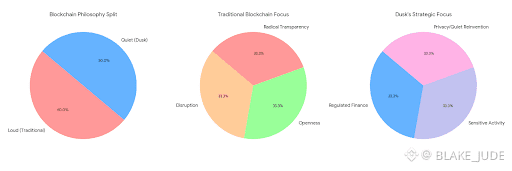

Most blockchains announce themselves loudly. They promise disruption, openness, radical transparency. Dusk took the opposite path. It began with a question that rarely shows up in whitepapers or conference panels: why would regulated finance ever place sensitive activity on a ledger that exposes everything by default? That question, uncomfortable as it is, sits at the heart of why Dusk exists and why its design looks nothing like the chains that dominate headlines.

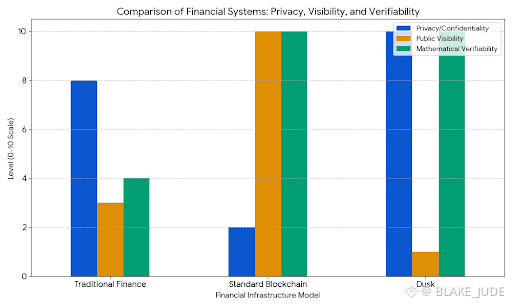

Finance does not operate in public. It never has. Large transactions move through private agreements, negotiated terms, and layers of legal obligation that require discretion. Transparency exists, but it is contextual and controlled. Auditors see what they are authorized to see. Regulators receive disclosures tailored to their mandate. Counterparties protect competitive information because survival depends on it. When blockchain entered the conversation, it brought a radical assumption with it: that visibility equals trust. For open networks and censorship-resistant money, that assumption works. For securities, credit markets, or institutional settlement, it breaks down almost immediately.

Dusk was built around this mismatch. Instead of forcing financial actors to adapt to public ledgers, it adapts ledger design to financial reality. The result is a Layer 1 that treats privacy not as secrecy, but as structure. Transactions can be hidden without becoming unverifiable. Rules can be enforced without exposing the data they act on. Trust is preserved, not by making everything visible, but by making everything provable.

This distinction matters more than it sounds. On most blockchains, privacy is something you bolt on after the fact. Mixers, shields, off-chain computations. Each adds complexity and risk, and none fully resolve the core issue: the base layer still assumes disclosure. Dusk flips that assumption. Its transaction model is built so that confidentiality is the default state, while correctness is mathematically enforced. Zero-knowledge proofs ensure balances remain valid and constraints are satisfied, even though observers learn nothing about the underlying values. What you see is not the data itself, but proof that the data obeys the rules.

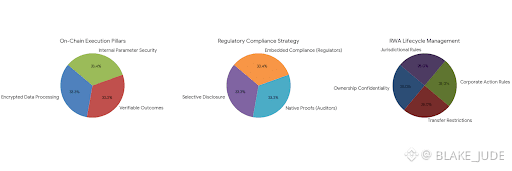

Once you accept that premise, the rest of the system falls into place. Smart contracts no longer need to expose their inputs to function. Business logic can run on encrypted data, producing outcomes that are verifiable without being revealing. This is a subtle but profound shift. It means on-chain execution can finally mirror off-chain workflows, where sensitive parameters are processed internally but outcomes are accountable. For institutions, this is the difference between experimentation and deployment.

Regulation, often portrayed as blockchain’s adversary, becomes a design constraint rather than an obstacle. Dusk does not attempt to hide activity from oversight. Instead, it supports selective disclosure. Information can be revealed to specific parties under defined conditions, without turning the ledger into a public archive of proprietary data. Auditors gain confidence because proofs are native, not reconstructed after the fact. Regulators gain clarity because compliance is embedded in transaction logic, not enforced through external reporting alone.

This approach is particularly well suited to tokenized real-world assets, where the gap between blockchain ideals and legal reality is widest. Issuing a token that represents a bond or equity stake is trivial. Managing its lifecycle is not. Ownership records must remain confidential. Transfers may be restricted. Corporate actions must follow jurisdictional rules. Most public chains struggle here because every requirement fights the transparency-first model. Dusk aligns with these constraints from the start, which allows tokenization to move beyond pilots and proofs of concept into infrastructure that can actually support markets.

The architecture reinforces this intent. By evolving toward a modular, multi-layer design, Dusk separates concerns that are often entangled elsewhere. Settlement can remain stable and auditable while execution environments adapt to new use cases. Privacy primitives can be upgraded as cryptographic standards evolve. This flexibility matters in a regulatory landscape that changes slowly but decisively. Institutions need assurance that a network can evolve without breaking legal continuity.

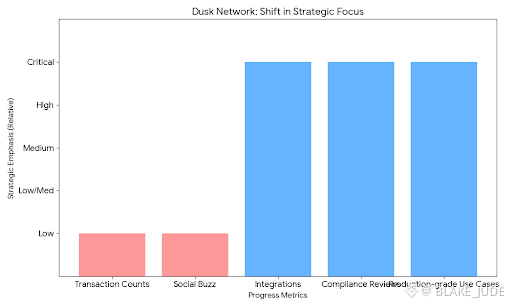

There is nothing flashy about this strategy. It does not lend itself to viral narratives or speculative mania. It requires patience, audits, and collaboration with entities that move carefully by necessity. That may be why Dusk feels less like a startup chasing relevance and more like infrastructure quietly taking shape. Its progress is measured not in transaction counts or social buzz, but in integrations, compliance reviews, and production-grade use cases.

Of course, this path carries risk. Privacy-preserving systems demand rigorous engineering. Zero-knowledge proofs raise the bar for audits and developer tooling. Liquidity does not automatically flow into regulated environments. And privacy itself remains politically sensitive, often misunderstood as opacity rather than protection. Dusk’s challenge is not only technical, but narrative: explaining that controlled disclosure strengthens markets instead of weakening them.

Still, the direction of travel in finance is clear. Settlement cycles are compressing. Tokenization is moving from experimentation to execution. Compliance is becoming more automated, not less. In that world, blockchains that insist on total transparency will remain misaligned with institutional needs. Networks that acknowledge how finance actually works will quietly take their place beneath it.

Dusk belongs to that second category. It is not trying to reinvent money for everyone. It is trying to make blockchain usable for markets that already exist, under rules that are not going away. That may not be the loudest ambition in the space, but it might be one of the most durable.