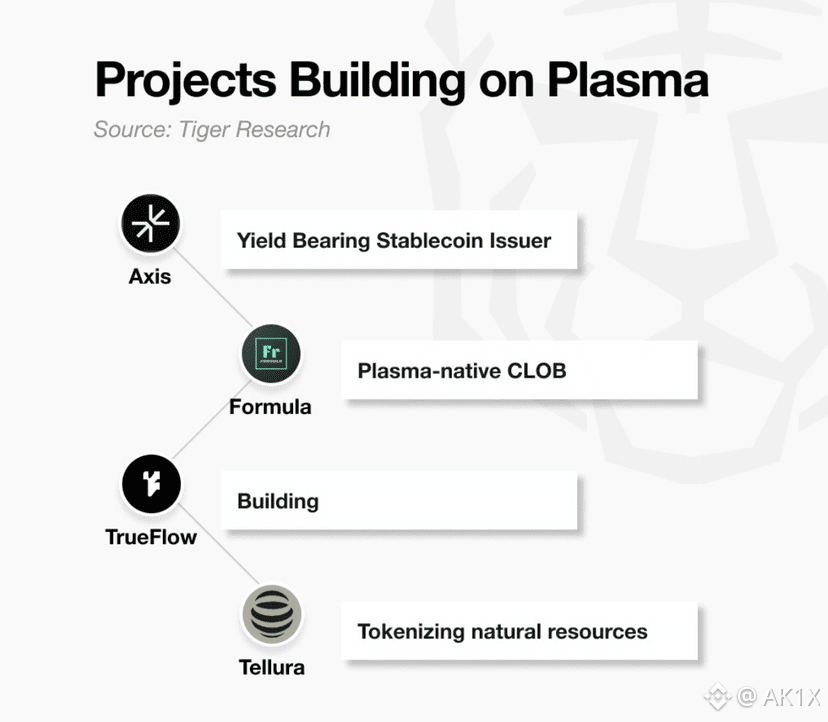

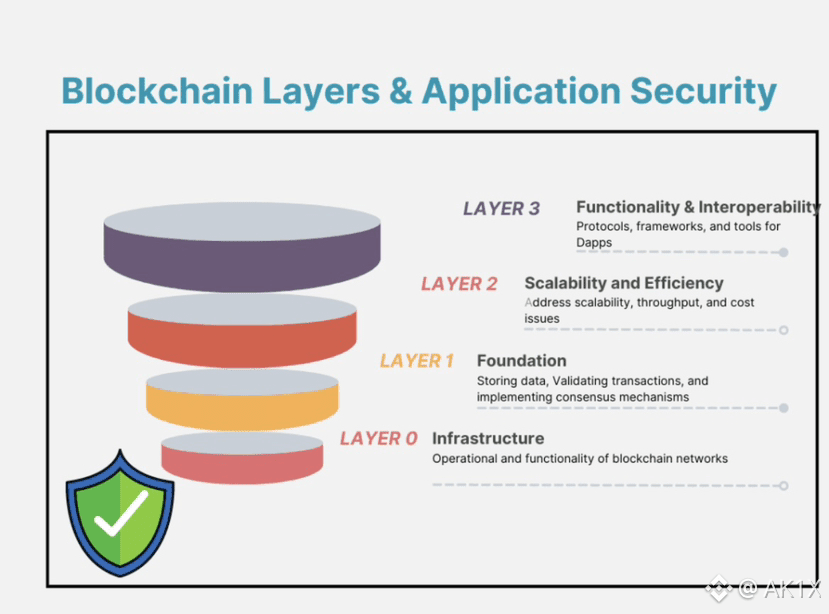

Plasma is a Layer-1 blockchain created with one clear purpose: to make stablecoins behave like real, usable money. Most blockchains were built for general computation first, and payments came later as an add-on. Plasma flips this model. From its base layer, it is optimized for stablecoins such as USDT, focusing on speed, reliability, and simplicity rather than speculation or complexity. This design choice allows Plasma to remove friction that has long blocked stablecoins from mass adoption.

