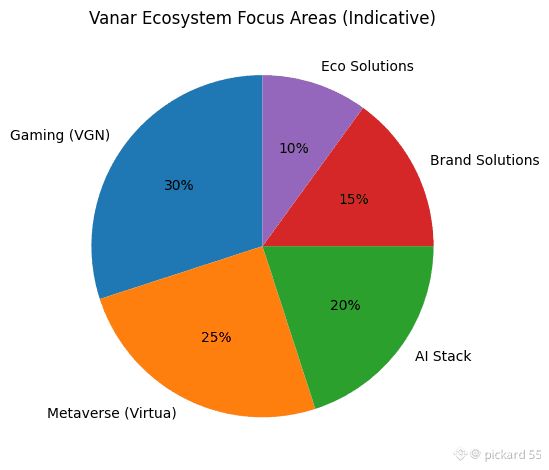

Vanar Chain is a Layer-1 blockchain that tries to feel practical for everyday users instead of feeling like “crypto infrastructure that only crypto people understand.” The project’s main idea is that real adoption will not come from people reading whitepapers or learning wallet jargon. It will come from products that already have mass audiences—games, entertainment, metaverse-style experiences, and brand ecosystems—where blockchain stays mostly invisible and only shows up as a benefit: faster digital ownership, cheaper micro-transactions, smoother marketplaces, and easier cross-app asset use. That “next 3 billion users” goal is central to Vanar’s positioning, and it is also why the ecosystem keeps highlighting consumer-facing products like Virtua and gaming infrastructure like VGN.

What makes Vanar worth paying attention to is the specific set of problems it tries to solve for mainstream apps. A lot of blockchains are strong on paper but weak for real products because fees can spike unpredictably, UX is confusing, and performance can break when you put real consumer traffic on it. Vanar’s documentation and whitepaper repeatedly emphasize fee predictability and throughput/scalability for apps that need consistent user costs. The chain uses a fixed-fee approach and then updates protocol fee values based on the market value of the gas token at regular intervals (the docs describe it updating every 100 blocks, and the “fee management” workflow describes it as a frequent update loop so costs stay stable in user terms). This is a very “business-minded” design choice because games and consumer apps cannot price things if fees randomly jump. �

VanarChain +3

At the base level, Vanar is the L1 where transactions are processed and smart contracts run, and the network is powered by the VANRY token as the native gas token (similar to how ETH is used on Ethereum for gas). The whitepaper describes VANRY as the cornerstone of the ecosystem, primarily used to pay for network operations and transaction processing. �

VanarChain +1

Where Vanar has been evolving (and where many people may not realize it’s trying to differentiate) is that it’s not only presenting itself as “a gaming L1.” On its official product stack pages, Vanar markets itself as an AI-native infrastructure stack, with the L1 as the foundation and additional layers like Neutron and Kayon sitting above it. Neutron is described as a “semantic memory foundation” that compresses data into “Seeds” that can be stored and queried, and Kayon is positioned as a reasoning layer that enables natural-language querying and contextual intelligence for Web3 and enterprise systems. Whether someone fully buys the AI narrative or not, the practical pitch is clear: make data easier to store, verify, and use; make apps feel smarter; and reduce friction for mainstream workflows. �

Vanar Chain +2

In simple terms, the “how it works” story looks like this: Vanar Chain handles execution and settlement; VANRY pays for actions and helps secure the network; validators maintain the chain; and the stack layers (like Neutron and Kayon) aim to make storage and intelligent interaction easier for developers and end users. The docs also describe Vanar’s architecture as based on a Geth implementation (execution layer), plus a hybrid consensus approach. �

