Dusk Network ko samajhne ke liye sabse pehle ye clear hona chahiye ki ye ek “general blockchain” nahi hai jo baad me compliance aur privacy add kar raha ho. Dusk shuru se hi is assumption ke saath build hua hai ki real financial markets ko blockchain par lana hai, bina privacy aur regulation ko compromise kiye.

Aaj ke zyada tar public blockchains transparency ko default maan kar chalte hain. Ye DeFi aur open systems ke liye theek ho sakta hai, lekin jaise hi baat regulated finance, securities, ya institutional workflows ki aati hai, wahi transparency problem ban jaati hai. Dusk isi gap ko address karta hai.

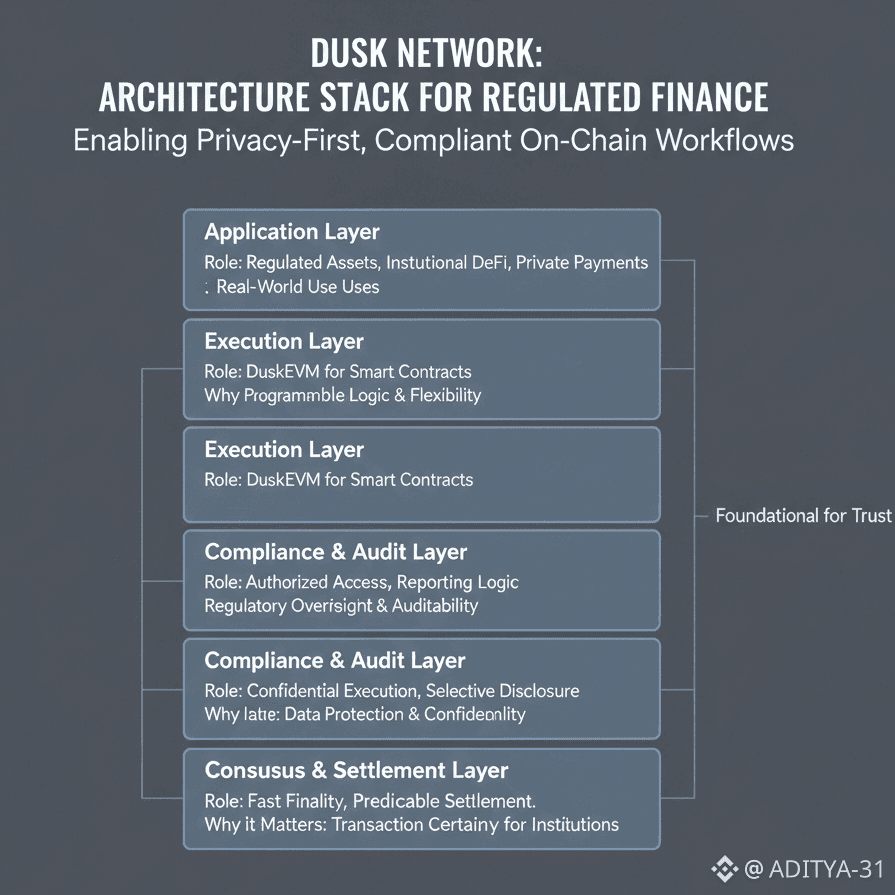

Regulated Markets ke Liye Purpose-Built Design

Dusk ka core focus traditional finance ke real workflows par hai — jaise asset issuance, settlement, aur compliance reporting — bas difference ye hai ki ye sab on-chain hota hai. Institutions Dusk par security tokens ya real-world assets issue kar sakti hain, lekin protocol level par hi KYC, reporting aur disclosure logic ka support hota hai.

Iska matlab ye nahi ki sab data public ho jaata hai. Dusk ka design allow karta hai ki transactions aur balances confidential rahen, lekin jab legally zaroorat ho, tab auditability aur oversight possible ho. Ye balance kaafi rare hai aur wahi Dusk ko alag banata hai.

Technology jo Privacy ko Core Banati Hai

Dusk privacy ko optional feature ki tarah treat nahi karta. Zero-knowledge cryptography ka use karke network aise transactions allow karta hai jahan sensitive information public ledger par expose nahi hoti. Saath hi, selective disclosure ka concept ensure karta hai ki regulators ya authorized parties ko zaroori data mil sake.

Regulatory alignment bhi baad me socha hua idea nahi hai. European frameworks jaise MiCA aur MiFID II ko dhyaan me rakh kar architecture design kiya gaya hai. Is wajah se Dusk sirf crypto-native users ke liye nahi, balki regulated institutions ke liye bhi relevant ban jaata hai.

Consensus aur settlement layer ko bhi finance-grade requirements ke liye optimize kiya gaya hai. Fast finality aur predictable settlement financial markets ke liye critical hote hain — aur Dusk ka proof-of-stake based consensus isi goal ko serve karta hai.

Modular Architecture: Developers ke Liye Familiar, Institutions ke Liye Safe

Dusk ka ek strong advantage uska modular design hai. Settlement aur execution ko alag-alag layers me divide kiya gaya hai. DuskDS core settlement aur data layer handle karta hai, jabki DuskEVM developers ko familiar Ethereum-style smart contracts deploy karne ka option deta hai.

Iska matlab ye hai ki developers ko naye tools ya languages seekhne ki zaroorat nahi padti, lekin unke applications ke neeche privacy aur compliance baked-in hoti hai. Ye combination institutional adoption ke liye kaafi important hai.

Practical Use Cases jahan Dusk Fit Hota Hai

Dusk sirf theory nahi hai. Uska design clearly kuch real-world use cases target karta hai:

Regulated securities aur real-world asset tokenization

Institutional DeFi jahan confidentiality mandatory hoti hai

Private payment rails aur settlement systems

Identity aur access control systems jahan data exposure limited rehna chahiye

Ye sab use cases aise hain jahan “open by default” blockchains kaam nahi kar paate.

Final Thought

Jahan zyada tar blockchains decentralization ko pehle aur compliance ko baad me sochte hain, Dusk ne approach ulta rakha hai. Privacy aur regulation ko foundation bana kar blockchain build karna easy nahi hota — lekin long-term adoption ke liye ye zaroori hai.

Agar blockchain ko sirf speculation se aage le jaana hai aur real financial systems ke saath integrate karna hai, to Dusk jaise networks ki relevance naturally badhti jaati hai.