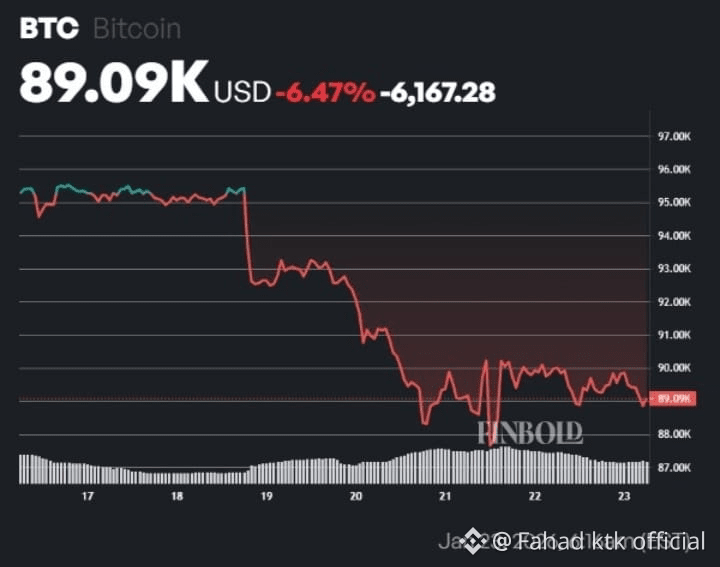

📊 Bitcoin Price Snapshot & Recent $90,000s, with recent volatility and consolidation dominating price action.

Market mood: Uncertain and range-bound — neither clearly bullish nor outright bearish.

---

📈 Technical Analysis

🟢 Short-Term Price Zone & Support/Resistance

Key levels to watch:

Support range: ~$85,000–$88,000

Immediate resistance: ~$96,000–$100,000

A break above $96k–$100k could trigger bullish continuation, while holding below it may keep BTC in consolidation.

📉 Medium-Term Trend Indicators

Short-term moving averages still below long-term EMAs, hinting at a cautious trend.

Momentum indicators (MACD) are flattening, suggesting selling pressure is easing but not yet reversing.

Consolidation likely persists until a catalyst breaks the range.

---

📊 Market Structure & Sentiment

⚖️ Bullish Scenarios

Bullish forecasts suggest:

Rally toward $110,000+ if resistance is overcome and institutional inflows resume.

Some analysts see extended long-term upside above $120k–$150k later in 2026.

🟠 Bearish Risks

Bearish pressures include:

Breakdown below major support around $85k–$80k could lead to deeper corrections.

On-chain indicators have shown weakening market momentum at times, pointing toward possible extended bearish phases.

---

📉 Fundamental & Market News Impact

📰 Recent Market Headlines

Bitcoin below $90k as big investors reduce positions:

Institutional outflows and risk-off sentiment have weighed on BTC, with significant ETF outflows and futures liquidations noted.

Range-bound trading near $89,800:

The market awaits clear catalysts to break out of the current consolidation.

Gold & safe havens rising as BTC retreats:

Precious metals have benefited as risk appetite recedes, potentially drawing funds away from crypto.

Strong accumulation by some institutions:

Massive purchases (~22,000 BTC) by major holders signal confidence but have not yet reversed bearish sentiment.

---

🧠 What This Means for Traders & Investors

🎯 Short-Term

Neutral–cautious: Prices likely to hover in a wide range unless breakout triggers emerge.

Watch for breakout above $96k–$100k as a bullish confirmation signal.

📆 Mid-Term

Bullish if macro and institutional interest returns.

Bearish if support levels fail and risk-off flows continue.

📌 Strategy Notes

Range trading or scaling entries/layers around support and resistance may suit current conditions.

Long-term holders might focus on macro catalysts (ETF flows, regulations, institutional demand).

---

🧠 Summary Table

Scenario Target Range Key Trigger

Bullish breakout $100,000 → $110,000+ Close above resistance zone

Neutral / range $85,000 → $96,000 Continued consolidation

Bearish breakdown $80,000 ↓ Loss of key support

#WEFDavos2026 #TrumpCancelsEUTariffThreat #WhoIsNextFedChair #BTC100kNext? #BTC100kNext? $BTC