Vanar Documentation +1

On consensus and security, Vanar documentation and its whitepaper describe a hybrid model built around Proof of Authority (PoA) governed by Proof of Reputation (PoR). The idea is that the network starts with a more controlled validator set (with the foundation initially running validator nodes), while external validators can be onboarded through reputation-based processes. In parallel, staking and delegation appear in the docs as a way for the community to participate by delegating stake to validator nodes and earning yield, with the foundation selecting validators in its “unique approach” description. The simple takeaway is that Vanar is trying to balance speed and reliability with a pathway to wider participation through validator onboarding and delegated staking. �

VanarChain +3

Now the tokenomics, because that’s where people usually want clarity fast. VANRY is capped at a maximum supply of 2.4 billion tokens, and the whitepaper describes minting happening in two ways: an initial genesis mint and then ongoing block rewards over a long timeframe. Specifically, it describes an initial genesis amount created to support the 1:1 migration from Virtua’s earlier TVK token supply (it states TVK had a 1.2 billion max supply and Vanar minted an equivalent 1.2 billion VANRY at genesis for a 1:1 swap), and then the remaining supply minted gradually as block rewards over 20 years. This “long release” approach is meant to incentivize validators and avoid sudden supply shocks. �

VanarChain +2

That TVK → VANRY migration is also supported by major exchange announcements. Binance published that it completed the Virtua (TVK) token swap and rebranding to Vanar (VANRY) at a 1:1 ratio. Other exchanges published similar 1:1 swap notices as well. �

Binance +2

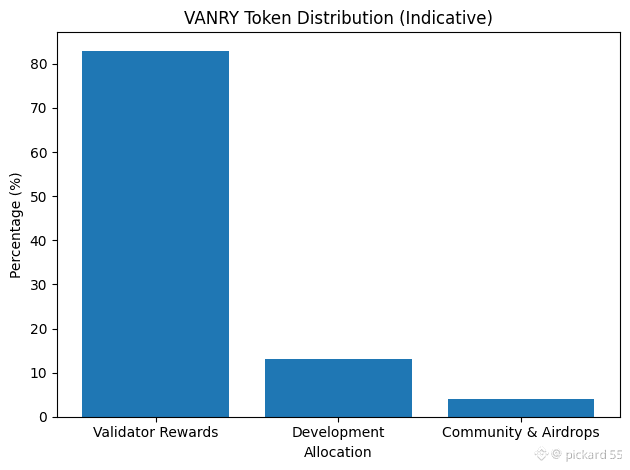

For distribution, it is important to be honest because different documents describe the initial distribution figures differently. Vanar’s whitepaper states that out of the additional 1.2 billion (the part beyond the genesis swap supply), 83% goes to validator rewards, 13% to development rewards, and 4% to airdrops/community incentives, and it explicitly says no team tokens are allocated in that distribution section. �

VanarChain

However, a Kraken UK crypto-asset statement document lists a different breakdown for the “genesis/swap” portion (it lists 1.5B as genesis for the TVK swap, and then separate percentages for validator rewards, development rewards, and community incentives). This does not necessarily mean one is “wrong,” but it does mean that tokenomics numbers can be presented differently depending on document version, definitions, or reporting standards. The safest way to talk about it is: maximum supply 2.4B is consistent; VANRY is used for gas, staking, and governance; and emissions are designed to be long-term through block rewards. �

VanarChain +1

Utility is straightforward and consistent across sources: VANRY is used to pay transaction fees, support staking and validator participation, and power smart contract operations. The whitepaper also describes a wrapped ERC-20 version of VANRY on Ethereum and bridging infrastructure, which is important because it means VANRY can connect to existing EVM tooling and liquidity environments instead of being isolated. �

Kraken Assets +1

When people ask about “ecosystem,” what they usually mean is: does anything exist beyond promises? Vanar points to two headline examples that represent its mainstream direction. First is Virtua, which describes its NFT marketplace (Bazaa) as built on the Vanar blockchain, and it positions itself as a consumer metaverse/gaming experience where digital assets have real on-chain utility. Virtua is useful as a proof point because it’s easier to understand than pure infrastructure—users explore, trade, unlock experiences, and interact with content. �

