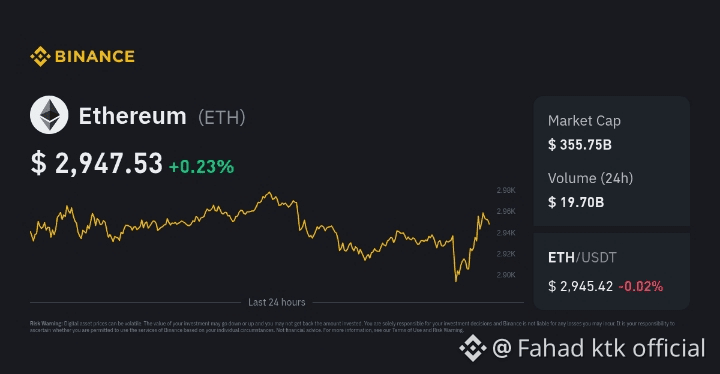

$ETH 📊 Market Overview & Current Tech Signals

📈 Short-Term Price Structure

ETH recently reclaimed the $3,000 zone, which now acts as key support — a close above this strengthens the near-term bullish case. �

Bullish momentum is showing some recovery with daily gains and elevated buying interest at support levels. �

Meyka

Technical analysts point to crucial resistance near $3,200–$3,350 — a breakout above could trigger upside continuation. �

📉 Downside Risk

If ETH drops decisively below $2,900–$2,950, further correction toward lower support zones becomes more likely. �

Brave New Coin

Market sentiment remains mixed — momentum indicators show room for both upside and downside depending on macro flow and volume confirmation.

🔮 Analyst Predictions: Bull & Bear Scenarios

🟢 Bullish Case

Some medium-term forecasts suggest ETH could rally toward $3,400–$3,500 as momentum builds and key resistance zones are overcome. �

Blockchain News

A breakout above major levels might open paths to $4,000+ if buying pressure and volume continue. �

Blockchain News

Long-term institutional views (historical) have even projected much higher peaks (e.g., up to $7,500 by year-end in some bullish models), driven by ETF flows and network adoption. �

🔴 Bearish / Risk Case

Some analysts warn ETH could retrace if broader crypto sentiment turns risk-off — earlier bearish calls even imagined deep drawdowns if support fails. �

CCN.com

Weak market structure around resistance and potential ETF outflows remain short-term risks for ETH. �

🔑 Key Levels to Watch

✅ Support: ~$2,900–$3,000

⚠️ Immediate resistance: ~$3,200–$3,350

📈 Bullish breakout level: Above ~$3,400

📉 Bearish invalidation: Below ~$2,900

📌 Summary

Time Frame

Outlook

Short-term

Neutral-Bullish as ETH defends key support

Medium-term

Cautiously Optimistic with potential rallies if resistance breaks

Long-term

Mixed views — from significant upside to wide bearish ranges depending on adoption & macro

Takeaway:

Ethereum is at a pivotal technical crossroads — defending major support near ~$3,000 gives bulls a runway toward $3,400–$4,000 if momentum sustains, but losing that zone could expose deeper retracements.