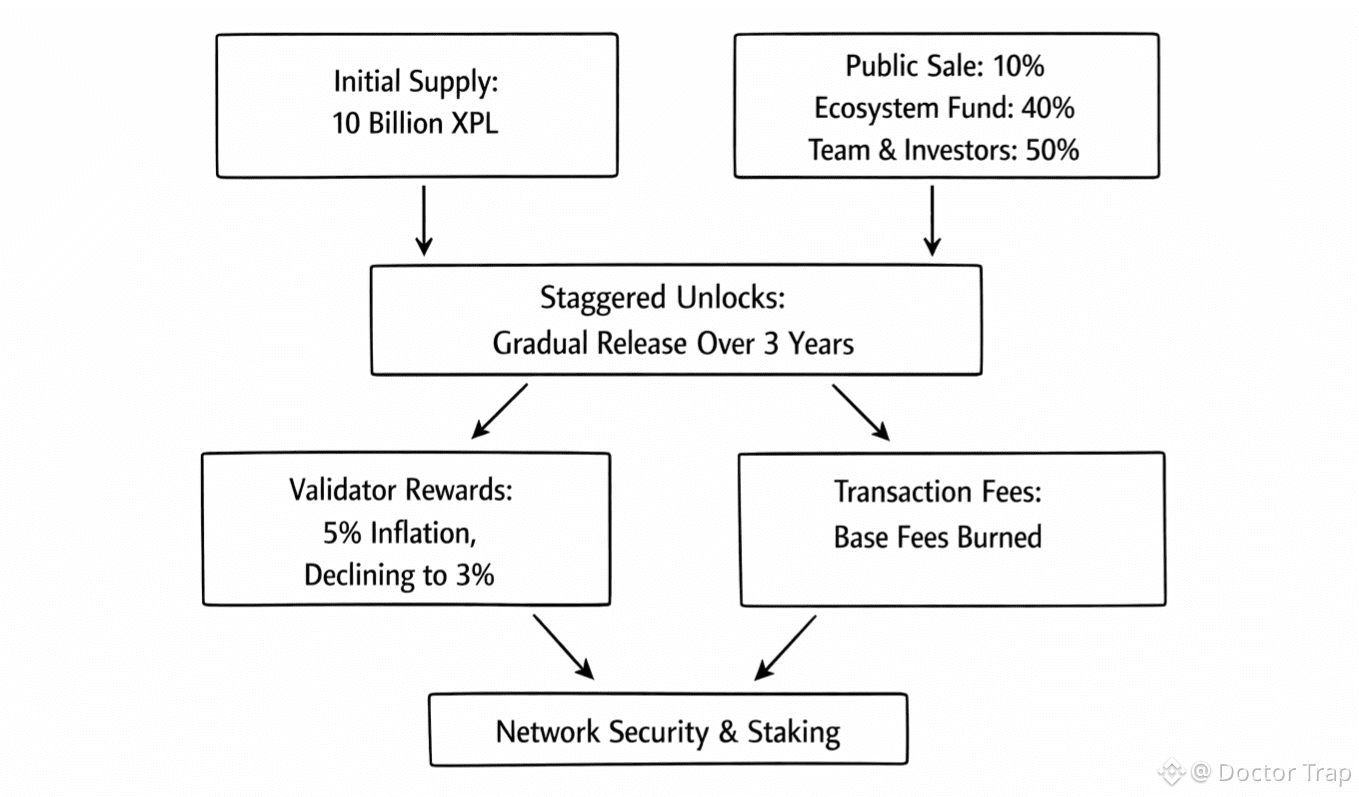

The total supply at mainnet beta sits at 10 billion XPL. Ten percent was allocated to the public sale, forty percent reserved for ecosystem growth, and the remaining half split evenly between the team and early investors. To me, this balance reads like a practical compromise rather than a marketing trick. Networks fail when ownership tilts too far in either direction. Too much insider weight starves the ecosystem. Too little long-term alignment drains accountability. I have watched both happen.

What keeps pulling me back here is how the distribution feels designed to keep gravity centered. Not flashy, just stable enough to let builders and validators plan without guessing what tomorrow’s cap table will look like.

unlocks, time as an engineering tool

The most important part of tokenomics is not allocation, it is patience. XPL treats time as a tool, not a footnote. Public sale tokens unlock around the mainnet beta phase, while certain regions follow longer schedules extending into mid 2026. Ecosystem tokens start with a measured release, intended for early liquidity and integration needs, with the remainder unlocking gradually over about three years. Team and investor tokens follow a familiar rhythm, a one year cliff, then steady monthly unlocks.

I remember earlier cycles where cliffs were mocked as outdated. Later, when volatility arrived, those same cliffs became anchors. Here, time is doing quiet work, smoothing pressure instead of amplifying it.

supply, inflation, and the validator budget

People often treat inflation like ideology, when it is really budgeting. XPL begins with an annual inflation rate around five percent, designed to fund validator rewards once external validation and delegation are live. Over time, that rate steps down toward a lower long-term baseline.

What stands out to me is that emissions are tied to actual network security needs, not switched on by default. Locked team and investor tokens do not receive staking rewards, which keeps incentives pointed toward those actively securing the chain. Base transaction fees are burned, creating a modest counterbalance as usage grows.

It is not a promise of scarcity. It is a recognition that supply should respond to demand without shouting about it.

utility, where sustainability actually lives

Sustainability only shows up when a token keeps doing necessary work. XPL is used for transactions and for staking in a proof of stake environment that underwrites the network. The underlying stack combines a fast consensus layer tuned for stablecoin settlement with an execution layer that feels familiar to developers. I keep coming back to the way stablecoin transfers are framed. Zero fee transfers are enabled in early phases within defined scopes, rolled out carefully rather than declared universal. That distinction matters. I have watched networks promise too much too early. This feels more restrained. It reads like infrastructure first, depth over breadth, quietly building under the surface.

on-chain signals, depth over breadth

When I spend time looking at on-chain activity, I see signals that feel closer to settlement than speculation. Total value locked has grown into the billions, with bridged value even higher, suggesting real movement rather than idle capital. Stablecoins dominate supply, with USD-denominated assets making up the majority of liquidity.

Daily DEX volumes sit in the tens of millions, weekly volumes scale steadily, and fees tell an interesting story. Application fees outweigh base layer fees by a wide margin, which hints at an economy where apps carry monetization while the base stays lean. Blocks are fast, throughput steady, transaction counts rising without noise. It is not loud. It is the kind of footprint that forms when a network is being used for what it was designed to do.

closing thoughts, why I keep circling back

I remember cycles where tokenomics felt like theater, big numbers arranged to impress for a quarter or two. What I see with XPL feels closer to operations. Distribution avoids extremes. Unlocks use time as a stabilizer. Inflation behaves like a security budget, not a growth hack. Burns are simple and honest. And the on-chain activity suggests usage that grows quietly, not because it is fashionable, but because it fits a need. From my vantage point, that is usually how infrastructure survives when attention moves on.

People eventually ask about price, and I usually hesitate. XPL has been trading in a modest range recently, drifting around the low teens in cents, and it will keep moving like all markets do. What matters more to me is whether the supply schedule and incentives still make sense when nobody is watching. That is where real sustainability shows itself.

Quiet numbers, patient time, and infrastructure that holds when the noise fades.