Virtua +1

Second is VGN (Vanar Games Network), which is presented as a dedicated gaming network pillar inside the broader Vanar strategy. Third-party research pieces summarizing Vanar often highlight VGN as part of the scaling strategy for Web3 games (asset ownership, rewards, interoperability) while trying not to break the gameplay experience with heavy blockchain friction. �

OKX +2

Vanar also maintains an ecosystem/partners page to show corporate adopters and alliances. A partnerships page alone is not “adoption,” but it is still relevant because adoption in gaming and brands usually depends on distribution: studios, platforms, payment rails, and integration partners that can bring users without forcing them to become crypto experts. �

Vanar Chain

Roadmap-wise, the safest approach is to anchor to what the project itself has published plus recent summaries that align with official product direction. Vanar’s own blog has milestone-and-roadmap posts (for example, a Q4 2023 milestone delivery and 2024 roadmap post, and ongoing recaps that show continued shipping). Meanwhile, more recent update summaries describe 2026 focus around expanding Neutron and Kayon and pushing a sustainable usage model around the AI stack. The key point is that Vanar’s roadmap direction is not only “ship L1 upgrades,” but “mature the stack and grow real utility in consumer verticals.” �

Vanar Chain +2

If I put all of that into a human, realistic narrative, Vanar is basically trying to become the chain that normal products can use without normal users feeling it. The ideal Vanar user is not a trader staring at charts; it’s a gamer buying an item, a fan unlocking content, a brand customer using a digital collectible, or a creator interacting with a marketplace—where blockchain improves ownership and portability without adding friction. That’s why the project keeps mixing gaming/metaverse messaging with infrastructure messaging like fixed fees, validator design, and an “AI stack.” �

Vanar Chain +2

But a serious deep dive must include challenges, because that is what separates a real analysis from marketing. Vanar faces at least five practical challenges. One, execution complexity: building an L1 is hard, and building an L1 plus a multi-layer AI/data stack plus consumer products is even harder; shipping delays or weak tooling can slow developer adoption. �

Vanar Chain +2

Two, competition: even Kraken’s risk section points out that Vanar competes with other gaming and entertainment-focused chains (and the broader market is even more crowded when you include general-purpose L1s and fast L2s). If developers can get similar performance and better liquidity elsewhere, Vanar must win with tooling, distribution, and real products. �

Kraken Assets

Three, consumer cycles: gaming and metaverse narratives can swing with hype cycles. The only long-term defense is sticky products and consistent user activity. Having Virtua and VGN as active pillars helps the story, but the market will still judge on actual usage, not just vision. �

Virtua +2

Four, tokenomics communication: as seen in the differences between the whitepaper distribution description and an exchange disclosure document, tokenomics can look confusing if the project does not keep a single “source of truth” easy to find and updated. People can forgive complexity; they don’t forgive lack of clarity. �

VanarChain +1

Five, onboarding reality: “next 3 billion” only happens if onboarding feels like Web2—simple sign-in flows, smooth payments, minimal wallet anxiety, and fees that are predictable. Vanar’s fixed-fee approach is aligned with this, but execution on UX and developer experience matters just as much as protocol design. �

Vanar Documentation +2

So, if you’re looking at Vanar during the event period starting 2026-01-20, the clean way to describe it is: it’s an adoption-driven Layer-1 with a strong focus on gaming, entertainment, and brands, anchored by live ecosystem pillars (Virtua and VGN), with a token (VANRY) capped at 2.4B supply used for gas, staking, and network operations, and a technical direction that leans into predictable fees and an AI-native stack (Neutron and Kayon) to make apps feel smarter and easier. The upside is clear: if Vanar becomes the invisible infrastructure behind consumer products, demand comes from usage. The risk is also clear: competition is fierce, and mainstream success requires shipping, partners, and UX excellence—not just blockchain features.