Understanding Price Change Distribution in Crypto (With Real Coin Examples)

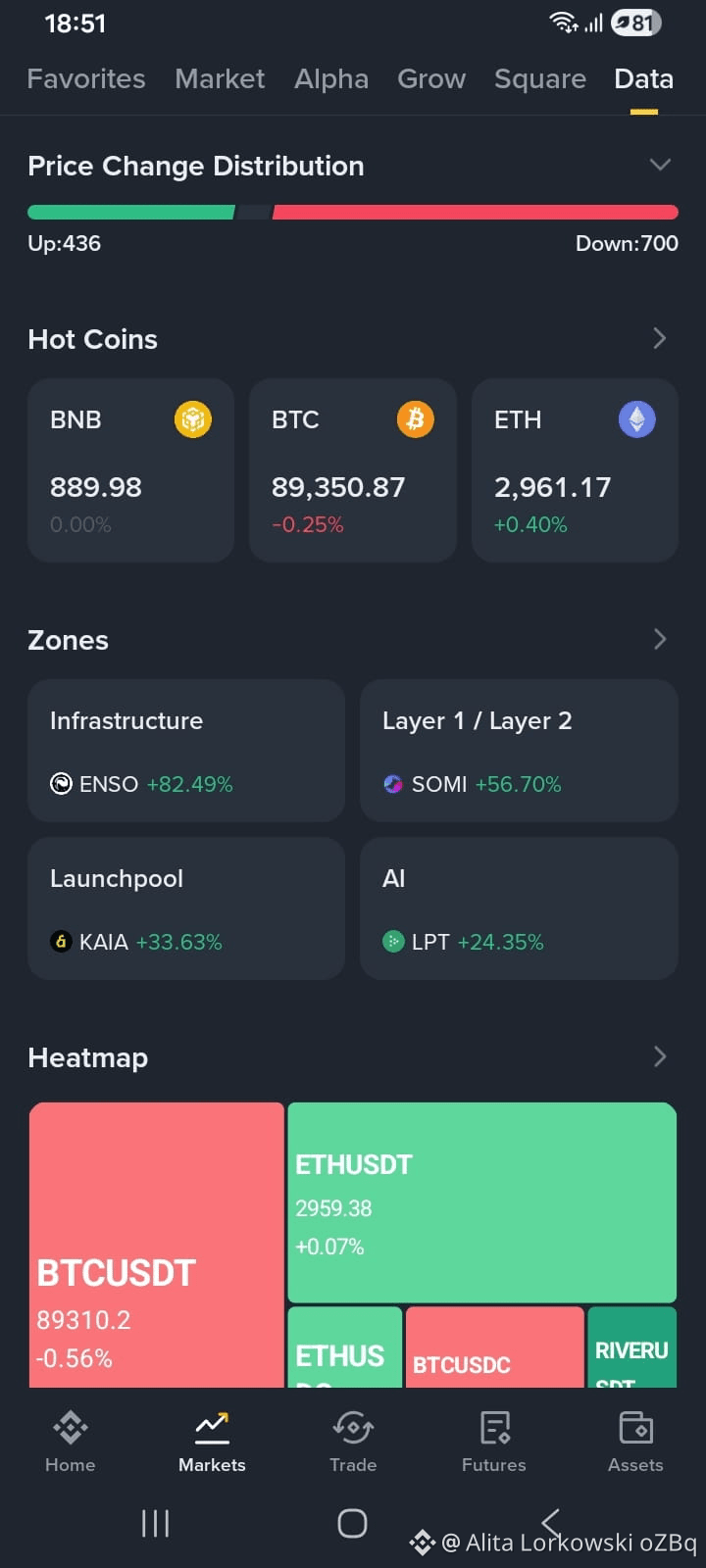

Price change distribution helps traders and investors understand how a coin’s price moves over a specific period—whether gains or losses are spread gradually or driven by sudden spikes. On Binance, this metric is useful for spotting volatility, momentum, and market sentiment.

Let’s break it down using three popular coins.

🔶 1. $BTC (Bitcoin)

Bitcoin usually shows a balanced price change distribution.

Small daily movements (±1–3%) dominate

Larger moves happen during macro news or ETF inflows

Example:

If $BTC moves from $42,000 → $43,200 in a week, most gains are spread across several days rather than one big pump.

👉 This shows stable accumulation and strong institutional interest.

Trader insight:

Price change distribution like this favors swing traders and long-term holders.

🔷 2. $ETH (Ethereum)

Ethereum’s price change distribution is slightly more volatile than Bitcoin.

Medium price jumps (3–6%) appear more often

Strongly influenced by network upgrades and DeFi activity

Example:

$ETH rising from $2,200 → $2,400 might include one strong bullish day followed by smaller consolidations.

Trader insight:

This distribution signals healthy momentum, attractive for both spot traders and medium-term investors.

🟢 3. $SOL (Solana)

Solana often shows a skewed price change distribution.

Fewer small moves

More sudden spikes (10%+) during hype or ecosystem news

Example:

$SOL jumping from $85 → $100 in two days shows price changes concentrated in a short time.

Trader insight:

High-risk, high-reward coin—best for momentum and breakout traders.

📌 Why Price Change Distribution Matters

On Binance, analyzing price change distribution helps you:

Identify stable vs volatile assets

Choose the right trading strategy

Avoid emotional entries during sudden spikes

Coins with smoother distribution suit long-term investing, while sharp distributions favor short-term trading.

🔍 Final Thoughts

Understanding how price changes are distributed—not just the final percentage—gives you an edge. Before entering any trade, always check price movement patterns, volume, and overall market trend.

Trade smart, not just fast.

#WriteToEarn #BinanceSquare #CryptoEducation #BTC #ETH #SOL #PriceAction #TradingTips 🚀