At a technical level, Plasma is engineered to handle very high transaction volumes with near-instant finality, making it suitable for real-world payments. Whether it’s cross-border remittances, merchant settlements, or everyday transfers, Plasma aims to operate at the scale and speed of traditional payment networks but without banks or intermediaries. This performance is achieved through an efficient consensus model and a streamlined execution layer designed specifically for payment-heavy activity.

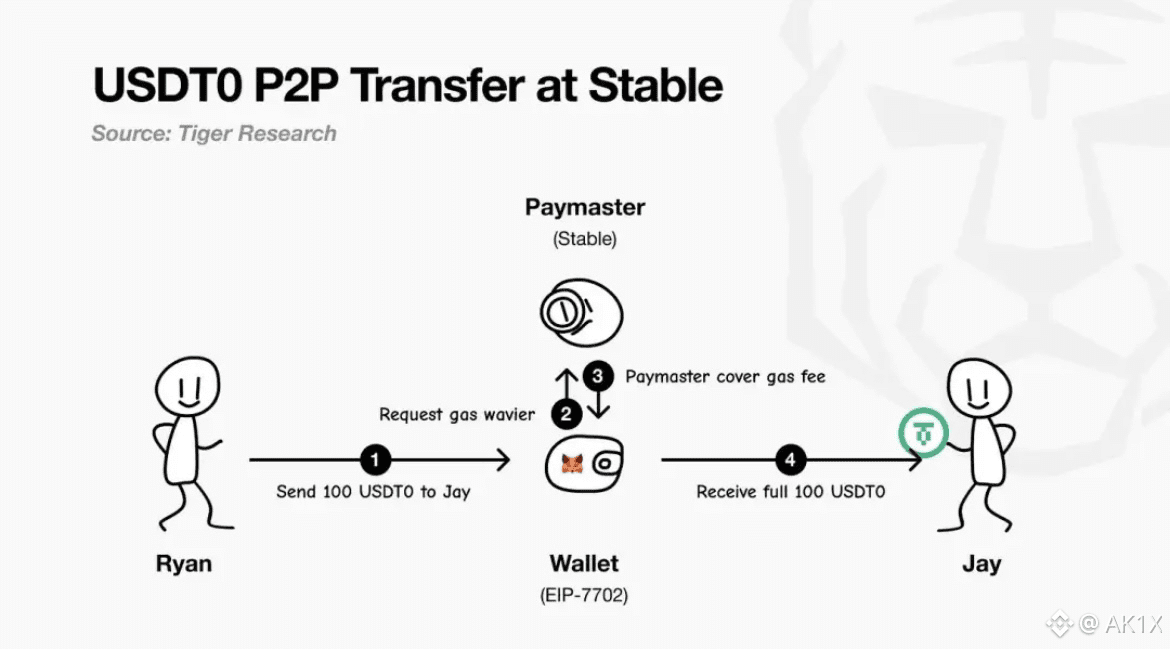

One of Plasma’s most important innovations is how it handles transaction fees. On most blockchains, users must hold a native token just to send funds, which creates confusion and friction. Plasma introduces gas abstraction, allowing users to send stablecoins without worrying about separate gas tokens. In some cases, transfers can even be processed with zero visible fees, making the experience feel closer to sending money through a modern payment app than using a traditional blockchain.

Plasma is also fully EVM-compatible, which is critical for adoption. Developers can deploy existing Ethereum smart contracts using familiar tools like Solidity, MetaMask, and Hardhat, without rewriting code. This lowers the barrier for builders and allows existing DeFi, payment, and financial applications to migrate or expand onto a chain that is better suited for stablecoin usage.

Beyond payments, Plasma is designed as long-term financial infrastructure. Features such as Bitcoin bridging, privacy-aware transactions, and modular expansion are meant to support a future where stablecoins, BTC, and on-chain financial products coexist seamlessly. The native XPL token secures the network through staking and validator incentives, ensuring decentralization and long-term sustainability.

In essence, Plasma represents a shift toward specialized blockchains that do one thing extremely well. By focusing on stablecoins as the foundation of its network, Plasma positions itself as a core settlement layer for digital dollars, a system built not for hype, but for real economic activity at global scale.