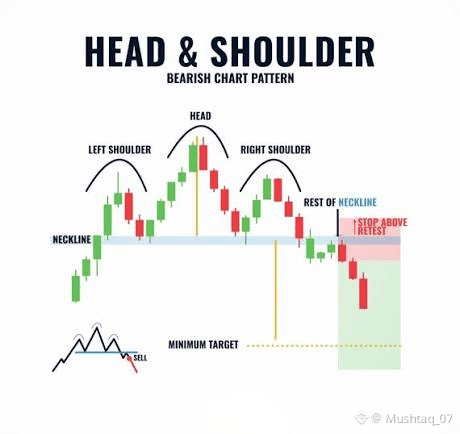

🔍 Trade Overview:

- Bias: Bearish continuation

- Entry Zone (SELL): 385-415 (Sell-side FVG + neckline retest area)

- Stop Loss: 455 (daily close above right-shoulder high)

- Targets:

- T1: 320

- T2: 250

- T3: 180

- Extended Target: 90-80 (major historical demand)

📊 Why This Trade Makes Sense:

The Head & Shoulders pattern indicates distribution after an extended markup. The neckline break confirms a trend transition, and price is retracing to an area where sellers previously dominated. There's clean liquidity on the downside with little structural support.

⏳ Risk Management:

- This is a swing trade, so expect slow movement and multiple pauses.

- Take partial profits at each target to reduce exposure.

- If price holds above the invalidation zone, exit the trade.

Structure says bearish. Timeframe says patience. Execution says discipline 😊

Want to discuss this trade setup or get more insights?

#MarketRebound #StrategyBTCPurchase #USJobsData #WriteToEarnUpgrade #WhoIsNextFedChair